Chembond Material Technologies (NSE:CHEMBOND) Has Announced That Its Dividend Will Be Reduced To ₹1.75

Chembond Material Technologies Limited (NSE:CHEMBOND) is reducing its dividend from last year's comparable payment to ₹1.75 on the 13th of September. However, the dividend yield of 0.8% still remains in a typical range for the industry.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Chembond Material Technologies' stock price has reduced by 56% in the last 3 months, which is not ideal for investors and can explain a sharp increase in the dividend yield.

Chembond Material Technologies' Future Dividend Projections Appear Well Covered By Earnings

We aren't too impressed by dividend yields unless they can be sustained over time. Before making this announcement, Chembond Material Technologies was easily earning enough to cover the dividend. As a result, a large proportion of what it earned was being reinvested back into the business.

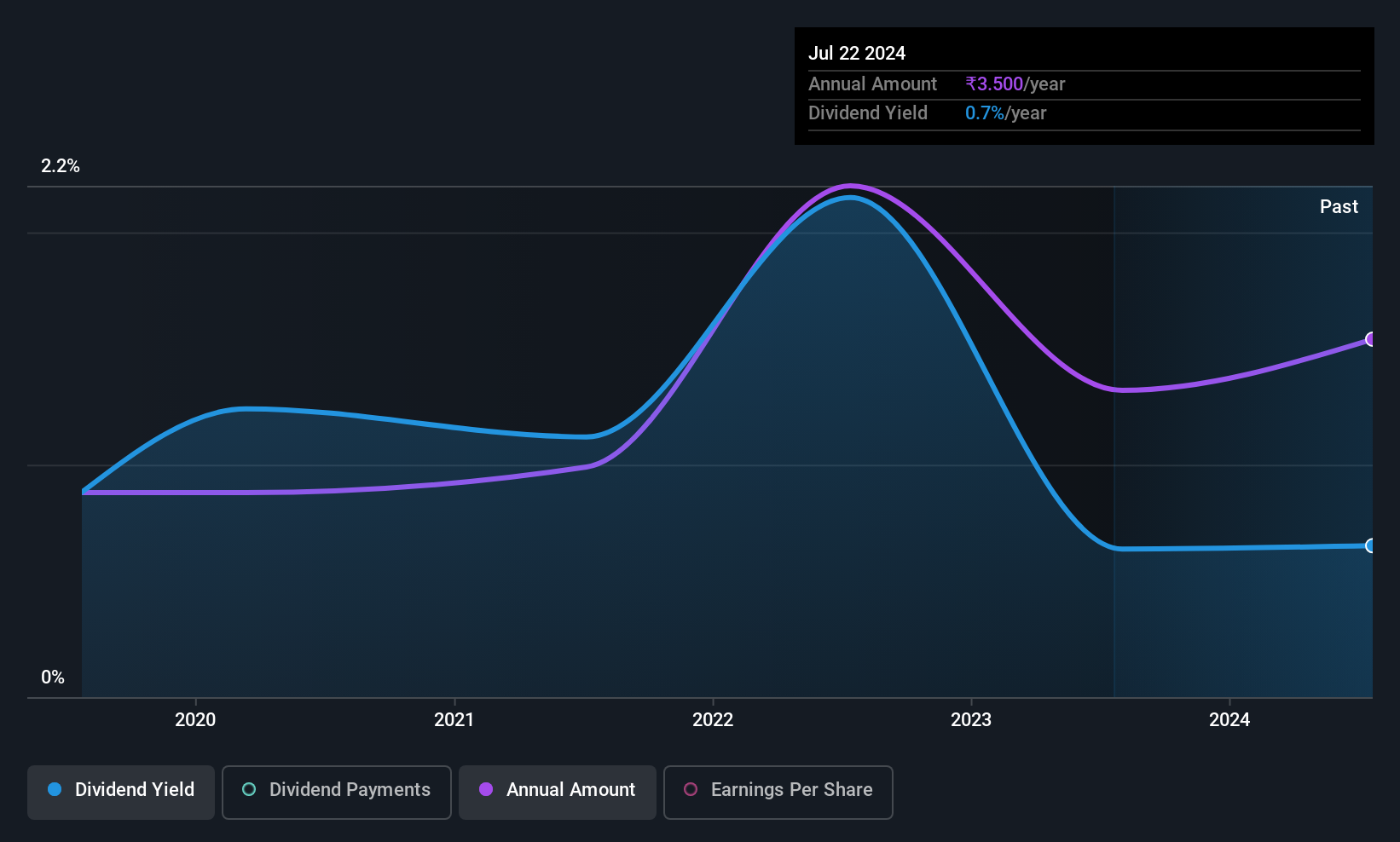

If the trend of the last few years continues, EPS will grow by 56.5% over the next 12 months. Assuming the dividend continues along recent trends, we think the payout ratio could be 9.2% by next year, which is in a pretty sustainable range.

Check out our latest analysis for Chembond Material Technologies

Dividend Volatility

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. The dividend has gone from an annual total of ₹1.50 in 2015 to the most recent total annual payment of ₹1.75. This implies that the company grew its distributions at a yearly rate of about 1.6% over that duration. We're glad to see the dividend has risen, but with a limited rate of growth and fluctuations in the payments the total shareholder return may be limited.

The Dividend Looks Likely To Grow

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. We are encouraged to see that Chembond Material Technologies has grown earnings per share at 56% per year over the past five years. A low payout ratio gives the company a lot of flexibility, and growing earnings also make it very easy for it to grow the dividend.

Chembond Material Technologies Looks Like A Great Dividend Stock

Overall, we think that Chembond Material Technologies could be a great option for a dividend investment, although we would have preferred if the dividend wasn't cut this year. By reducing the dividend, pressure will be taken off the balance sheet, which could help the dividend to be consistent in the future. All in all, this checks a lot of the boxes we look for when choosing an income stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Just as an example, we've come across 3 warning signs for Chembond Material Technologies you should be aware of, and 1 of them is a bit unpleasant. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CHEMBOND

Chembond Material Technologies

Manufactures, sells, and trades specialty chemicals in India and internationally.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion