Three Solid Indian Dividend Stocks With Minimum Yields Of 2%

Indian equity markets have been on an upward trajectory, with the Nifty 50 and BSE Sensex reaching new record highs amid robust economic growth and positive domestic sentiment. In this environment, investors may look for stability and consistent returns, making dividend stocks with a minimum yield of 2% an attractive option for those seeking to balance growth with income generation.

Top 10 Dividend Stocks In India

| Name | Dividend Yield | Dividend Rating |

| EPL (BSE:500135) | 2.35% | ★★★★★★ |

| Narmada Gelatines (BSE:526739) | 2.60% | ★★★★★★ |

| Vinyl Chemicals (India) (BSE:524129) | 2.71% | ★★★★★★ |

| Castrol India (BSE:500870) | 3.57% | ★★★★★☆ |

| Swaraj Engines (NSEI:SWARAJENG) | 3.87% | ★★★★★☆ |

| Balmer Lawrie (BSE:523319) | 3.12% | ★★★★★☆ |

| Indian Oil (NSEI:IOC) | 2.82% | ★★★★★☆ |

| Ruchira Papers (NSEI:RUCHIRA) | 3.89% | ★★★★★☆ |

| Sun TV Network (NSEI:SUNTV) | 2.44% | ★★★★★☆ |

| Power Grid Corporation of India (NSEI:POWERGRID) | 3.85% | ★★★★★☆ |

Click here to see the full list of 61 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

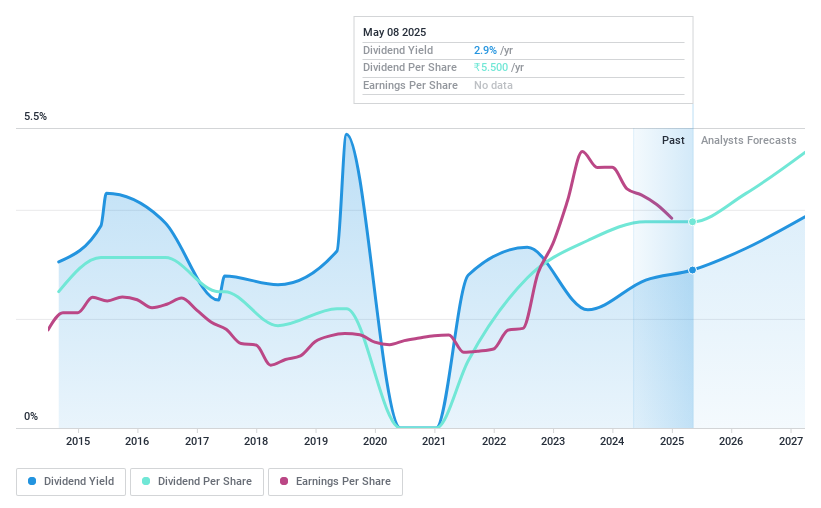

Glenmark Life Sciences (NSEI:GLS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Glenmark Life Sciences Limited is a pharmaceutical company based in India, specializing in the development, manufacturing, and supply of high-value non-commoditized active pharmaceutical ingredients (APIs) for chronic therapeutic areas, with a market capitalization of approximately ₹94.36 billion.

Operations: Glenmark Life Sciences Limited generates its revenue primarily through the sale of active pharmaceutical ingredients (APIs), which amounted to ₹23.68 billion.

Dividend Yield: 3.1%

Glenmark Life Sciences (GLS) offers a dividend yield of 3.06%, ranking in the top quarter of Indian market payers, supported by a payout ratio of 53.1% and cash payout ratio of 85.5%. With earnings forecasted to grow by 11.17% per year, dividends appear sustainable given current earnings and cash flow coverage. However, recent board resignations may raise governance concerns, potentially impacting future performance despite robust sales growth reported for Q3 with revenue reaching ₹5.74 billion and net income at ₹1.19 billion.

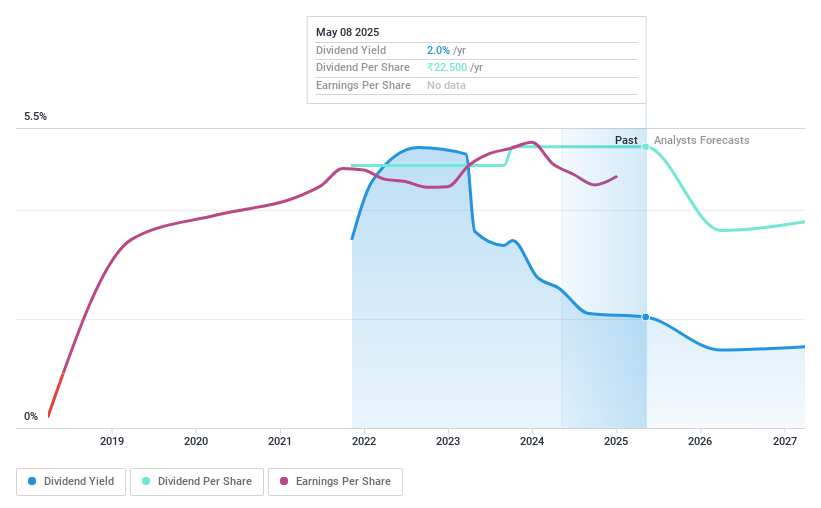

Chambal Fertilisers and Chemicals (NSEI:CHAMBLFERT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Chambal Fertilisers and Chemicals Limited is an Indian company engaged in the production and sale of fertilizers, serving both domestic and international markets, with a market capitalization of approximately ₹143.19 billion.

Operations: Chambal Fertilisers and Chemicals Limited generates its revenue primarily through the manufacture and distribution of fertilizers across India and beyond.

Dividend Yield: 2.1%

Chambal Fertilisers and Chemicals' dividends, with a yield of ₹2.09%, stand above the Indian market average. Despite a sporadic history, current earnings cover dividends at 24.5%, and cash flows are robust with a 3.2% payout ratio, indicating sustainability. The stock trades at 58% below estimated fair value, suggesting attractive valuation relative to peers. A recent share buyback for ₹7 billion reflects confidence in capital structure efficiency, while Q3 reports show revenue of ₹44.44 billion and net income growth to ₹4.59 billion from last year's ₹3.24 billion, signaling positive financial health.

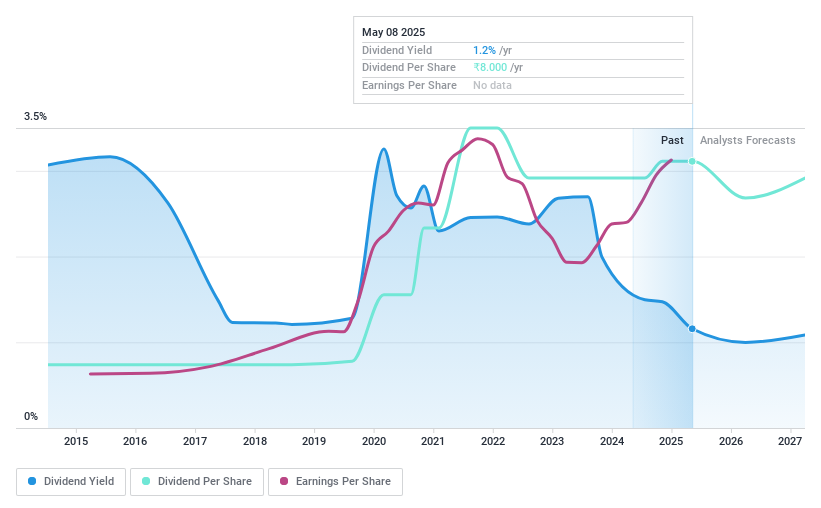

Karnataka Bank (NSEI:KTKBANK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Karnataka Bank Limited is a financial institution based in India, offering a diverse range of banking services with a market capitalization of approximately ₹88.41 billion.

Operations: Karnataka Bank Limited generates revenue primarily through Treasury Operations and Corporate/Wholesale Banking, contributing ₹16.47 billion and ₹30.89 billion respectively, alongside a smaller segment in Other Banking Operations at ₹4.28 billion.

Dividend Yield: 2%

Karnataka Bank, celebrating its centenary, is expanding with 15 new branches and a digital push. The bank's dividend history is marked by volatility but maintains a low payout ratio of 13.2%, suggesting sustainability. Analysts project a stock price increase of 30.4%. Despite concerns over bad loans at 3.6% and recent shareholder dilution, the bank's Price-To-Earnings ratio at ₹6.2 is attractive compared to the market average of ₹31, and its dividend yield ranks in the top quartile at 2.04%.

Make It Happen

- Dive into all 61 of the Top Dividend Stocks we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore small companies with big growth potential before they take off.

- Fuel your portfolio with fast-growing stocks poised for rapid expansion.

- Play it safe and steady with these reliable blue chips that offer both stability and growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:CHAMBLFERT

Chambal Fertilisers and Chemicals

Produces and sells fertilizers primarily in India.

Very undervalued with excellent balance sheet and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)