- India

- /

- Paper and Forestry Products

- /

- NSEI:ABREL

We're Not Counting On Century Textiles and Industries (NSE:CENTURYTEX) To Sustain Its Statutory Profitability

Statistically speaking, it is less risky to invest in profitable companies than in unprofitable ones. Having said that, sometimes statutory profit levels are not a good guide to ongoing profitability, because some short term one-off factor has impacted profit levels. This article will consider whether Century Textiles and Industries' (NSE:CENTURYTEX) statutory profits are a good guide to its underlying earnings.

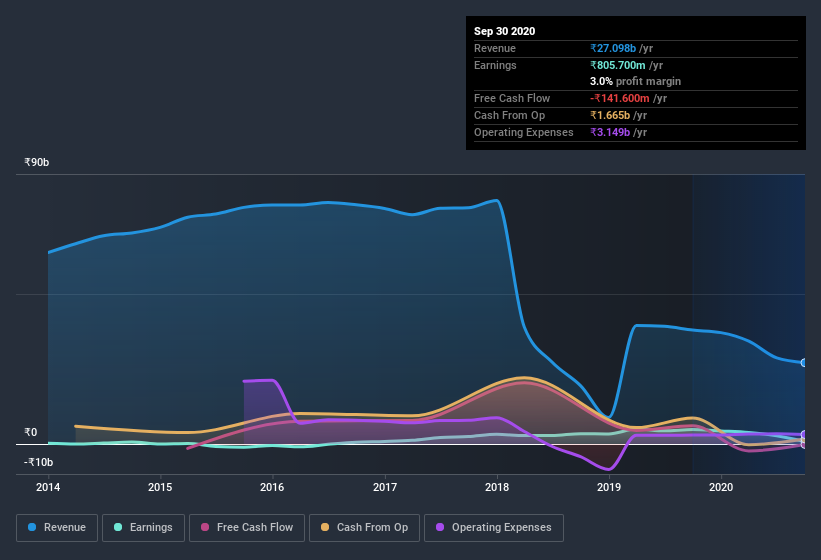

It's good to see that over the last twelve months Century Textiles and Industries made a profit of ₹805.7m on revenue of ₹27.1b. The chart below shows that both revenue and profit have declined over the last three years.

Check out our latest analysis for Century Textiles and Industries

Of course, when it comes to statutory profit, the devil is often in the detail, and we can get a better sense for a company by diving deeper into the financial statements. Therefore, we think it makes sense to note and understand the impact that a tax benefit has had on Century Textiles and Industries' statutory profit in the last twelve months. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Century Textiles and Industries.

An Unusual Tax Situation

We can see that Century Textiles and Industries received a tax benefit of ₹491m. This is of course a bit out of the ordinary, given it is more common for companies to be paying tax than receiving tax benefits! We're sure the company was pleased with its tax benefit. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth.

Our Take On Century Textiles and Industries' Profit Performance

In its most recent report, Century Textiles and Industries disclosed a tax benefit, as we discussed above. Given that sort of benefit is not recurring, it's safe to say the statutory profit overstates its underlying profitability quite significantly. As a result, we think it may well be the case that Century Textiles and Industries' underlying earnings power is lower than its statutory profit. In further bad news, its earnings per share decreased in the last year. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. Be aware that Century Textiles and Industries is showing 3 warning signs in our investment analysis and 1 of those shouldn't be ignored...

Today we've zoomed in on a single data point to better understand the nature of Century Textiles and Industries' profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

When trading Century Textiles and Industries or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:ABREL

Aditya Birla Real Estate

Manufactures and sells textiles, and pulp and paper products in India and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives