- India

- /

- Paper and Forestry Products

- /

- NSEI:CENTURYPLY

Century Plyboards (India) Limited's (NSE:CENTURYPLY) CEO Compensation Is Looking A Bit Stretched At The Moment

Key Insights

- Century Plyboards (India) to hold its Annual General Meeting on 18th of September

- CEO Sanjay Agarwal's total compensation includes salary of ₹20.0m

- The overall pay is 186% above the industry average

- Over the past three years, Century Plyboards (India)'s EPS fell by 18% and over the past three years, the total shareholder return was 20%

CEO Sanjay Agarwal has done a decent job of delivering relatively good performance at Century Plyboards (India) Limited (NSE:CENTURYPLY) recently. As shareholders go into the upcoming AGM on 18th of September, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders will still be cautious of paying the CEO excessively.

Check out our latest analysis for Century Plyboards (India)

Comparing Century Plyboards (India) Limited's CEO Compensation With The Industry

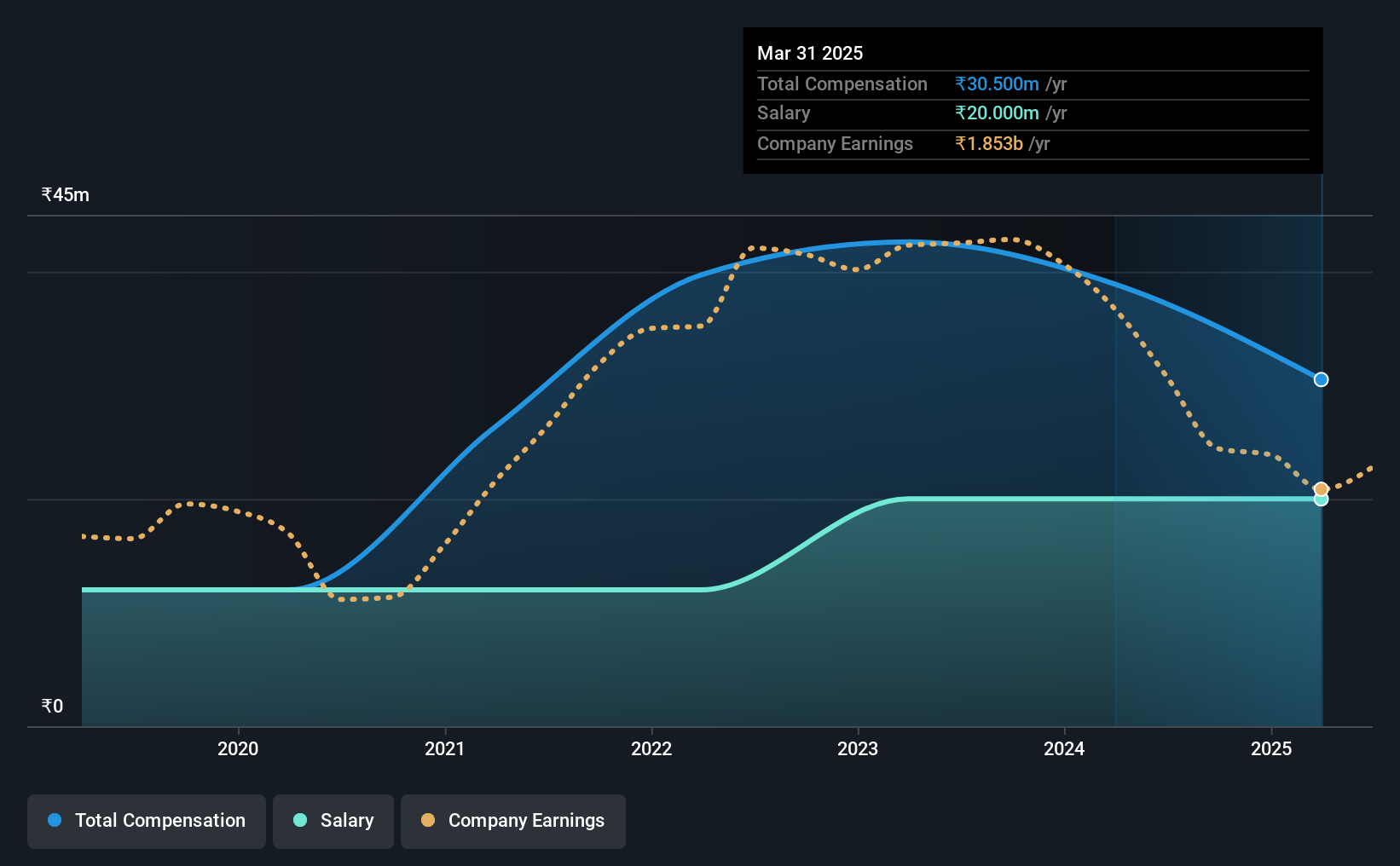

According to our data, Century Plyboards (India) Limited has a market capitalization of ₹180b, and paid its CEO total annual compensation worth ₹31m over the year to March 2025. We note that's a decrease of 22% compared to last year. We note that the salary portion, which stands at ₹20.0m constitutes the majority of total compensation received by the CEO.

On examining similar-sized companies in the Indian Forestry industry with market capitalizations between ₹88b and ₹283b, we discovered that the median CEO total compensation of that group was ₹11m. This suggests that Sanjay Agarwal is paid more than the median for the industry. Furthermore, Sanjay Agarwal directly owns ₹20b worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2025 | 2024 | Proportion (2025) |

| Salary | ₹20m | ₹20m | 66% |

| Other | ₹11m | ₹19m | 34% |

| Total Compensation | ₹31m | ₹39m | 100% |

On an industry level, around 92% of total compensation represents salary and 8% is other remuneration. In Century Plyboards (India)'s case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Century Plyboards (India) Limited's Growth

Over the last three years, Century Plyboards (India) Limited has shrunk its earnings per share by 18% per year. Its revenue is up 17% over the last year.

Investors would be a bit wary of companies that have lower EPS On the other hand, the strong revenue growth suggests the business is growing. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Century Plyboards (India) Limited Been A Good Investment?

Century Plyboards (India) Limited has generated a total shareholder return of 20% over three years, so most shareholders would be reasonably content. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

To Conclude...

Some shareholders will be pleased by the relatively good results, however, the results could still be improved. EPS growth is still weak, and until that picks up, shareholders may find it hard to approve a pay rise for the CEO, since they are already paid above the average in their industry.

CEO pay is simply one of the many factors that need to be considered while examining business performance. That's why we did our research, and identified 2 warning signs for Century Plyboards (India) (of which 1 can't be ignored!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CENTURYPLY

Century Plyboards (India)

Engages in the manufacture and sale of plywood, laminates, decorative veneers, medium density fiber boards (MDF), pre-laminated boards, particle boards, and flush doors in India.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives