- India

- /

- Metals and Mining

- /

- NSEI:CENTEXT

Century Extrusions Limited's (NSE:CENTEXT) Subdued P/E Might Signal An Opportunity

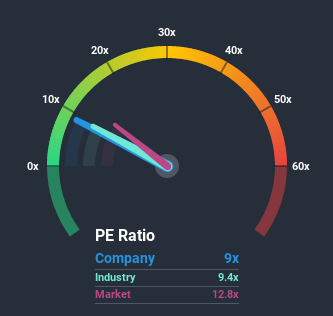

When close to half the companies in India have price-to-earnings ratios (or "P/E's") above 13x, you may consider Century Extrusions Limited (NSE:CENTEXT) as an attractive investment with its 9x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

For example, consider that Century Extrusions' financial performance has been poor lately as it's earnings have been in decline. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Century Extrusions

How Does Century Extrusions' P/E Ratio Compare To Its Industry Peers?

An inspection of average P/E's throughout Century Extrusions' industry may help to explain its low P/E ratio. You'll notice in the figure below that P/E ratios in the Metals and Mining industry are also lower than the market. So it appears the company's ratio could be influenced considerably by these industry numbers currently. Ordinarily, the majority of companies' P/E's would be compressed by the general conditions within the Metals and Mining industry. Still, the strength of the company's earnings will most likely determine where its P/E shall sit.

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Century Extrusions would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered a frustrating 8.4% decrease to the company's bottom line. Still, the latest three year period has seen an excellent 173% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

In contrast to the company, the rest of the market is expected to decline by 4.3% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

In light of this, it's quite peculiar that Century Extrusions' P/E sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Final Word

The price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Century Extrusions revealed its growing earnings over the medium-term aren't contributing to its P/E anywhere near as much as we would have predicted, given the market is set to shrink. We think potential risks might be placing significant pressure on the P/E ratio and share price. One major risk is whether its earnings trajectory can keep outperforming under these tough market conditions. At least the risk of a price drop looks to be subdued, but investors think future earnings could see a lot of volatility.

It is also worth noting that we have found 3 warning signs for Century Extrusions (2 make us uncomfortable!) that you need to take into consideration.

If you're unsure about the strength of Century Extrusions' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you decide to trade Century Extrusions, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:CENTEXT

Century Extrusions

Manufactures and sells aluminum extrusion products in India.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026