If You Had Bought Castrol India's (NSE:CASTROLIND) Shares Five Years Ago You Would Be Down 37%

Castrol India Limited (NSE:CASTROLIND) shareholders should be happy to see the share price up 24% in the last quarter. But over the last half decade, the stock has not performed well. In fact, the share price is down 37%, which falls well short of the return you could get by buying an index fund.

View our latest analysis for Castrol India

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

While the share price declined over five years, Castrol India actually managed to increase EPS by an average of 1.9% per year. So it doesn't seem like EPS is a great guide to understanding how the market is valuing the stock. Alternatively, growth expectations may have been unreasonable in the past.

Based on these numbers, we'd venture that the market may have been over-optimistic about forecast growth, half a decade ago. Looking to other metrics might better explain the share price change.

We note that the dividend has remained healthy, so that wouldn't really explain the share price drop. While it's not completely obvious why the share price is down, a closer look at the company's history might help explain it.

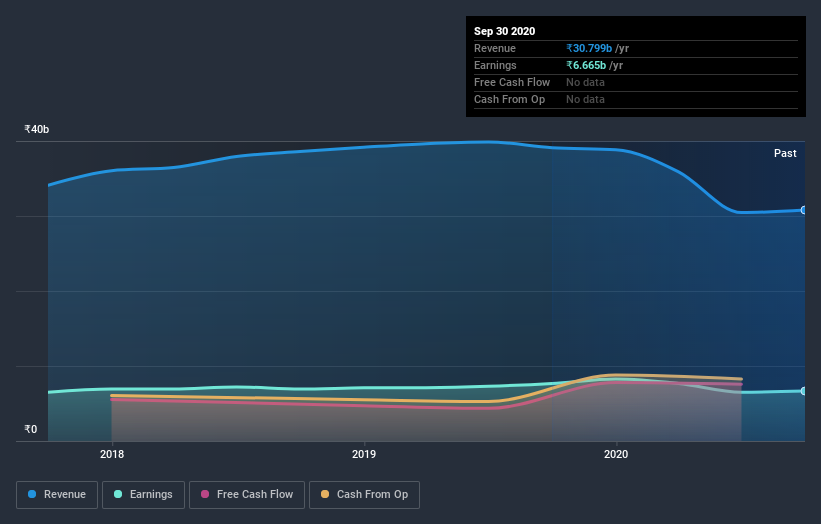

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Castrol India's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Castrol India, it has a TSR of -26% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Castrol India provided a TSR of 1.4% over the last twelve months. But that was short of the market average. But at least that's still a gain! Over five years the TSR has been a reduction of 5% per year, over five years. It could well be that the business is stabilizing. Keeping this in mind, a solid next step might be to take a look at Castrol India's dividend track record. This free interactive graph is a great place to start.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you decide to trade Castrol India, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:CASTROLIND

Castrol India

Manufactures and markets automotive and industrial lubricants in India and internationally.

Outstanding track record 6 star dividend payer.