Despite the downward trend in earnings at Bodal Chemicals (NSE:BODALCHEM) the stock soars 13%, bringing one-year gains to 44%

There's no doubt that investing in the stock market is a truly brilliant way to build wealth. But if you choose that path, you're going to buy some stocks that fall short of the market. Unfortunately for shareholders, while the Bodal Chemicals Limited (NSE:BODALCHEM) share price is up 44% in the last year, that falls short of the market return. Having said that, the longer term returns aren't so impressive, with stock gaining just 4.1% in three years.

The past week has proven to be lucrative for Bodal Chemicals investors, so let's see if fundamentals drove the company's one-year performance.

See our latest analysis for Bodal Chemicals

We don't think that Bodal Chemicals' modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last year Bodal Chemicals saw its revenue shrink by 21%. Given the revenue reduction the modest 44% share price rise over the year seems pretty decent. Generally we're pretty unenthusiastic about loss making stocks that are not growing revenue.

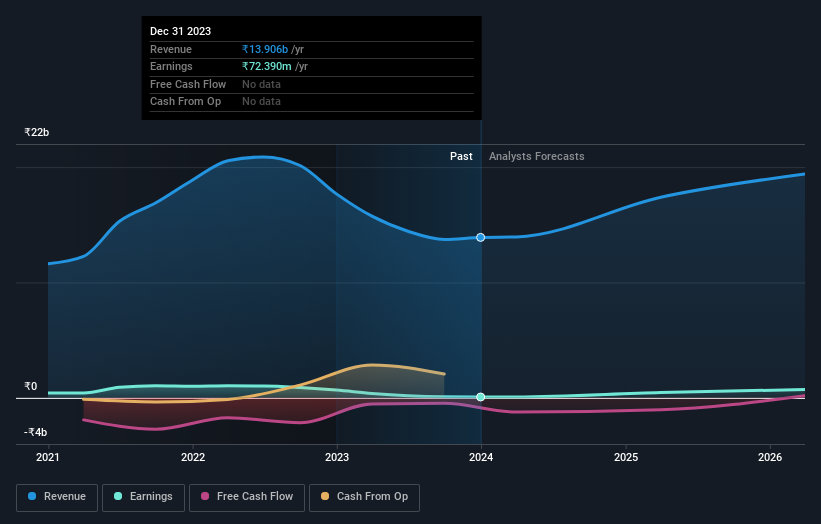

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Bodal Chemicals stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Bodal Chemicals shareholders are up 44% for the year (even including dividends). Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 3% endured over half a decade. It could well be that the business is stabilizing. It's always interesting to track share price performance over the longer term. But to understand Bodal Chemicals better, we need to consider many other factors. Take risks, for example - Bodal Chemicals has 2 warning signs (and 1 which is potentially serious) we think you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Bodal Chemicals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BODALCHEM

Bodal Chemicals

Engages in the manufacture and sale of dyestuffs, dyes intermediates, and other chemicals in India.

Reasonable growth potential slight.

Market Insights

Community Narratives