- India

- /

- Metals and Mining

- /

- NSEI:BMETRICS

Here's Why We Think Bombay Metrics Supply Chain (NSE:BMETRICS) Might Deserve Your Attention Today

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Bombay Metrics Supply Chain (NSE:BMETRICS). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Bombay Metrics Supply Chain with the means to add long-term value to shareholders.

See our latest analysis for Bombay Metrics Supply Chain

Bombay Metrics Supply Chain's Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That makes EPS growth an attractive quality for any company. We can see that in the last three years Bombay Metrics Supply Chain grew its EPS by 12% per year. That's a pretty good rate, if the company can sustain it.

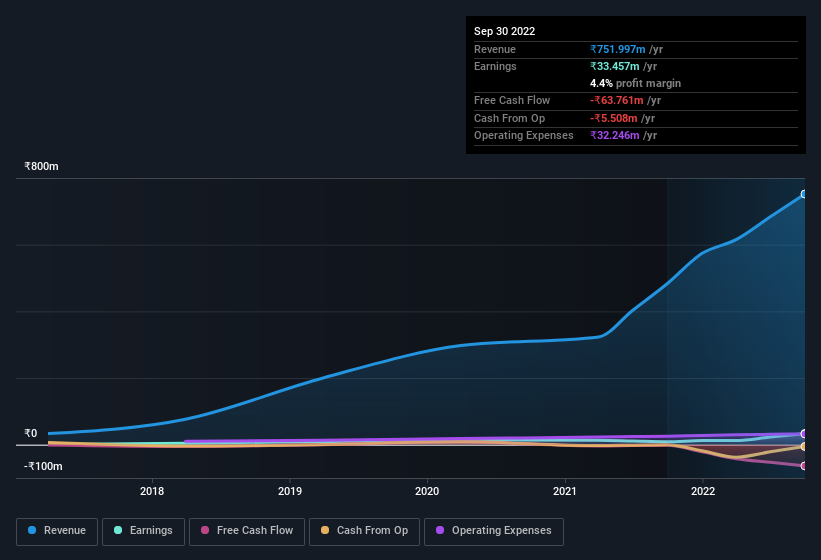

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. EBIT margins for Bombay Metrics Supply Chain remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 56% to ₹752m. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Since Bombay Metrics Supply Chain is no giant, with a market capitalisation of ₹2.8b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Bombay Metrics Supply Chain Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So we're pleased to report that Bombay Metrics Supply Chain insiders own a meaningful share of the business. Indeed, with a collective holding of 80%, company insiders are in control and have plenty of capital behind the venture. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. To give you an idea, the value of insiders' holdings in the business are valued at ₹2.2b at the current share price. So there's plenty there to keep them focused!

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. A brief analysis of the CEO compensation suggests they are. For companies with market capitalisations under ₹17b, like Bombay Metrics Supply Chain, the median CEO pay is around ₹3.6m.

The CEO of Bombay Metrics Supply Chain was paid just ₹3.1m in total compensation for the year ending March 2022. This total may indicate that the CEO is sacrificing take home pay for performance-based benefits, ensuring that their motivations are synonymous with strong company results. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Bombay Metrics Supply Chain To Your Watchlist?

As previously touched on, Bombay Metrics Supply Chain is a growing business, which is encouraging. Earnings growth might be the main attraction for Bombay Metrics Supply Chain, but the fun does not stop there. With company insiders aligning themselves considerably with the company's success and modest CEO compensation, there's no arguments that this is a stock worth looking into. What about risks? Every company has them, and we've spotted 3 warning signs for Bombay Metrics Supply Chain (of which 1 doesn't sit too well with us!) you should know about.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Bombay Metrics Supply Chain might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BMETRICS

Bombay Metrics Supply Chain

Together with its subsidiary, Metrics Vietnam Company Limited, provides manufacturing and trading of engineering tools and components, and supply chain management services in India and internationally.

Solid track record with moderate risk.

Market Insights

Community Narratives