Here's Why We Think Berger Paints India (NSE:BERGEPAINT) Is Well Worth Watching

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Berger Paints India (NSE:BERGEPAINT), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Berger Paints India with the means to add long-term value to shareholders.

View our latest analysis for Berger Paints India

Berger Paints India's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. We can see that in the last three years Berger Paints India grew its EPS by 10% per year. That growth rate is fairly good, assuming the company can keep it up.

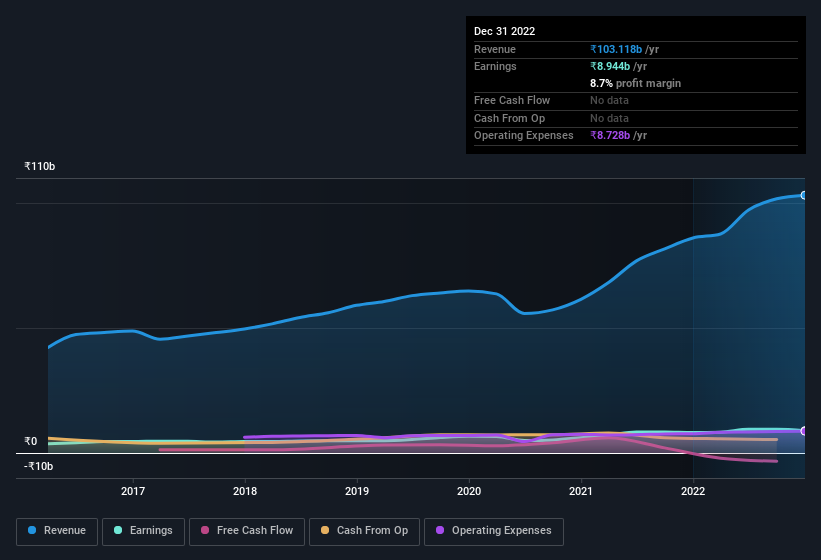

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note Berger Paints India achieved similar EBIT margins to last year, revenue grew by a solid 20% to ₹103b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Berger Paints India's future profits.

Are Berger Paints India Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Over the preceding 12 months, we see that company insiders sold ₹2.9m worth of Berger Paints India stock. On a brighter note, we see that company insider Deeksha Gujral paid ₹6.4m for shares, at an average acquisition price of ₹592 per share. And that's a reason to be optimistic.

On top of the insider buying, it's good to see that Berger Paints India insiders have a valuable investment in the business. We note that their impressive stake in the company is worth ₹14b. Holders should find this level of insider commitment quite encouraging, since it would ensure that the leaders of the company would also experience their success, or failure, with the stock.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. The cherry on top is that the CEO, Abhijit Roy is paid comparatively modestly to CEOs at similar sized companies. The median total compensation for CEOs of companies similar in size to Berger Paints India, with market caps between ₹330b and ₹990b, is around ₹68m.

The Berger Paints India CEO received ₹58m in compensation for the year ending March 2022. That is actually below the median for CEO's of similarly sized companies. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Berger Paints India Deserve A Spot On Your Watchlist?

One important encouraging feature of Berger Paints India is that it is growing profits. Better yet, insiders are significant shareholders, and have been buying more shares. That should do plenty in prompting budding investors to undertake a bit more research - or even adding the company to their watchlists. We don't want to rain on the parade too much, but we did also find 1 warning sign for Berger Paints India that you need to be mindful of.

Keen growth investors love to see insider buying. Thankfully, Berger Paints India isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Berger Paints India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BERGEPAINT

Berger Paints India

Manufactures and sells paints for home, professional, and industrial users in India and internationally.

Flawless balance sheet with solid track record and pays a dividend.