Berger Paints India Limited (NSE:BERGEPAINT) Just Released Its Half-Yearly Earnings: Here's What Analysts Think

Shareholders might have noticed that Berger Paints India Limited (NSE:BERGEPAINT) filed its half-year result this time last week. The early response was not positive, with shares down 3.8% to ₹516 in the past week. Revenues of ₹59b were in line with forecasts, although statutory earnings per share (EPS) came in below expectations at ₹2.31, missing estimates by 2.7%. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

Check out our latest analysis for Berger Paints India

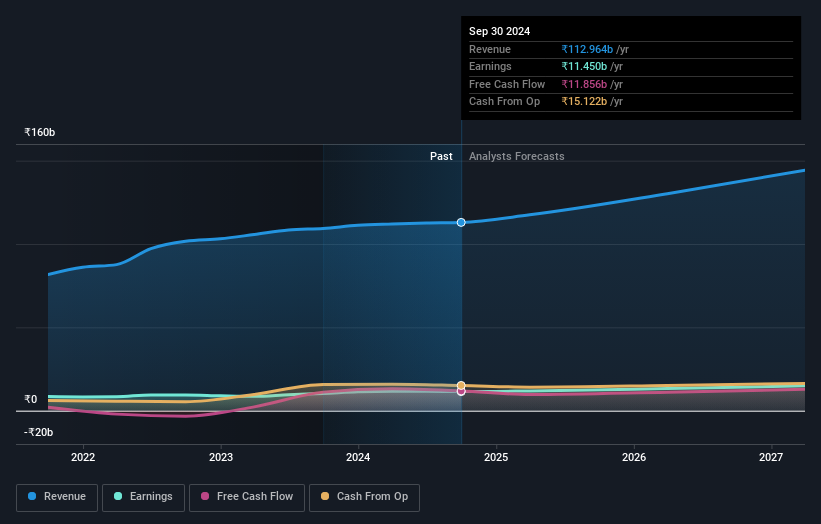

Taking into account the latest results, the most recent consensus for Berger Paints India from 20 analysts is for revenues of ₹117.5b in 2025. If met, it would imply an okay 4.0% increase on its revenue over the past 12 months. Per-share earnings are expected to accumulate 3.7% to ₹10.19. In the lead-up to this report, the analysts had been modelling revenues of ₹119.6b and earnings per share (EPS) of ₹10.47 in 2025. So it looks like there's been a small decline in overall sentiment after the recent results - there's been no major change to revenue estimates, but the analysts did make a small dip in their earnings per share forecasts.

The consensus price target held steady at ₹531, with the analysts seemingly voting that their lower forecast earnings are not expected to lead to a lower stock price in the foreseeable future. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. Currently, the most bullish analyst values Berger Paints India at ₹650 per share, while the most bearish prices it at ₹420. This shows there is still a bit of diversity in estimates, but analysts don't appear to be totally split on the stock as though it might be a success or failure situation.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. It's pretty clear that there is an expectation that Berger Paints India's revenue growth will slow down substantially, with revenues to the end of 2025 expected to display 8.2% growth on an annualised basis. This is compared to a historical growth rate of 15% over the past five years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 13% per year. Factoring in the forecast slowdown in growth, it seems obvious that Berger Paints India is also expected to grow slower than other industry participants.

The Bottom Line

The most important thing to take away is that the analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. On the plus side, there were no major changes to revenue estimates; although forecasts imply they will perform worse than the wider industry. The consensus price target held steady at ₹531, with the latest estimates not enough to have an impact on their price targets.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have estimates - from multiple Berger Paints India analysts - going out to 2027, and you can see them free on our platform here.

We also provide an overview of the Berger Paints India Board and CEO remuneration and length of tenure at the company, and whether insiders have been buying the stock, here.

If you're looking to trade Berger Paints India, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Berger Paints India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BERGEPAINT

Berger Paints India

Manufactures and sells paints for home, professional, and industrial users in India and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives