- India

- /

- Metals and Mining

- /

- NSEI:BAHETI

Why Investors Shouldn't Be Surprised By Baheti Recycling Industries Limited's (NSE:BAHETI) 59% Share Price Surge

Baheti Recycling Industries Limited (NSE:BAHETI) shareholders have had their patience rewarded with a 59% share price jump in the last month. The annual gain comes to 173% following the latest surge, making investors sit up and take notice.

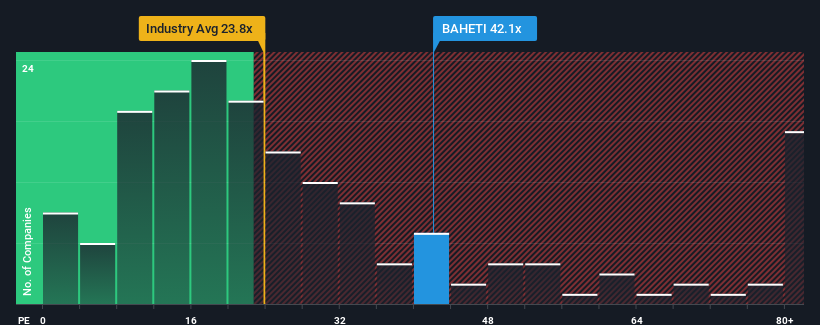

Following the firm bounce in price, given around half the companies in India have price-to-earnings ratios (or "P/E's") below 30x, you may consider Baheti Recycling Industries as a stock to potentially avoid with its 42.1x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

We'd have to say that with no tangible growth over the last year, Baheti Recycling Industries' earnings have been unimpressive. One possibility is that the P/E is high because investors think the benign earnings growth will improve to outperform the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Baheti Recycling Industries

Is There Enough Growth For Baheti Recycling Industries?

Baheti Recycling Industries' P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. Although pleasingly EPS has lifted 808% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 25% shows it's noticeably more attractive on an annualised basis.

With this information, we can see why Baheti Recycling Industries is trading at such a high P/E compared to the market. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Final Word

Baheti Recycling Industries' P/E is getting right up there since its shares have risen strongly. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Baheti Recycling Industries revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 4 warning signs for Baheti Recycling Industries you should be aware of, and 3 of them are potentially serious.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Baheti Recycling Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BAHETI

Baheti Recycling Industries

An aluminum recycling company, primarily engages in processing aluminum-based metal scrap in India.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026