- India

- /

- Metals and Mining

- /

- NSEI:BAHETI

Should You Be Adding Baheti Recycling Industries (NSE:BAHETI) To Your Watchlist Today?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Baheti Recycling Industries (NSE:BAHETI). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Baheti Recycling Industries with the means to add long-term value to shareholders.

How Fast Is Baheti Recycling Industries Growing Its Earnings Per Share?

Over the last three years, Baheti Recycling Industries has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. In impressive fashion, Baheti Recycling Industries' EPS grew from ₹6.94 to ₹17.37, over the previous 12 months. It's a rarity to see 150% year-on-year growth like that.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The music to the ears of Baheti Recycling Industries shareholders is that EBIT margins have grown from 4.5% to 7.5% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

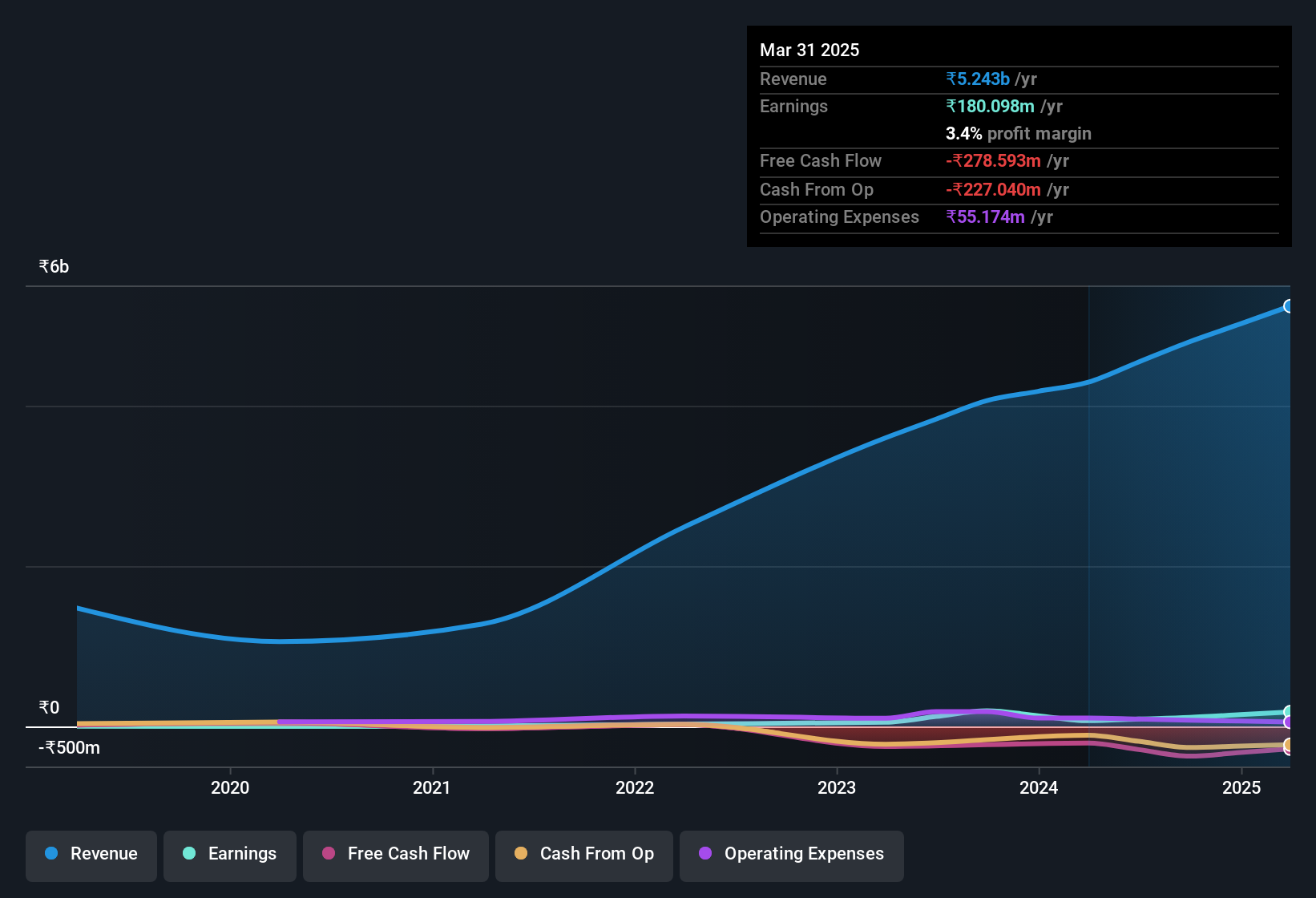

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Check out our latest analysis for Baheti Recycling Industries

Since Baheti Recycling Industries is no giant, with a market capitalisation of ₹5.2b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Baheti Recycling Industries Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Shareholders in Baheti Recycling Industries will be more than happy to see insiders committing themselves to the company, spending ₹26m on shares in just twelve months. This, combined with the lack of sales from insiders, should be a great signal for shareholders in what's to come. Zooming in, we can see that the biggest insider purchase was by Chairman Shankerlal Shah for ₹26m worth of shares, at about ₹466 per share.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Baheti Recycling Industries insiders own more than a third of the company. In fact, they own 42% of the shares, making insiders a very influential shareholder group. This should be a welcoming sign for investors because it suggests that the people making the decisions are also impacted by their choices. To give you an idea, the value of insiders' holdings in the business are valued at ₹2.2b at the current share price. That's nothing to sneeze at!

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because Baheti Recycling Industries' CEO, Yash Shah, is paid at a relatively modest level when compared to other CEOs for companies of this size. For companies with market capitalisations under ₹17b, like Baheti Recycling Industries, the median CEO pay is around ₹3.6m.

The Baheti Recycling Industries CEO received total compensation of only ₹2.4m in the year to March 2024. This total may indicate that the CEO is sacrificing take home pay for performance-based benefits, ensuring that their motivations are synonymous with strong company results. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Does Baheti Recycling Industries Deserve A Spot On Your Watchlist?

Baheti Recycling Industries' earnings per share growth have been climbing higher at an appreciable rate. To make matters even better, the company insiders who know the company best have put their faith in the its future and have been buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Baheti Recycling Industries deserves timely attention. Don't forget that there may still be risks. For instance, we've identified 4 warning signs for Baheti Recycling Industries (2 don't sit too well with us) you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Baheti Recycling Industries, you'll probably love this curated collection of companies in IN that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Baheti Recycling Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BAHETI

Baheti Recycling Industries

An aluminum recycling company, primarily engages in processing aluminum-based metal scrap in India.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.