- India

- /

- Metals and Mining

- /

- NSEI:BAHETI

Baheti Recycling Industries Limited (NSE:BAHETI) Stocks Shoot Up 29% But Its P/E Still Looks Reasonable

Baheti Recycling Industries Limited (NSE:BAHETI) shareholders have had their patience rewarded with a 29% share price jump in the last month. The last month tops off a massive increase of 135% in the last year.

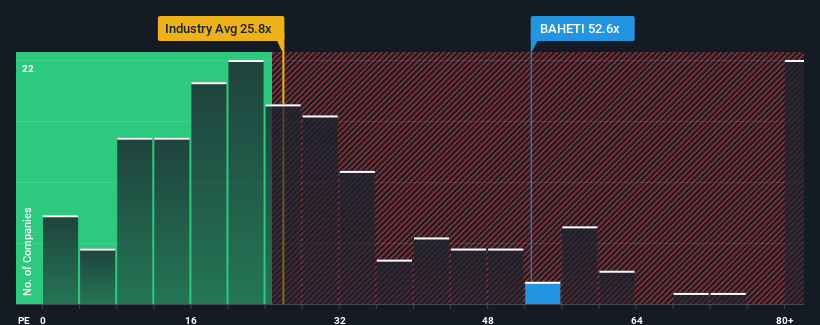

Since its price has surged higher, Baheti Recycling Industries may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 52.6x, since almost half of all companies in India have P/E ratios under 33x and even P/E's lower than 19x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

We'd have to say that with no tangible growth over the last year, Baheti Recycling Industries' earnings have been unimpressive. It might be that many are expecting an improvement to the uninspiring earnings performance over the coming period, which has kept the P/E from collapsing. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Baheti Recycling Industries

How Is Baheti Recycling Industries' Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Baheti Recycling Industries' to be considered reasonable.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. Still, the latest three year period has seen an excellent 808% overall rise in EPS, in spite of its uninspiring short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 26% shows it's noticeably more attractive on an annualised basis.

In light of this, it's understandable that Baheti Recycling Industries' P/E sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Key Takeaway

The strong share price surge has got Baheti Recycling Industries' P/E rushing to great heights as well. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Baheti Recycling Industries revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Baheti Recycling Industries (of which 2 are potentially serious!) you should know about.

If you're unsure about the strength of Baheti Recycling Industries' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Baheti Recycling Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BAHETI

Baheti Recycling Industries

An aluminum recycling company, primarily engages in processing aluminum-based metal scrap in India.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.