This article will reflect on the compensation paid to Ashok Hiremath who has served as CEO of Astec LifeSciences Limited (NSE:ASTEC) since 2006. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Astec LifeSciences.

See our latest analysis for Astec LifeSciences

How Does Total Compensation For Ashok Hiremath Compare With Other Companies In The Industry?

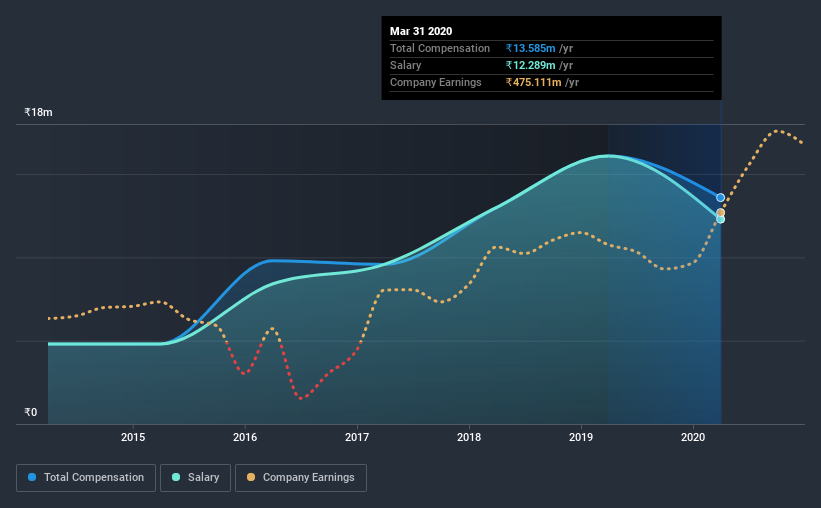

At the time of writing, our data shows that Astec LifeSciences Limited has a market capitalization of ₹21b, and reported total annual CEO compensation of ₹14m for the year to March 2020. Notably, that's a decrease of 16% over the year before. In particular, the salary of ₹12.3m, makes up a huge portion of the total compensation being paid to the CEO.

On examining similar-sized companies in the industry with market capitalizations between ₹7.3b and ₹29b, we discovered that the median CEO total compensation of that group was ₹18m. This suggests that Astec LifeSciences remunerates its CEO largely in line with the industry average. What's more, Ashok Hiremath holds ₹604m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | ₹12m | ₹16m | 90% |

| Other | ₹1.3m | - | 10% |

| Total Compensation | ₹14m | ₹16m | 100% |

Talking in terms of the industry, salary represented approximately 89% of total compensation out of all the companies we analyzed, while other remuneration made up 11% of the pie. Our data reveals that Astec LifeSciences allocates salary more or less in line with the wider market. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Astec LifeSciences Limited's Growth Numbers

Astec LifeSciences Limited's earnings per share (EPS) grew 50% per year over the last three years. In the last year, its revenue is up 17%.

Shareholders would be glad to know that the company has improved itself over the last few years. This sort of respectable year-on-year revenue growth is often seen at a healthy, growing business. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Astec LifeSciences Limited Been A Good Investment?

We think that the total shareholder return of 85%, over three years, would leave most Astec LifeSciences Limited shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

As we touched on above, Astec LifeSciences Limited is currently paying a compensation that's close to the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. The company is growing EPS and total shareholder returns have been pleasing. So one could argue that CEO compensation is quite modest, if you consider company performance! Stockholders might even be okay with a bump in pay, seeing as how investor returns have been so strong.

CEO compensation can have a massive impact on performance, but it's just one element. We've identified 1 warning sign for Astec LifeSciences that investors should be aware of in a dynamic business environment.

Switching gears from Astec LifeSciences, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you decide to trade Astec LifeSciences, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:ASTEC

Astec LifeSciences

Engages in the manufacture and sale of agrochemical active ingredients and pharmaceutical intermediates in India.

High growth potential very low.

Similar Companies

Market Insights

Community Narratives