What Asian Paints Limited's (NSE:ASIANPAINT) P/E Is Not Telling You

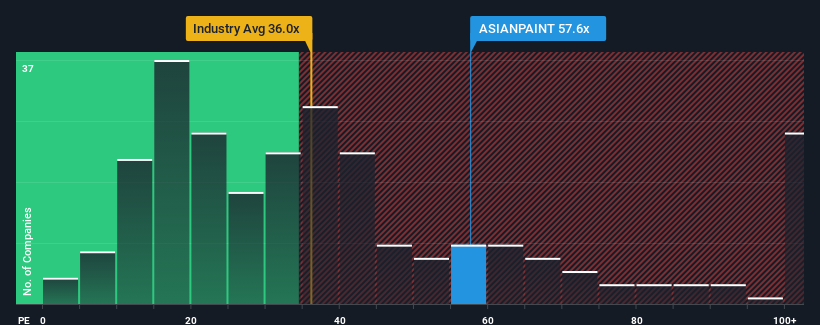

With a price-to-earnings (or "P/E") ratio of 57.6x Asian Paints Limited (NSE:ASIANPAINT) may be sending very bearish signals at the moment, given that almost half of all companies in India have P/E ratios under 34x and even P/E's lower than 19x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Recent times haven't been advantageous for Asian Paints as its earnings have been rising slower than most other companies. It might be that many expect the uninspiring earnings performance to recover significantly, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Asian Paints

How Is Asian Paints' Growth Trending?

The only time you'd be truly comfortable seeing a P/E as steep as Asian Paints' is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings growth, the company posted a worthy increase of 9.5%. This was backed up an excellent period prior to see EPS up by 46% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 8.0% per annum over the next three years. That's shaping up to be materially lower than the 20% each year growth forecast for the broader market.

With this information, we find it concerning that Asian Paints is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Asian Paints currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Asian Paints with six simple checks.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ASIANPAINT

Asian Paints

Engages in the manufacturing, selling, and distribution of paints, coatings, and products related to home decoration and bath fittings in Asia, the Middle East, Africa, and the South Pacific region.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives