Do Asian Paints' (NSE:ASIANPAINT) Earnings Warrant Your Attention?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Asian Paints (NSE:ASIANPAINT). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Asian Paints

How Fast Is Asian Paints Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. It certainly is nice to see that Asian Paints has managed to grow EPS by 26% per year over three years. As a result, we can understand why the stock trades on a high multiple of trailing twelve month earnings.

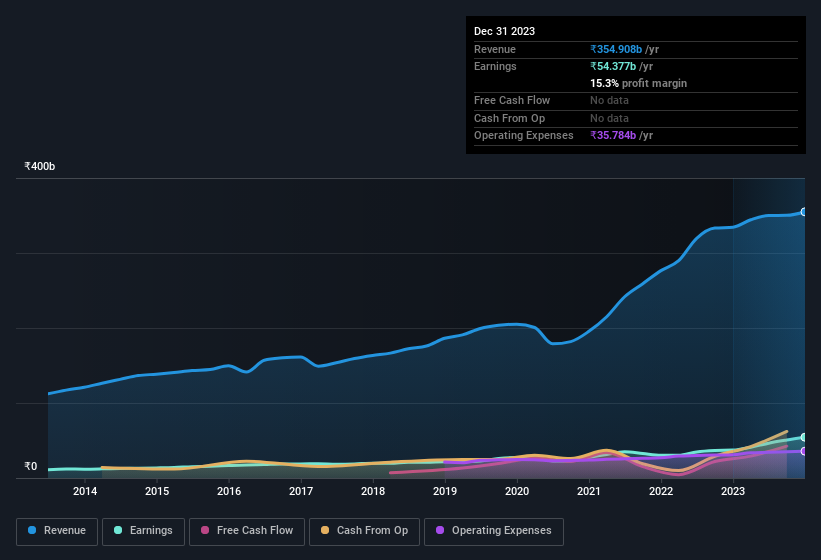

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Asian Paints shareholders can take confidence from the fact that EBIT margins are up from 15% to 20%, and revenue is growing. Ticking those two boxes is a good sign of growth, in our book.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Asian Paints' future profits.

Are Asian Paints Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a ₹2.7t company like Asian Paints. But thanks to their investment in the company, it's pleasing to see that there are still incentives to align their actions with the shareholders. Indeed, they have a considerable amount of wealth invested in it, currently valued at ₹217b. This suggests that leadership will be very mindful of shareholders' interests when making decisions!

Should You Add Asian Paints To Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Asian Paints' strong EPS growth. Further, the high level of insider ownership is impressive and suggests that the management appreciates the EPS growth and has faith in Asian Paints' continuing strength. The growth and insider confidence is looked upon well and so it's worthwhile to investigate further with a view to discern the stock's true value. Another important measure of business quality not discussed here, is return on equity (ROE). Click on this link to see how Asian Paints shapes up to industry peers, when it comes to ROE.

Although Asian Paints certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of Indian companies that not only boast of strong growth but have also seen recent insider buying..

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ASIANPAINT

Asian Paints

Engages in the manufacturing, selling, and distribution of paints, coatings, and products related to home decoration and bath fittings in Asia, the Middle East, Africa, and the South Pacific region.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives