- India

- /

- Metals and Mining

- /

- NSEI:ASHAPURMIN

Slammed 29% Ashapura Minechem Limited (NSE:ASHAPURMIN) Screens Well Here But There Might Be A Catch

Unfortunately for some shareholders, the Ashapura Minechem Limited (NSE:ASHAPURMIN) share price has dived 29% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 28% share price drop.

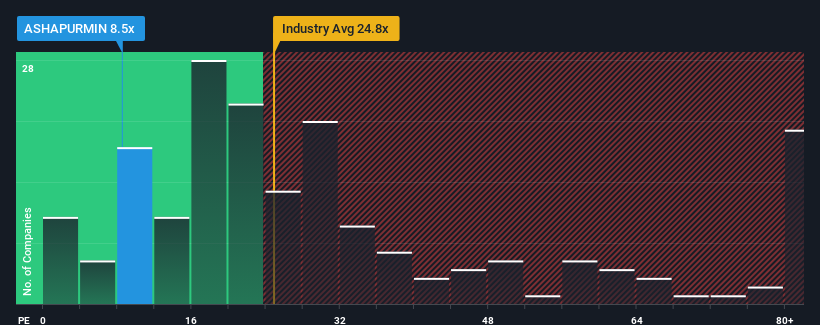

In spite of the heavy fall in price, Ashapura Minechem's price-to-earnings (or "P/E") ratio of 8.5x might still make it look like a strong buy right now compared to the market in India, where around half of the companies have P/E ratios above 32x and even P/E's above 60x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Ashapura Minechem certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Ashapura Minechem

Is There Any Growth For Ashapura Minechem?

The only time you'd be truly comfortable seeing a P/E as depressed as Ashapura Minechem's is when the company's growth is on track to lag the market decidedly.

Retrospectively, the last year delivered an exceptional 31% gain to the company's bottom line. The latest three year period has also seen an excellent 99% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

It's interesting to note that the rest of the market is similarly expected to grow by 26% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this information, we find it odd that Ashapura Minechem is trading at a P/E lower than the market. It may be that most investors are not convinced the company can maintain recent growth rates.

What We Can Learn From Ashapura Minechem's P/E?

Shares in Ashapura Minechem have plummeted and its P/E is now low enough to touch the ground. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Ashapura Minechem currently trades on a lower than expected P/E since its recent three-year growth is in line with the wider market forecast. When we see average earnings with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions should normally provide more support to the share price.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Ashapura Minechem (1 doesn't sit too well with us!) that you should be aware of before investing here.

Of course, you might also be able to find a better stock than Ashapura Minechem. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Ashapura Minechem, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ASHAPURMIN

Ashapura Minechem

Ashapura Minechem Limited is involved in the mining, manufacturing, and trading of various minerals and its derivative products in India and internationally.

Adequate balance sheet low.

Similar Companies

Market Insights

Community Narratives