We Ran A Stock Scan For Earnings Growth And Anupam Rasayan India (NSE:ANURAS) Passed With Ease

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Anupam Rasayan India (NSE:ANURAS). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Anupam Rasayan India with the means to add long-term value to shareholders.

View our latest analysis for Anupam Rasayan India

How Fast Is Anupam Rasayan India Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Impressively, Anupam Rasayan India has grown EPS by 18% per year, compound, in the last three years. As a result, we can understand why the stock trades on a high multiple of trailing twelve month earnings.

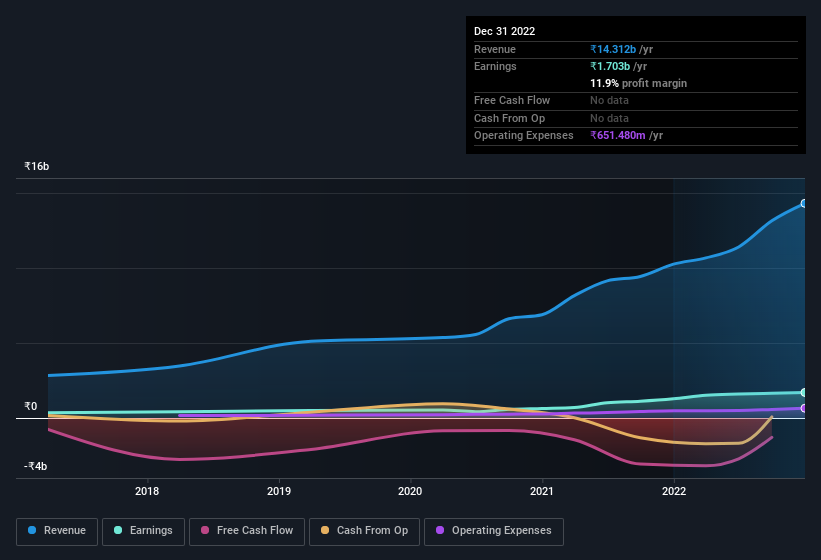

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Anupam Rasayan India is growing revenues, and EBIT margins improved by 3.0 percentage points to 24%, over the last year. Both of which are great metrics to check off for potential growth.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Anupam Rasayan India's future EPS 100% free.

Are Anupam Rasayan India Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So we're pleased to report that Anupam Rasayan India insiders own a meaningful share of the business. Actually, with 40% of the company to their names, insiders are profoundly invested in the business. This should be a welcoming sign for investors because it suggests that the people making the decisions are also impacted by their choices. at the current share price. That level of investment from insiders is nothing to sneeze at.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Our quick analysis into CEO remuneration would seem to indicate they are. The median total compensation for CEOs of companies similar in size to Anupam Rasayan India, with market caps between ₹33b and ₹131b, is around ₹33m.

Anupam Rasayan India's CEO took home a total compensation package of ₹13m in the year prior to March 2022. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Is Anupam Rasayan India Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into Anupam Rasayan India's strong EPS growth. If that's not enough, consider also that the CEO pay is quite reasonable, and insiders are well-invested alongside other shareholders. Everyone has their own preferences when it comes to investing but it definitely makes Anupam Rasayan India look rather interesting indeed. What about risks? Every company has them, and we've spotted 1 warning sign for Anupam Rasayan India you should know about.

Although Anupam Rasayan India certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ANURAS

Anupam Rasayan India

Engages in the custom synthesis and manufacturing of specialty chemicals in India, Europe, Japan, Singapore, China, North America, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026