Is It Worth Considering Akzo Nobel India Limited (NSE:AKZOINDIA) For Its Upcoming Dividend?

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Akzo Nobel India Limited (NSE:AKZOINDIA) is about to trade ex-dividend in the next three days. You can purchase shares before the 17th of February in order to receive the dividend, which the company will pay on the 11th of March.

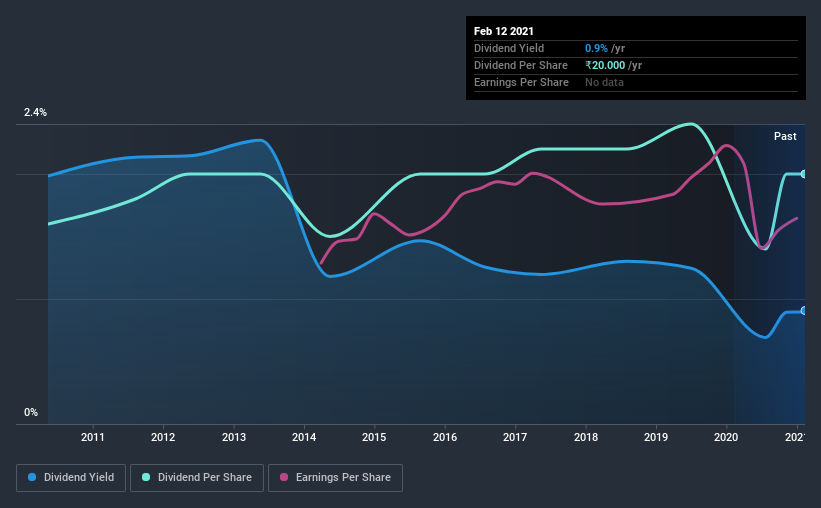

Akzo Nobel India's upcoming dividend is ₹20.00 a share, following on from the last 12 months, when the company distributed a total of ₹20.00 per share to shareholders. Calculating the last year's worth of payments shows that Akzo Nobel India has a trailing yield of 0.9% on the current share price of ₹2193.2. If you buy this business for its dividend, you should have an idea of whether Akzo Nobel India's dividend is reliable and sustainable. As a result, readers should always check whether Akzo Nobel India has been able to grow its dividends, or if the dividend might be cut.

View our latest analysis for Akzo Nobel India

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Akzo Nobel India paid out a comfortable 34% of its profit last year. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. The company paid out 105% of its free cash flow over the last year, which we think is outside the ideal range for most businesses. Cash flows are usually much more volatile than earnings, so this could be a temporary effect - but we'd generally want look more closely here.

Akzo Nobel India paid out less in dividends than it reported in profits, but unfortunately it didn't generate enough cash to cover the dividend. Were this to happen repeatedly, this would be a risk to Akzo Nobel India's ability to maintain its dividend.

Click here to see how much of its profit Akzo Nobel India paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Stocks with flat earnings can still be attractive dividend payers, but it is important to be more conservative with your approach and demand a greater margin for safety when it comes to dividend sustainability. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. It's not encouraging to see that Akzo Nobel India's earnings are effectively flat over the past five years. It's better than seeing them drop, certainly, but over the long term, all of the best dividend stocks are able to meaningfully grow their earnings per share. Earnings have been growing somewhat, but we're concerned dividend payments consumed most of the company's cash flow over the past year.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Since the start of our data, 10 years ago, Akzo Nobel India has lifted its dividend by approximately 2.3% a year on average.

To Sum It Up

From a dividend perspective, should investors buy or avoid Akzo Nobel India? Earnings per share have barely grown in this time, and although Akzo Nobel India is paying out a low percentage of its profit, its dividend was not well covered by free cash flow. It's not common to see a company paying out a limited amount of its profits yet a substantially higher percentage of its cash flow, so we'd flag this as a concern. While it does have some good things going for it, we're a bit ambivalent and it would take more to convince us of Akzo Nobel India's dividend merits.

So if you want to do more digging on Akzo Nobel India, you'll find it worthwhile knowing the risks that this stock faces. Every company has risks, and we've spotted 2 warning signs for Akzo Nobel India (of which 1 doesn't sit too well with us!) you should know about.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

When trading Akzo Nobel India or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:AKZOINDIA

Akzo Nobel India

Manufactures, distributes, and sells paints and coatings in India and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives