- India

- /

- Paper and Forestry Products

- /

- NSEI:AIROLAM

With EPS Growth And More, Airo Lam (NSE:AIROLAM) Makes An Interesting Case

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Airo Lam (NSE:AIROLAM). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Airo Lam with the means to add long-term value to shareholders.

Check out the opportunities and risks within the IN Forestry industry.

How Quickly Is Airo Lam Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. We can see that in the last three years Airo Lam grew its EPS by 14% per year. That's a pretty good rate, if the company can sustain it.

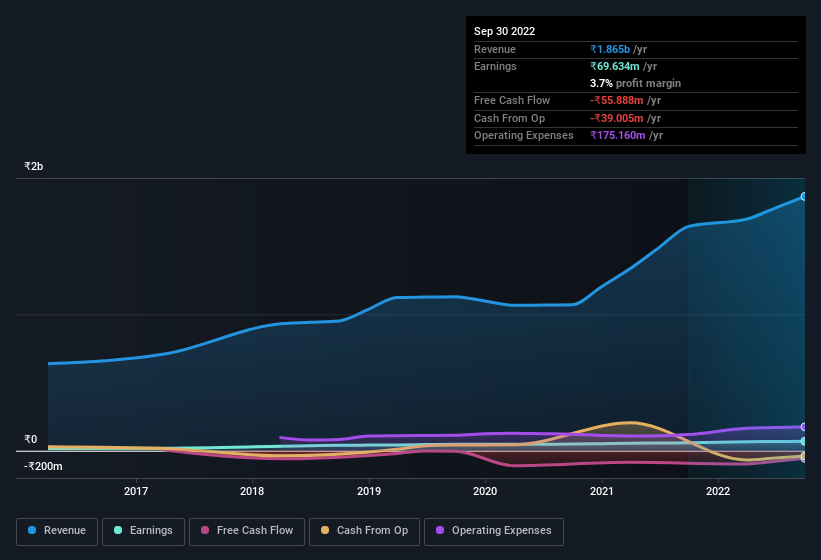

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Airo Lam maintained stable EBIT margins over the last year, all while growing revenue 13% to ₹1.9b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Airo Lam isn't a huge company, given its market capitalisation of ₹1.4b. That makes it extra important to check on its balance sheet strength.

Are Airo Lam Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

One positive for Airo Lam, is that company insiders spent ₹1.1m acquiring shares in the last year. While this isn't much, we also note an absence of sales. We also note that it was the Non Executive Director, Hardik Kumar Patel, who made the biggest single acquisition, paying ₹218k for shares at about ₹62.42 each.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for Airo Lam will reveal that insiders own a significant piece of the pie. In fact, they own 48% of the shares, making insiders a very influential shareholder group. Shareholders and speculators should be reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. Of course, Airo Lam is a very small company, with a market cap of only ₹1.4b. So this large proportion of shares owned by insiders only amounts to ₹667m. This isn't an overly large holding but it should still keep the insiders motivated to deliver the best outcomes for shareholders.

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. The cherry on top is that the CEO, Pravin Kumar Patel is paid comparatively modestly to CEOs at similar sized companies. Our analysis has discovered that the median total compensation for the CEOs of companies like Airo Lam with market caps under ₹16b is about ₹3.6m.

The CEO of Airo Lam was paid just ₹840k in total compensation for the year ending March 2022. This total may indicate that the CEO is sacrificing take home pay for performance-based benefits, ensuring that their motivations are synonymous with strong company results. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Does Airo Lam Deserve A Spot On Your Watchlist?

One positive for Airo Lam is that it is growing EPS. That's nice to see. Better yet, insiders are significant shareholders, and have been buying more shares. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. It is worth noting though that we have found 3 warning signs for Airo Lam (2 are a bit unpleasant!) that you need to take into consideration.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Airo Lam, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:AIROLAM

Airo Lam

Engages in the production, processing, and marketing of decorative laminate sheets and plywood boards in India.

Slight risk with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives