Are Insiders Buying Advanced Enzyme Technologies Limited (NSE:ADVENZYMES) Stock?

It is not uncommon to see companies perform well in the years after insiders buy shares. Unfortunately, there are also plenty of examples of share prices declining precipitously after insiders have sold shares. So shareholders might well want to know whether insiders have been buying or selling shares in Advanced Enzyme Technologies Limited (NSE:ADVENZYMES).

What Is Insider Buying?

It's quite normal to see company insiders, such as board members, trading in company stock, from time to time. However, rules govern insider transactions, and certain disclosures are required.

We don't think shareholders should simply follow insider transactions. But it is perfectly logical to keep tabs on what insiders are doing. For example, a Harvard University study found that 'insider purchases earn abnormal returns of more than 6% per year'.

Check out our latest analysis for Advanced Enzyme Technologies

The Last 12 Months Of Insider Transactions At Advanced Enzyme Technologies

In the last twelve months, the biggest single purchase by an insider was when Director of Operations & Whole Time Director Mukund Kabra bought ₹13m worth of shares at a price of ₹99.00 per share. We do like to see buying, but this purchase was made at well below the current price of ₹177. Because it occurred at a lower valuation, it doesn't tell us much about whether insiders might find today's price attractive.

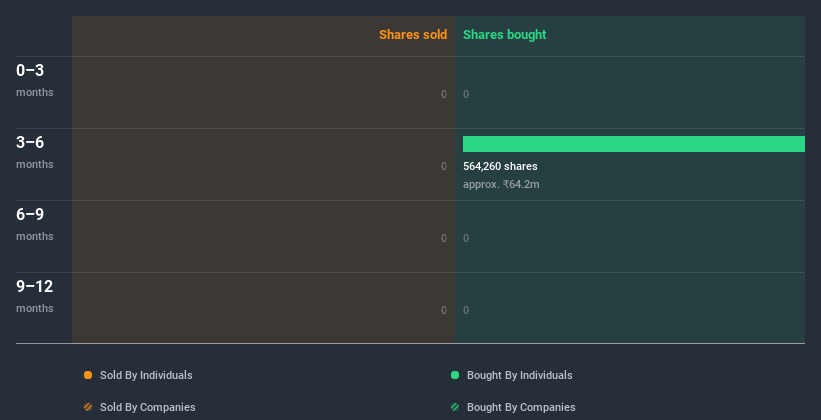

In the last twelve months Advanced Enzyme Technologies insiders were buying shares, but not selling. Their average price was about ₹114. To my mind it is good that insiders have invested their own money in the company. However, you should keep in mind that they bought when the share price was meaningfully below today's levels. The chart below shows insider transactions (by companies and individuals) over the last year. By clicking on the graph below, you can see the precise details of each insider transaction!

There are always plenty of stocks that insiders are buying. So if that suits your style you could check each stock one by one or you could take a look at this free list of companies. (Hint: insiders have been buying them).

Does Advanced Enzyme Technologies Boast High Insider Ownership?

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. We usually like to see fairly high levels of insider ownership. It's great to see that Advanced Enzyme Technologies insiders own 48% of the company, worth about ₹9.1b. This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

What Might The Insider Transactions At Advanced Enzyme Technologies Tell Us?

It doesn't really mean much that no insider has traded Advanced Enzyme Technologies shares in the last quarter. But insiders have shown more of an appetite for the stock, over the last year. Judging from their transactions, and high insider ownership, Advanced Enzyme Technologies insiders feel good about the company's future. Of course, the future is what matters most. So if you are interested in Advanced Enzyme Technologies, you should check out this free report on analyst forecasts for the company.

Of course Advanced Enzyme Technologies may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you decide to trade Advanced Enzyme Technologies, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:ADVENZYMES

Advanced Enzyme Technologies

Engages in the research, development, manufacture, and marketing of enzymes and probiotics in India, Europe, the United States, Asia, and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026