Religare Enterprises Limited's (NSE:RELIGARE) Shares Not Telling The Full Story

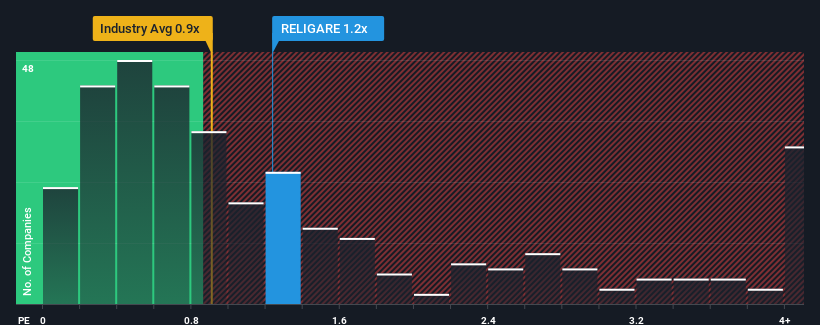

There wouldn't be many who think Religare Enterprises Limited's (NSE:RELIGARE) price-to-sales (or "P/S") ratio of 1.2x is worth a mention when the median P/S for the Insurance industry in India is very similar. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Religare Enterprises

How Has Religare Enterprises Performed Recently?

Recent times have been quite advantageous for Religare Enterprises as its revenue has been rising very briskly. It might be that many expect the strong revenue performance to wane, which has kept the share price, and thus the P/S ratio, from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Religare Enterprises will help you shine a light on its historical performance.How Is Religare Enterprises' Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Religare Enterprises' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 33%. The strong recent performance means it was also able to grow revenue by 149% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 0.7%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we find it interesting that Religare Enterprises is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From Religare Enterprises' P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Religare Enterprises currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

There are also other vital risk factors to consider before investing and we've discovered 3 warning signs for Religare Enterprises that you should be aware of.

If you're unsure about the strength of Religare Enterprises' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:RELIGARE

Religare Enterprises

Through its subsidiaries, provides various financial services in India and internationally.

Adequate balance sheet very low.

Market Insights

Community Narratives