Despite lower earnings than a year ago, New India Assurance (NSE:NIACL) investors are up 40% since then

The New India Assurance Company Limited (NSE:NIACL) shareholders might understandably be very concerned that the share price has dropped 35% in the last quarter. Taking a longer term view we see the stock is up over one year. But to be blunt its return of 39% fall short of what you could have got from an index fund (around 42%).

Since the long term performance has been good but there's been a recent pullback of 9.1%, let's check if the fundamentals match the share price.

See our latest analysis for New India Assurance

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year, New India Assurance actually saw its earnings per share drop 6.9%.

This means it's unlikely the market is judging the company based on earnings growth. Indeed, when EPS is declining but the share price is up, it often means the market is considering other factors.

We are skeptical of the suggestion that the 1.1% dividend yield would entice buyers to the stock. We think that the revenue growth of 4.2% could have some investors interested. Many businesses do go through a phase where they have to forgo some profits to drive business development, and sometimes its for the best.

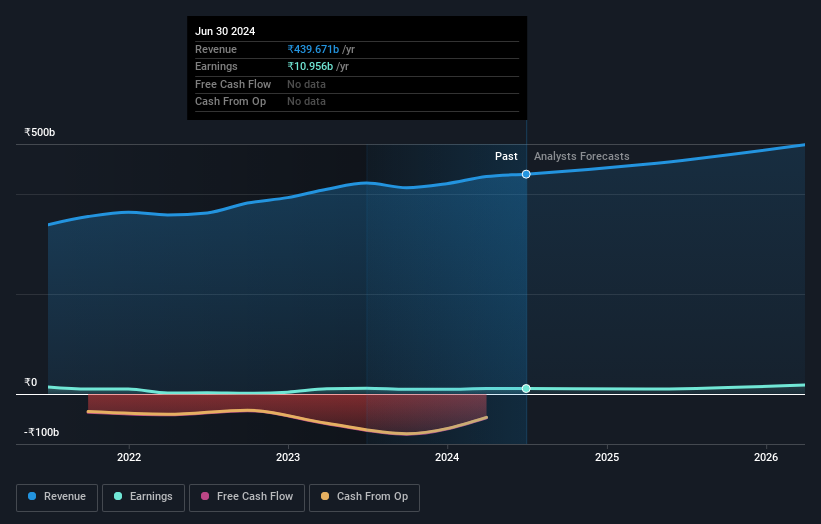

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on New India Assurance's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

New India Assurance's TSR for the year was broadly in line with the market average, at 40%. That gain looks pretty satisfying, and it is even better than the five-year TSR of 4% per year. Even if the share price growth slows down from here, there's a good chance that this is business worth watching in the long term. It's always interesting to track share price performance over the longer term. But to understand New India Assurance better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with New India Assurance .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if New India Assurance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:NIACL

New India Assurance

Operates as a general insurance company in India and internationally.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives