- India

- /

- Personal Products

- /

- NSEI:PGHH

Is Weakness In Procter & Gamble Hygiene and Health Care Limited (NSE:PGHH) Stock A Sign That The Market Could be Wrong Given Its Strong Financial Prospects?

It is hard to get excited after looking at Procter & Gamble Hygiene and Health Care's (NSE:PGHH) recent performance, when its stock has declined 4.4% over the past week. However, a closer look at its sound financials might cause you to think again. Given that fundamentals usually drive long-term market outcomes, the company is worth looking at. In this article, we decided to focus on Procter & Gamble Hygiene and Health Care's ROE.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Put another way, it reveals the company's success at turning shareholder investments into profits.

View our latest analysis for Procter & Gamble Hygiene and Health Care

How To Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Procter & Gamble Hygiene and Health Care is:

71% = ₹7.5b ÷ ₹11b (Based on the trailing twelve months to March 2024).

The 'return' refers to a company's earnings over the last year. That means that for every ₹1 worth of shareholders' equity, the company generated ₹0.71 in profit.

What Is The Relationship Between ROE And Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Procter & Gamble Hygiene and Health Care's Earnings Growth And 71% ROE

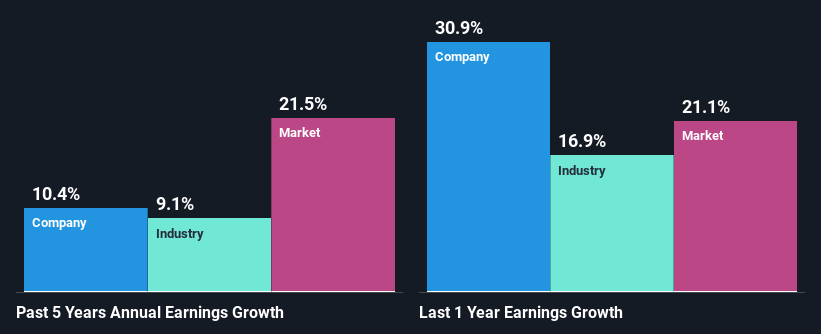

To begin with, Procter & Gamble Hygiene and Health Care has a pretty high ROE which is interesting. Additionally, the company's ROE is higher compared to the industry average of 12% which is quite remarkable. Probably as a result of this, Procter & Gamble Hygiene and Health Care was able to see a decent net income growth of 10% over the last five years.

We then performed a comparison between Procter & Gamble Hygiene and Health Care's net income growth with the industry, which revealed that the company's growth is similar to the average industry growth of 9.1% in the same 5-year period.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. Doing so will help them establish if the stock's future looks promising or ominous. If you're wondering about Procter & Gamble Hygiene and Health Care's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Procter & Gamble Hygiene and Health Care Using Its Retained Earnings Effectively?

While Procter & Gamble Hygiene and Health Care has a three-year median payout ratio of 89% (which means it retains 11% of profits), the company has still seen a fair bit of earnings growth in the past, meaning that its high payout ratio hasn't hampered its ability to grow.

Additionally, Procter & Gamble Hygiene and Health Care has paid dividends over a period of at least ten years which means that the company is pretty serious about sharing its profits with shareholders. Based on the latest analysts' estimates, we found that the company's future payout ratio over the next three years is expected to hold steady at 83%. However, Procter & Gamble Hygiene and Health Care's ROE is predicted to rise to 90% despite there being no anticipated change in its payout ratio.

Conclusion

In total, we are pretty happy with Procter & Gamble Hygiene and Health Care's performance. Especially the high ROE, Which has contributed to the impressive growth seen in earnings. Despite the company reinvesting only a small portion of its profits, it still has managed to grow its earnings so that is appreciable. Having said that, looking at the current analyst estimates, we found that the company's earnings are expected to gain momentum. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:PGHH

Procter & Gamble Hygiene and Health Care

Manufactures and sells branded packaged fast-moving consumer goods in the feminine care and healthcare businesses in India and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026