In the last week, the Indian market has been flat with a notable 4.1% drop in the Energy sector, yet it remains up 41% over the past year with earnings forecasted to grow by 17% annually. In this thriving environment, growth companies with substantial insider ownership can offer unique investment opportunities due to their strong alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 33.7% |

| Kirloskar Pneumatic (BSE:505283) | 30.4% | 30.1% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.6% | 36.7% |

| Jupiter Wagons (NSEI:JWL) | 10.8% | 27.4% |

| Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 32.5% | 22.2% |

| Paisalo Digital (BSE:532900) | 16.3% | 24.8% |

| Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 32.3% |

| KEI Industries (BSE:517569) | 18.7% | 22.4% |

| Pricol (NSEI:PRICOLLTD) | 25.5% | 24% |

| Aether Industries (NSEI:AETHER) | 31.1% | 45.9% |

Let's take a closer look at a couple of our picks from the screened companies.

Godrej Consumer Products (NSEI:GODREJCP)

Simply Wall St Growth Rating: ★★★★☆☆

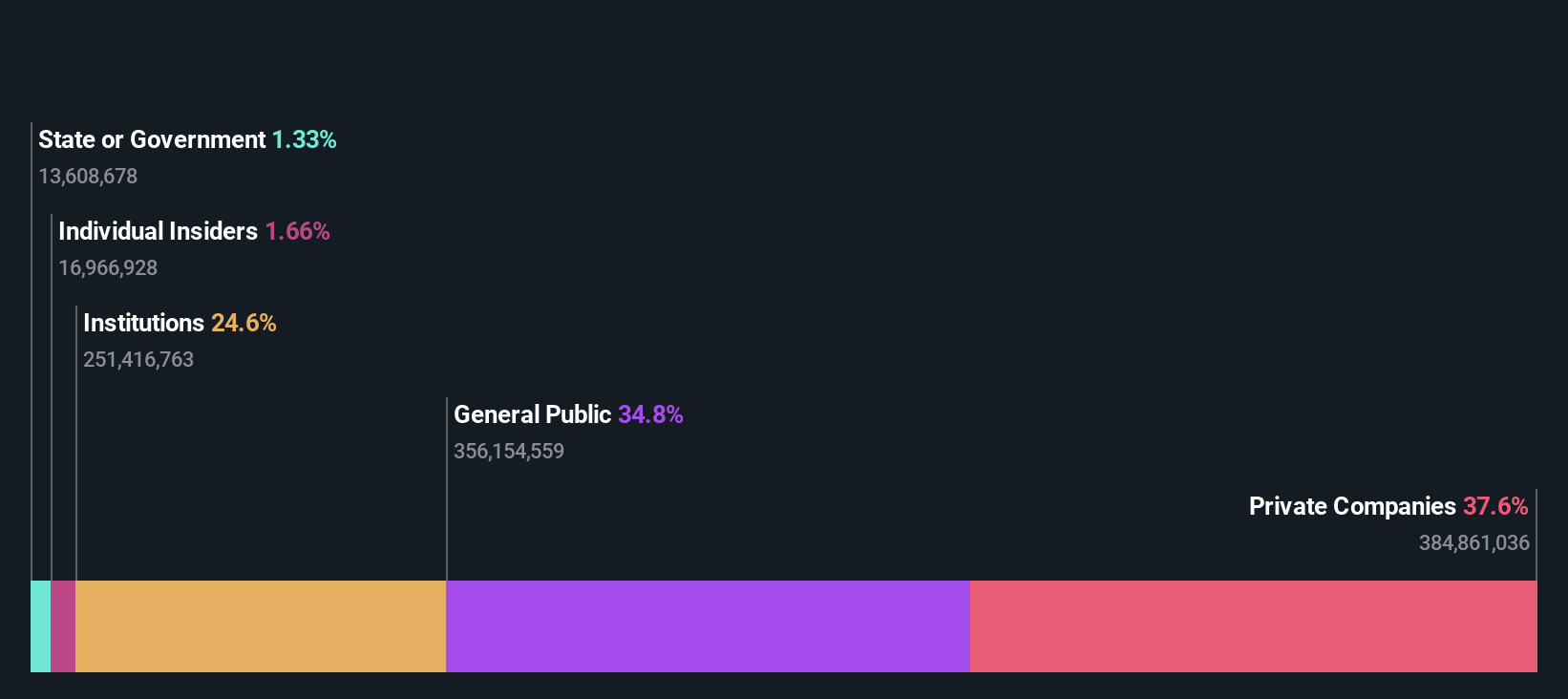

Overview: Godrej Consumer Products Limited is a fast-moving consumer goods company that manufactures and markets personal care and home care products in India, Africa, Indonesia, the Middle East, the United States of America, and internationally with a market cap of ₹1.54 trillion.

Operations: Godrej Consumer Products Limited generates revenue of ₹139.79 billion from the manufacturing of personal, household, and hair care products.

Insider Ownership: 13.8%

Godrej Consumer Products, a growth company with high insider ownership, recently announced significant management changes and expansion into the pet care market. The company plans to invest ₹5 billion over five years in this new venture. Despite a slight revenue dip to ₹34.09 billion in Q1 2024, net income rose to ₹4.51 billion from ₹3.19 billion the previous year. Earnings are forecasted to grow annually by 58.31%, indicating strong future profitability expectations.

- Unlock comprehensive insights into our analysis of Godrej Consumer Products stock in this growth report.

- Our expertly prepared valuation report Godrej Consumer Products implies its share price may be too high.

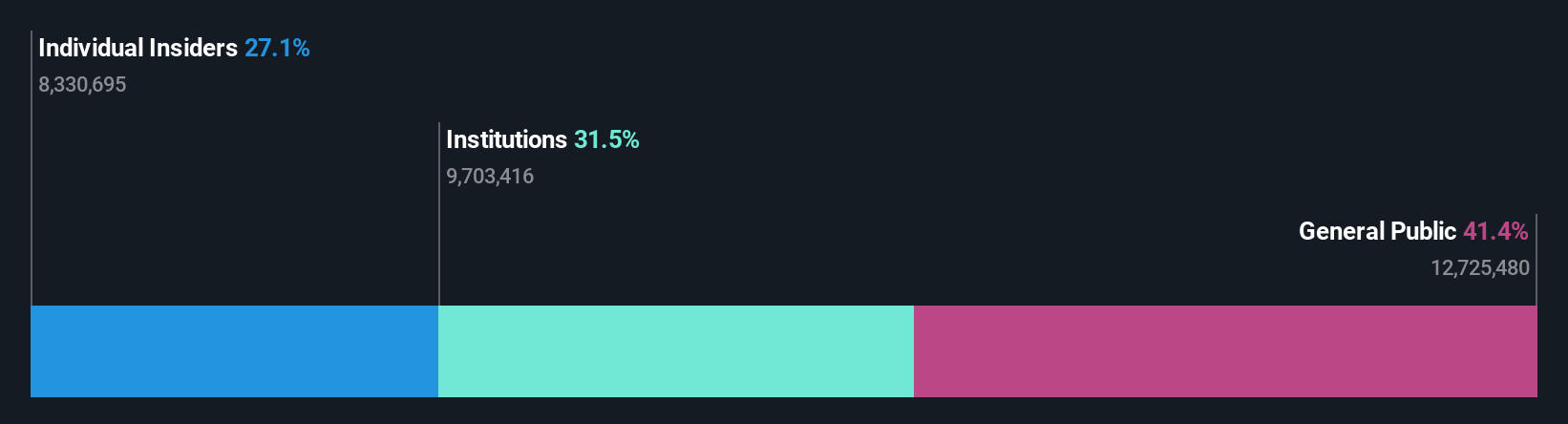

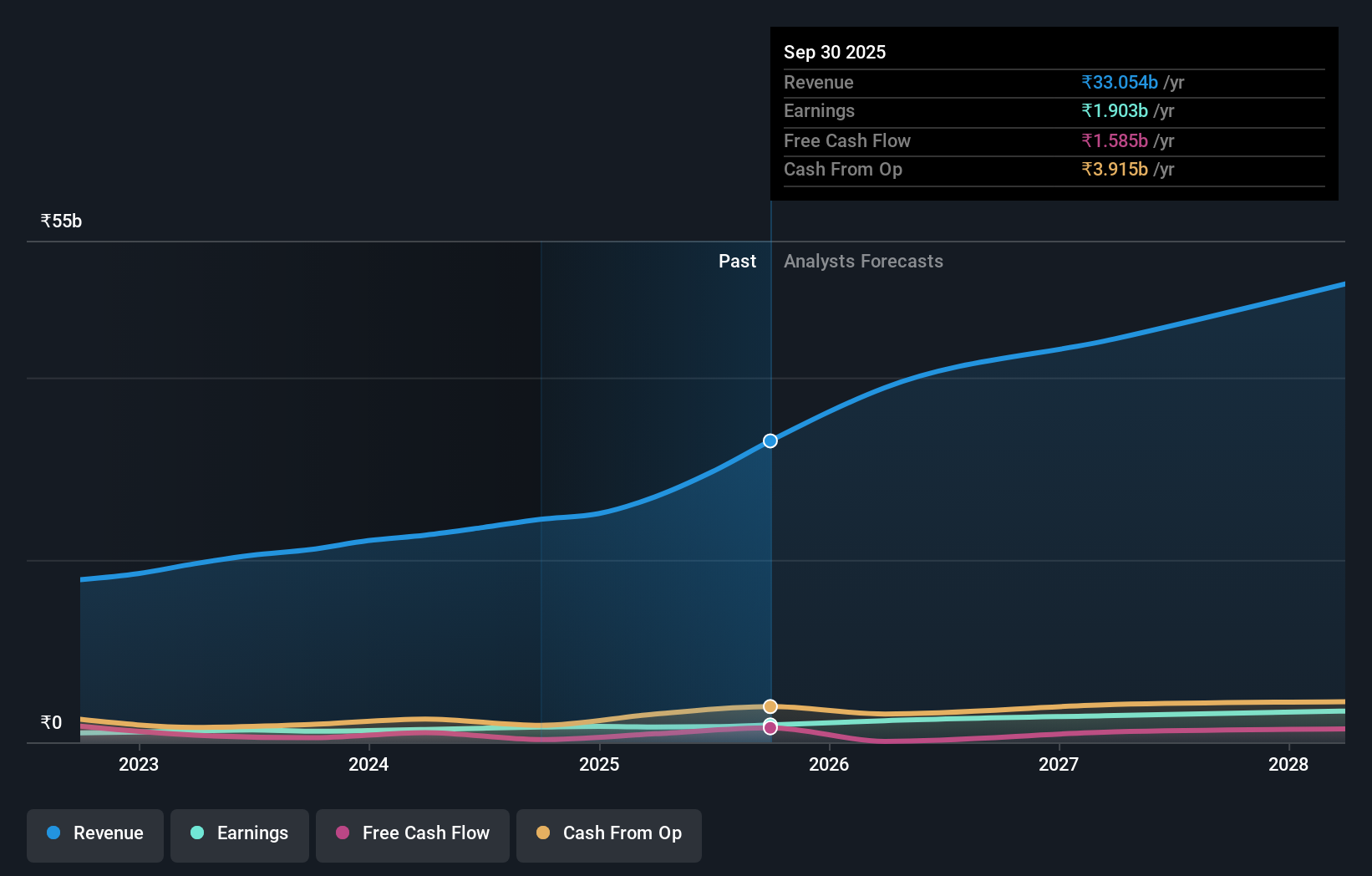

MTAR Technologies (NSEI:MTARTECH)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MTAR Technologies Limited is a precision engineering solutions company that develops, manufactures, and sells high precision heavy equipment, components, and machines in India and internationally with a market cap of ₹55.51 billion.

Operations: Revenue from manufacturing high precision and heavy equipment, components, and machines is ₹5.56 billion.

Insider Ownership: 36.4%

MTAR Technologies, with high insider ownership and minimal recent insider selling, is forecast to see significant earnings growth of 40.03% annually over the next three years. Despite a drop in Q1 revenue to ₹1.29 billion from ₹1.57 billion and net income to ₹44.28 million from ₹203.36 million year-over-year, the company secured a $16.73 million export order in the clean energy sector, indicating robust future prospects amidst current challenges.

- Navigate through the intricacies of MTAR Technologies with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that MTAR Technologies' current price could be inflated.

Pricol (NSEI:PRICOLLTD)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pricol Limited, along with its subsidiaries, manufactures and sells instrument clusters and other allied automobile components to original equipment manufacturers and replacement markets in India and internationally, with a market cap of ₹58.74 billion.

Operations: Pricol Limited's revenue primarily comes from its automotive components segment, amounting to ₹23.55 billion.

Insider Ownership: 25.5%

Pricol Limited, with substantial insider ownership, is forecast to achieve annual earnings growth of 24% and revenue growth of 16.5%, both outpacing the Indian market. Recent developments include active pursuit of acquisitions to diversify its portfolio and expand globally. Q1 FY25 results showed a rise in net income to ₹455.61 million from ₹319.38 million year-over-year, driven by consistent market outperformance and new project launches across various vehicle segments.

- Click here to discover the nuances of Pricol with our detailed analytical future growth report.

- According our valuation report, there's an indication that Pricol's share price might be on the expensive side.

Turning Ideas Into Actions

- Delve into our full catalog of 93 Fast Growing Indian Companies With High Insider Ownership here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:MTARTECH

MTAR Technologies

A precision engineering solutions company, develops, manufactures, and sells high precision, heavy equipment, components, and machines in India and internationally.

High growth potential with excellent balance sheet.