- India

- /

- Personal Products

- /

- NSEI:CUPID

Cupid Limited (NSE:CUPID) Looks Like A Good Stock, And It's Going Ex-Dividend Soon

Readers hoping to buy Cupid Limited (NSE:CUPID) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. If you purchase the stock on or after the 19th of November, you won't be eligible to receive this dividend, when it is paid on the 2nd of December.

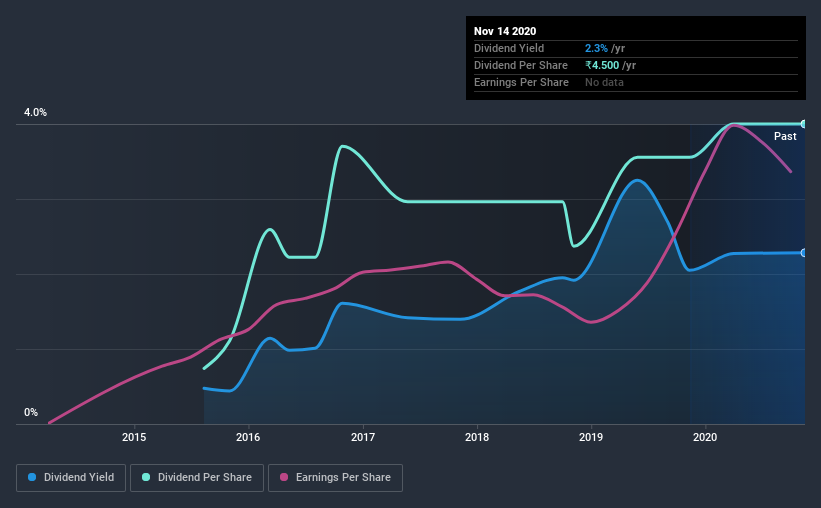

Cupid's next dividend payment will be ₹1.00 per share, and in the last 12 months, the company paid a total of ₹4.50 per share. Calculating the last year's worth of payments shows that Cupid has a trailing yield of 2.3% on the current share price of ₹196.75. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. So we need to investigate whether Cupid can afford its dividend, and if the dividend could grow.

Check out our latest analysis for Cupid

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Cupid is paying out just 14% of its profit after tax, which is comfortably low and leaves plenty of breathing room in the case of adverse events. Yet cash flow is typically more important than profit for assessing dividend sustainability, so we should always check if the company generated enough cash to afford its dividend. It paid out more than half (51%) of its free cash flow in the past year, which is within an average range for most companies.

It's positive to see that Cupid's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see how much of its profit Cupid paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. If earnings fall far enough, the company could be forced to cut its dividend. That's why it's comforting to see Cupid's earnings have been skyrocketing, up 34% per annum for the past five years.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Cupid has delivered 40% dividend growth per year on average over the past five years. Both per-share earnings and dividends have both been growing rapidly in recent times, which is great to see.

Final Takeaway

Has Cupid got what it takes to maintain its dividend payments? From a dividend perspective, we're encouraged to see that earnings per share have been growing, the company is paying out less than half of its earnings, and a bit over half its free cash flow. Overall we think this is an attractive combination and worthy of further research.

On that note, you'll want to research what risks Cupid is facing. Our analysis shows 3 warning signs for Cupid and you should be aware of them before buying any shares.

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

When trading Cupid or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:CUPID

Cupid

Designs, manufactures, markets, and exports male and female condoms in India.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives