- India

- /

- Healthcare Services

- /

- NSEI:SASTASUNDR

Sastasundar Ventures' (NSE:SASTASUNDR) growing losses don't faze investors as the stock soars 11% this past week

When you buy a stock there is always a possibility that it could drop 100%. But on a lighter note, a good company can see its share price rise well over 100%. One great example is Sastasundar Ventures Limited (NSE:SASTASUNDR) which saw its share price drive 262% higher over five years. Also pleasing for shareholders was the 12% gain in the last three months. But this move may well have been assisted by the reasonably buoyant market (up 8.4% in 90 days).

Since the stock has added ₹929m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

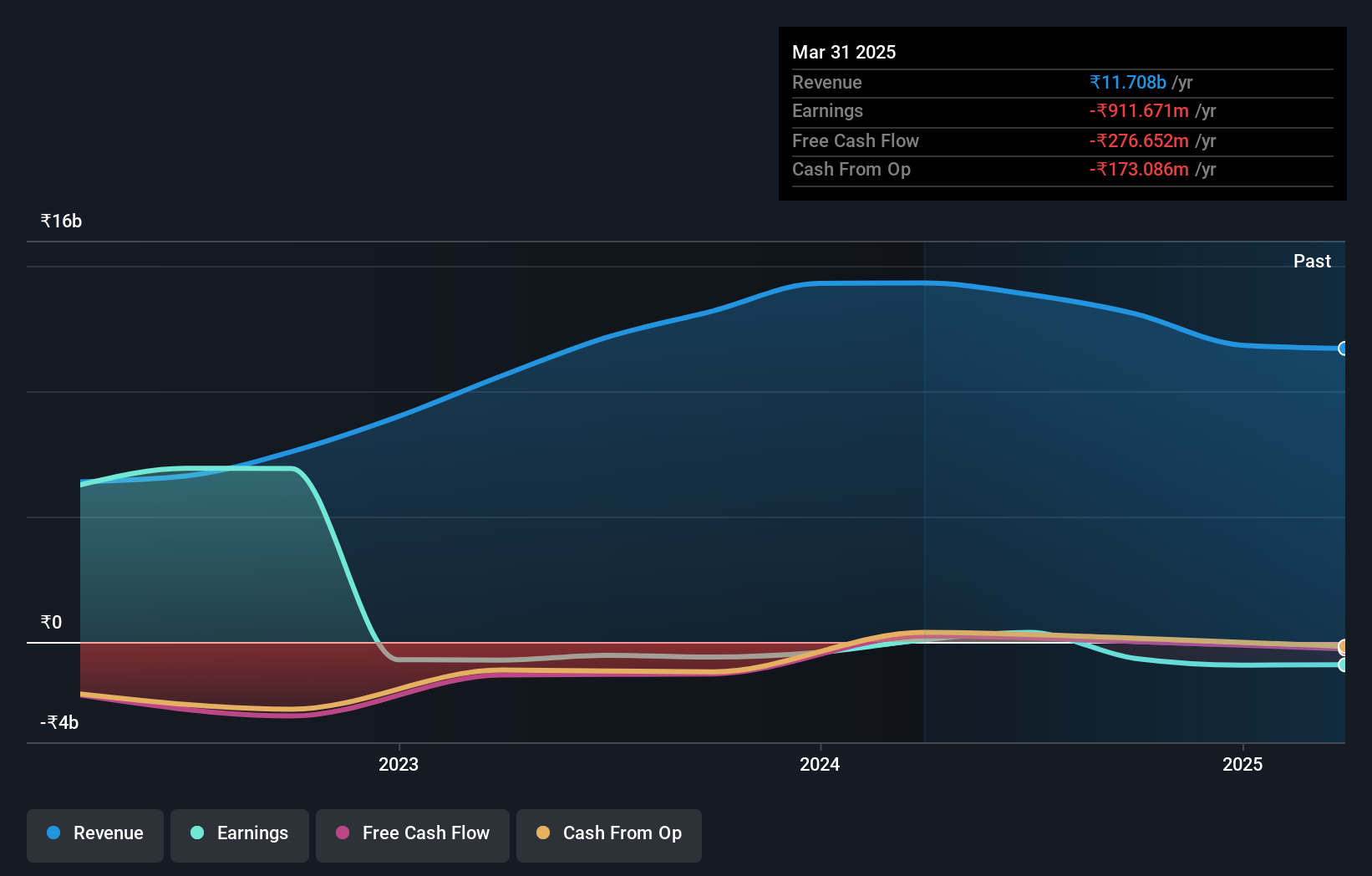

Given that Sastasundar Ventures didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 5 years Sastasundar Ventures saw its revenue grow at 25% per year. Even measured against other revenue-focussed companies, that's a good result. Meanwhile, its share price performance certainly reflects the strong growth, given the share price grew at 29% per year, compound, during the period. So it seems likely that buyers have paid attention to the strong revenue growth. Sastasundar Ventures seems like a high growth stock - so growth investors might want to add it to their watchlist.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Sastasundar Ventures' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market lost about 0.6% in the twelve months, Sastasundar Ventures shareholders did even worse, losing 3.5%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Longer term investors wouldn't be so upset, since they would have made 29%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 1 warning sign we've spotted with Sastasundar Ventures .

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SASTASUNDR

Sastasundar Ventures

Operates a digital network of healthcare and portfolio management services in India.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives