- India

- /

- Healthcare Services

- /

- NSEI:REMUS

We Ran A Stock Scan For Earnings Growth And Remus Pharmaceuticals (NSE:REMUS) Passed With Ease

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Remus Pharmaceuticals (NSE:REMUS). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Remus Pharmaceuticals

How Fast Is Remus Pharmaceuticals Growing Its Earnings Per Share?

In the last three years Remus Pharmaceuticals' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. Thus, it makes sense to focus on more recent growth rates, instead. Outstandingly, Remus Pharmaceuticals' EPS shot from ₹20.82 to ₹36.55, over the last year. It's not often a company can achieve year-on-year growth of 76%. The best case scenario? That the business has hit a true inflection point.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While Remus Pharmaceuticals did well to grow revenue over the last year, EBIT margins were dampened at the same time. So it seems the future may hold further growth, especially if EBIT margins can remain steady.

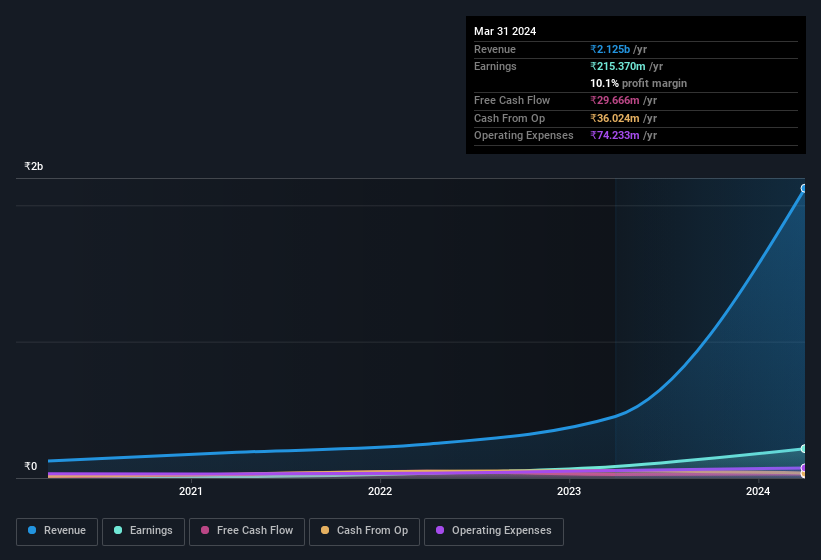

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Remus Pharmaceuticals isn't a huge company, given its market capitalisation of ₹16b. That makes it extra important to check on its balance sheet strength.

Are Remus Pharmaceuticals Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Even though some insiders sold down their holdings, their actions speak louder than words with ₹59m more invested than sold by people who know they company best. An optimistic sign for those with Remus Pharmaceuticals in their watchlist. We also note that it was the MD & Director, Arpit Shah, who made the biggest single acquisition, paying ₹11m for shares at about ₹1,260 each.

Along with the insider buying, another encouraging sign for Remus Pharmaceuticals is that insiders, as a group, have a considerable shareholding. To be specific, they have ₹3.1b worth of shares. That's a lot of money, and no small incentive to work hard. As a percentage, this totals to 20% of the shares on issue for the business, an appreciable amount considering the market cap.

Does Remus Pharmaceuticals Deserve A Spot On Your Watchlist?

Remus Pharmaceuticals' earnings have taken off in quite an impressive fashion. Just as heartening; insiders both own and are buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Remus Pharmaceuticals deserves timely attention. Don't forget that there may still be risks. For instance, we've identified 2 warning signs for Remus Pharmaceuticals (1 is a bit unpleasant) you should be aware of.

Keen growth investors love to see insider activity. Thankfully, Remus Pharmaceuticals isn't the only one. You can see a a curated list of Indian companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Remus Pharmaceuticals, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:REMUS

Remus Pharmaceuticals

Engages in the marketing, trading, and distribution of pharmaceutical finished formulations and products in India and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives