- India

- /

- Healthcare Services

- /

- NSEI:REMUS

If EPS Growth Is Important To You, Remus Pharmaceuticals (NSE:REMUS) Presents An Opportunity

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Remus Pharmaceuticals (NSE:REMUS). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Remus Pharmaceuticals

Remus Pharmaceuticals' Improving Profits

Remus Pharmaceuticals has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. As a result, we'll zoom in on growth over the last year, instead. Impressively, Remus Pharmaceuticals' EPS catapulted from ₹29.41 to ₹50.75, over the last year. It's a rarity to see 73% year-on-year growth like that. That could be a sign that the business has reached a true inflection point.

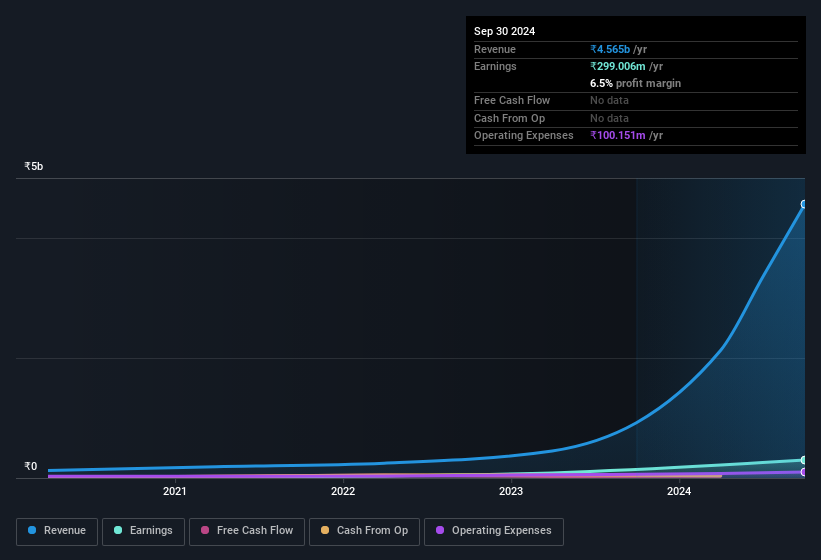

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. While Remus Pharmaceuticals did well to grow revenue over the last year, EBIT margins were dampened at the same time. If EBIT margins are able to stay balanced and this revenue growth continues, then we should see brighter days ahead.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Remus Pharmaceuticals isn't a huge company, given its market capitalisation of ₹12b. That makes it extra important to check on its balance sheet strength.

Are Remus Pharmaceuticals Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Our analysis into Remus Pharmaceuticals has shown that insiders have sold ₹2.9m worth of shares over the last 12 months. But this is outweighed by the trades from MD & Director Arpit Shah who spent ₹8.4m buying shares, at an average price of around ₹2,269. So, on balance, that's positive.

On top of the insider buying, we can also see that Remus Pharmaceuticals insiders own a large chunk of the company. In fact, they own 52% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. In terms of absolute value, insiders have ₹6.4b invested in the business, at the current share price. So there's plenty there to keep them focused!

Is Remus Pharmaceuticals Worth Keeping An Eye On?

Remus Pharmaceuticals' earnings per share have been soaring, with growth rates sky high. The icing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Remus Pharmaceuticals belongs near the top of your watchlist. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Remus Pharmaceuticals , and understanding them should be part of your investment process.

Keen growth investors love to see insider activity. Thankfully, Remus Pharmaceuticals isn't the only one. You can see a a curated list of Indian companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:REMUS

Remus Pharmaceuticals

Engages in the marketing, trading, and distribution of pharmaceutical finished formulations and products in India and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives