- India

- /

- Medical Equipment

- /

- NSEI:POLYMED

After Leaping 41% Poly Medicure Limited (NSE:POLYMED) Shares Are Not Flying Under The Radar

The Poly Medicure Limited (NSE:POLYMED) share price has done very well over the last month, posting an excellent gain of 41%. The last 30 days bring the annual gain to a very sharp 87%.

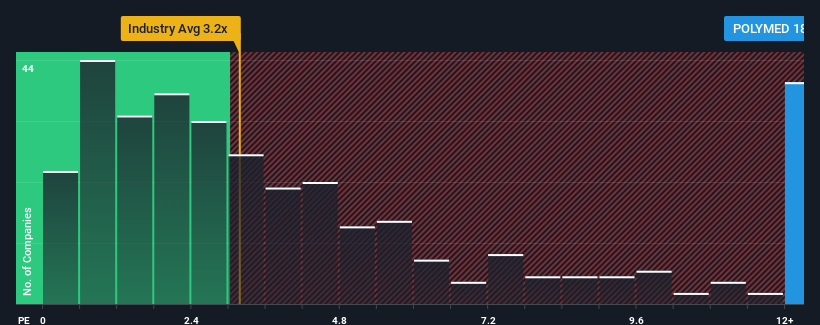

After such a large jump in price, when almost half of the companies in India's Medical Equipment industry have price-to-sales ratios (or "P/S") below 2.2x, you may consider Poly Medicure as a stock not worth researching with its 18.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Poly Medicure

How Has Poly Medicure Performed Recently?

There hasn't been much to differentiate Poly Medicure's and the industry's revenue growth lately. Perhaps the market is expecting future revenue performance to improve, justifying the currently elevated P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Poly Medicure will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Poly Medicure?

Poly Medicure's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered an exceptional 21% gain to the company's top line. Pleasingly, revenue has also lifted 74% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 25% during the coming year according to the five analysts following the company. With the industry only predicted to deliver 20%, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Poly Medicure's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Poly Medicure's P/S

The strong share price surge has lead to Poly Medicure's P/S soaring as well. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Poly Medicure's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Poly Medicure that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:POLYMED

Poly Medicure

Manufactures and sells medical devices in India and internationally.

Flawless balance sheet with high growth potential.