- India

- /

- Healthcare Services

- /

- NSEI:NIDAN

With EPS Growth And More, Nidan Laboratories and Healthcare (NSE:NIDAN) Makes An Interesting Case

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Nidan Laboratories and Healthcare (NSE:NIDAN). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Nidan Laboratories and Healthcare

How Fast Is Nidan Laboratories and Healthcare Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Nidan Laboratories and Healthcare's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 52%. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

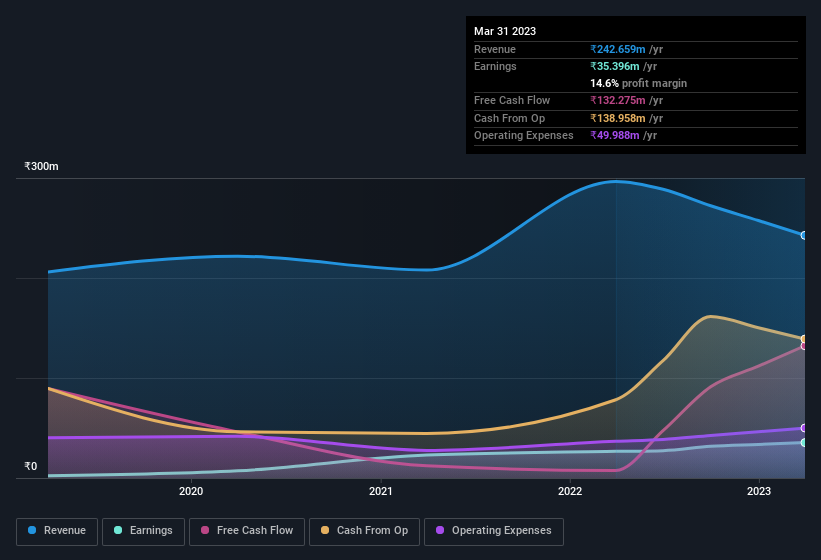

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. To cut to the chase Nidan Laboratories and Healthcare's EBIT margins dropped last year, and so did its revenue. This is less than stellar for the company.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Nidan Laboratories and Healthcare isn't a huge company, given its market capitalisation of ₹711m. That makes it extra important to check on its balance sheet strength.

Are Nidan Laboratories and Healthcare Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So as you can imagine, the fact that Nidan Laboratories and Healthcare insiders own a significant number of shares certainly is appealing. In fact, they own 71% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. Although, with Nidan Laboratories and Healthcare being valued at ₹711m, this is a small company we're talking about. That means insiders only have ₹506m worth of shares, despite the large proportional holding. This isn't an overly large holding but it should still keep the insiders motivated to deliver the best outcomes for shareholders.

Is Nidan Laboratories and Healthcare Worth Keeping An Eye On?

Nidan Laboratories and Healthcare's earnings per share have been soaring, with growth rates sky high. That sort of growth is nothing short of eye-catching, and the large investment held by insiders should certainly brighten the view of the company. At times fast EPS growth is a sign the business has reached an inflection point, so there's a potential opportunity to be had here. So based on this quick analysis, we do think it's worth considering Nidan Laboratories and Healthcare for a spot on your watchlist. You should always think about risks though. Case in point, we've spotted 3 warning signs for Nidan Laboratories and Healthcare you should be aware of, and 2 of them don't sit too well with us.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Nidan Laboratories and Healthcare might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:NIDAN

Nidan Laboratories and Healthcare

Provides healthcare and diagnostic services in India.

Excellent balance sheet slight.

Similar Companies

Market Insights

Community Narratives