- India

- /

- Healthcare Services

- /

- NSEI:KRSNAA

Discover 3 Indian Stocks That May Be Trading Below Their Intrinsic Value

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has dropped 1.2%, but it is up 38% over the past year with earnings expected to grow by 17% per annum over the next few years. In this context, identifying stocks that may be trading below their intrinsic value can offer investors potential opportunities for growth and stability.

Top 10 Undervalued Stocks Based On Cash Flows In India

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Everest Kanto Cylinder (NSEI:EKC) | ₹187.76 | ₹306.24 | 38.7% |

| Apollo Pipes (BSE:531761) | ₹623.80 | ₹1154.02 | 45.9% |

| Prataap Snacks (NSEI:DIAMONDYD) | ₹820.55 | ₹1509.79 | 45.7% |

| Venus Pipes and Tubes (NSEI:VENUSPIPES) | ₹2249.20 | ₹4446.24 | 49.4% |

| Titagarh Rail Systems (NSEI:TITAGARH) | ₹1391.85 | ₹2185.40 | 36.3% |

| Patel Engineering (BSE:531120) | ₹59.28 | ₹94.55 | 37.3% |

| IOL Chemicals and Pharmaceuticals (BSE:524164) | ₹484.30 | ₹762.32 | 36.5% |

| Artemis Medicare Services (NSEI:ARTEMISMED) | ₹286.50 | ₹445.15 | 35.6% |

| Tarsons Products (NSEI:TARSONS) | ₹454.50 | ₹710.77 | 36.1% |

| Manorama Industries (BSE:541974) | ₹840.80 | ₹1665.51 | 49.5% |

Let's explore several standout options from the results in the screener.

HIL (NSEI:HIL)

Overview: HIL Limited produces and distributes building materials and other solutions in India and internationally, with a market cap of ₹21.10 billion.

Operations: HIL Limited generates revenue from Polymer Solutions (₹6.10 billion), Roofing Solutions (₹11.44 billion), Building Solutions (₹5.46 billion), and Flooring Solutions (₹11.63 billion).

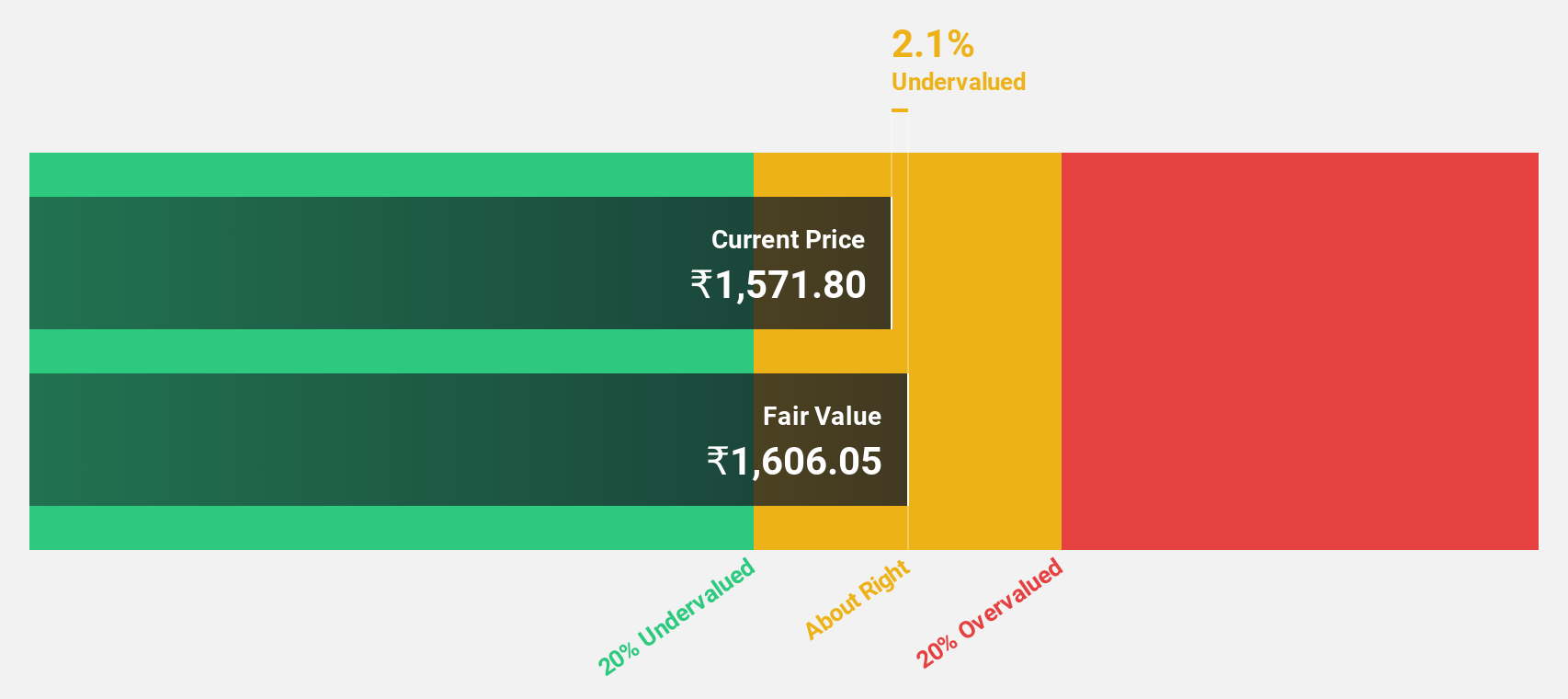

Estimated Discount To Fair Value: 21.4%

HIL Limited, trading at ₹2797.55, is undervalued based on discounted cash flow estimates with a fair value of ₹3559.21. Despite a significant drop in net income to INR 126.2 million for Q1 2025 from INR 578.6 million a year ago, the company is forecasted to achieve above-average market profit growth and faster revenue growth than the Indian market over the next three years, indicating potential for future profitability and value realization.

- Our expertly prepared growth report on HIL implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of HIL stock in this financial health report.

Krsnaa Diagnostics (NSEI:KRSNAA)

Overview: Krsnaa Diagnostics Limited provides diagnostic services in India and has a market cap of ₹24.55 billion.

Operations: Revenue from Radiology and Pathology Services amounts to ₹6.50 billion.

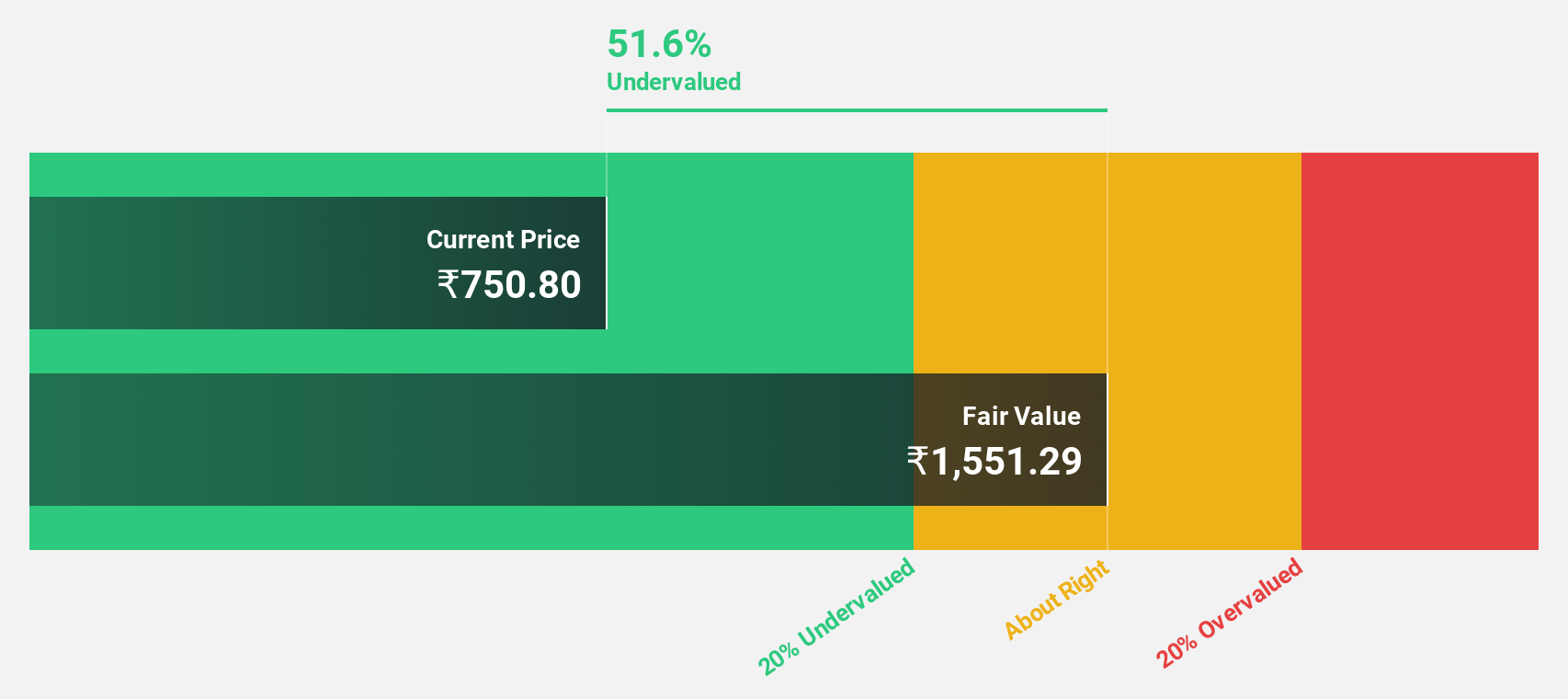

Estimated Discount To Fair Value: 34.8%

Krsnaa Diagnostics, trading at ₹760.15, is undervalued with a fair value estimate of ₹1165.33. The company reported strong Q1 2024 results with revenue rising to ₹1.78 billion and net income increasing to ₹179.21 million from the previous year. Forecasts indicate significant earnings growth of 36.9% annually over the next three years, outpacing both industry and market averages, despite recent executive changes and shareholder dilution concerns.

- The growth report we've compiled suggests that Krsnaa Diagnostics' future prospects could be on the up.

- Dive into the specifics of Krsnaa Diagnostics here with our thorough financial health report.

Piramal Pharma (NSEI:PPLPHARMA)

Overview: Piramal Pharma Limited is a pharmaceutical company with operations in North America, Europe, Japan, India, and internationally, and has a market cap of ₹306.83 billion.

Operations: The company's revenue from its pharmaceutical segment is ₹83.73 billion.

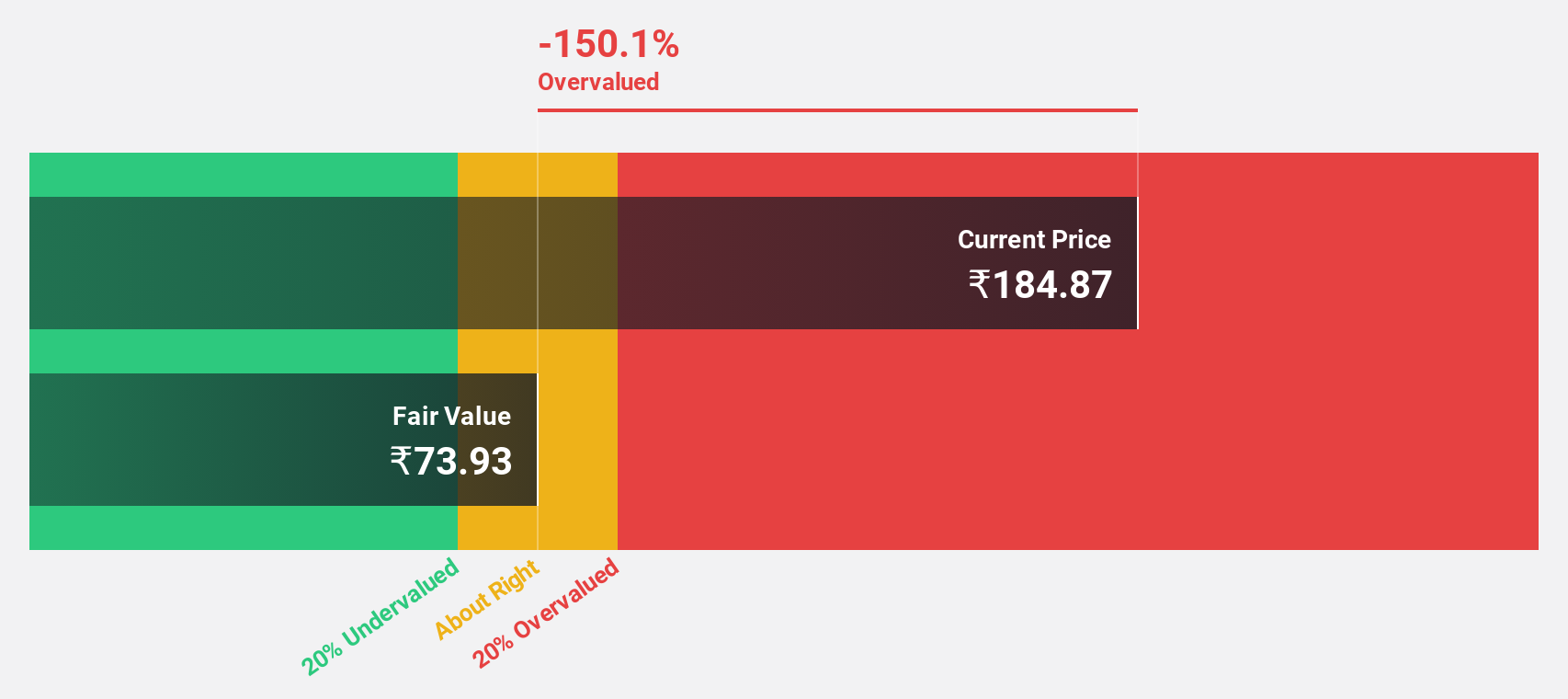

Estimated Discount To Fair Value: 20.1%

Piramal Pharma, trading at ₹231.44, is significantly undervalued with a fair value estimate of ₹289.56. Despite recent regulatory penalties and a net loss of ₹886.4 million in Q1 2024, the company has shown revenue growth to ₹19.71 billion from the previous year’s ₹17.87 billion. Forecasts predict earnings will grow 73.5% annually over the next three years, outpacing market averages and indicating strong future cash flow potential despite current interest payment challenges.

- The analysis detailed in our Piramal Pharma growth report hints at robust future financial performance.

- Click here to discover the nuances of Piramal Pharma with our detailed financial health report.

Turning Ideas Into Actions

- Investigate our full lineup of 27 Undervalued Indian Stocks Based On Cash Flows right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Krsnaa Diagnostics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:KRSNAA

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives