- India

- /

- Healthcare Services

- /

- NSEI:KIMS

Krishna Institute of Medical Sciences Limited's (NSE:KIMS) Shares May Have Run Too Fast Too Soon

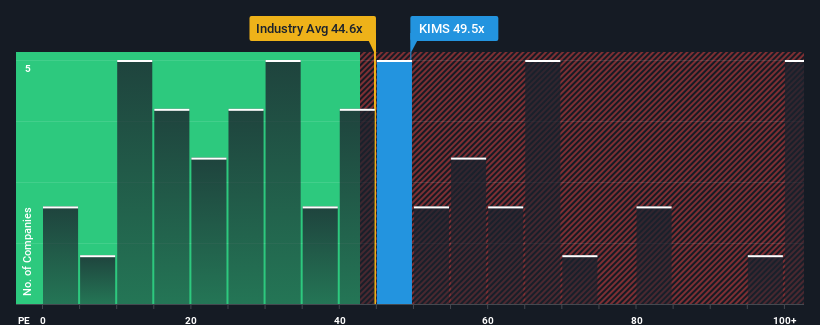

When close to half the companies in India have price-to-earnings ratios (or "P/E's") below 30x, you may consider Krishna Institute of Medical Sciences Limited (NSE:KIMS) as a stock to avoid entirely with its 49.5x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Krishna Institute of Medical Sciences hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Check out our latest analysis for Krishna Institute of Medical Sciences

Does Growth Match The High P/E?

Krishna Institute of Medical Sciences' P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 7.8%. Even so, admirably EPS has lifted 44% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 22% each year during the coming three years according to the eleven analysts following the company. With the market predicted to deliver 21% growth per year, the company is positioned for a comparable earnings result.

In light of this, it's curious that Krishna Institute of Medical Sciences' P/E sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Bottom Line On Krishna Institute of Medical Sciences' P/E

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Krishna Institute of Medical Sciences' analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Krishna Institute of Medical Sciences you should know about.

If these risks are making you reconsider your opinion on Krishna Institute of Medical Sciences, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Krishna Institute of Medical Sciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:KIMS

Krishna Institute of Medical Sciences

Provides medical and health care services under the KIMS Hospitals brand name in India.

Reasonable growth potential with questionable track record.

Market Insights

Community Narratives