- India

- /

- Healthcare Services

- /

- NSEI:KIMS

Getting In Cheap On Krishna Institute of Medical Sciences Limited (NSE:KIMS) Might Be Difficult

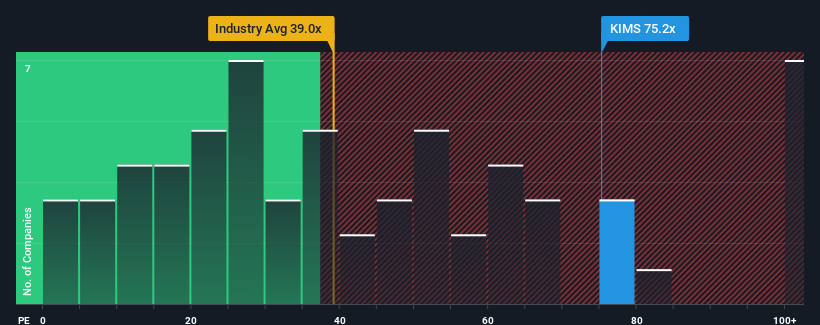

With a price-to-earnings (or "P/E") ratio of 75.2x Krishna Institute of Medical Sciences Limited (NSE:KIMS) may be sending very bearish signals at the moment, given that almost half of all companies in India have P/E ratios under 26x and even P/E's lower than 15x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Krishna Institute of Medical Sciences could be doing better as it's been growing earnings less than most other companies lately. One possibility is that the P/E is high because investors think this lacklustre earnings performance will improve markedly. If not, then existing shareholders may be very nervous about the viability of the share price.

View our latest analysis for Krishna Institute of Medical Sciences

What Are Growth Metrics Telling Us About The High P/E?

Krishna Institute of Medical Sciences' P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

If we review the last year of earnings growth, the company posted a worthy increase of 3.1%. The latest three year period has also seen a 6.4% overall rise in EPS, aided somewhat by its short-term performance. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 29% over the next year. Meanwhile, the rest of the market is forecast to only expand by 24%, which is noticeably less attractive.

In light of this, it's understandable that Krishna Institute of Medical Sciences' P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Krishna Institute of Medical Sciences' P/E

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Krishna Institute of Medical Sciences maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Having said that, be aware Krishna Institute of Medical Sciences is showing 1 warning sign in our investment analysis, you should know about.

If you're unsure about the strength of Krishna Institute of Medical Sciences' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Krishna Institute of Medical Sciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:KIMS

Krishna Institute of Medical Sciences

Provides medical and health care services under the KIMS Hospitals brand in India.

Exceptional growth potential with proven track record.

Market Insights

Community Narratives