- India

- /

- Auto Components

- /

- NSEI:LUMAXTECH

Three High Growth Companies With Significant Insider Ownership On The Indian Exchange

Reviewed by Simply Wall St

The Indian market increased by 1.1% over the last week and is up 42% over the past 12 months, with earnings expected to grow by 17% per annum over the next few years. In this thriving environment, stocks with high insider ownership often signal confidence from those who know the company best, making them attractive options for investors seeking growth opportunities.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 35% |

| Kirloskar Pneumatic (BSE:505283) | 30.6% | 30.1% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.6% | 35.7% |

| Jupiter Wagons (NSEI:JWL) | 10.8% | 27.2% |

| Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 31.9% | 26.3% |

| Paisalo Digital (BSE:532900) | 16.3% | 24.8% |

| JNK India (NSEI:JNKINDIA) | 21% | 31.8% |

| KEI Industries (BSE:517569) | 19.1% | 20.3% |

| Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 33% |

| Aether Industries (NSEI:AETHER) | 31.1% | 43.6% |

Let's dive into some prime choices out of the screener.

Dollar Industries (NSEI:DOLLAR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dollar Industries Limited manufactures and sells hosiery products, including knitted innerwear, casual wear, and thermal wear in India and internationally, with a market cap of ₹27.19 billion.

Operations: The company's revenue segments include knitted innerwear, casual wear, and thermal wear in India and internationally.

Insider Ownership: 14.2%

Dollar Industries Limited, a growth company with high insider ownership in India, reported strong financial performance for Q1 2024, with net income rising to ₹153.03 million from ₹145.26 million a year ago. Revenue growth is forecast at 14.5% annually, outpacing the Indian market's 9.9%. Earnings are expected to grow significantly at 34.1% per year, and its P/E ratio of 29.9x is below the market average of 33.7x, indicating good value potential despite modest dividend coverage by free cash flows.

- Take a closer look at Dollar Industries' potential here in our earnings growth report.

- Our valuation report here indicates Dollar Industries may be overvalued.

Entero Healthcare Solutions (NSEI:ENTERO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Entero Healthcare Solutions Limited trades pharmaceutical and surgical products to retail pharmacies, hospitals, healthcare product manufacturers, and healthcare clinics in India with a market cap of ₹53.70 billion.

Operations: Revenue from trading pharmaceutical and surgical products to retail pharmacies, hospitals, healthcare product manufacturers, and healthcare clinics in India totals ₹39.22 billion.

Insider Ownership: 15.9%

Entero Healthcare Solutions has shown impressive growth, becoming profitable this year with net income of ₹391.09 million for FY 2024 compared to a loss the previous year. Revenue is forecast to grow at 29.6% annually, significantly outpacing the Indian market's 9.9%. Earnings are expected to rise by 53.5% per year over the next three years, although Return on Equity is projected to be modest at 16%. The stock price is anticipated to increase by 22.3%, according to analysts' consensus estimates.

- Delve into the full analysis future growth report here for a deeper understanding of Entero Healthcare Solutions.

- In light of our recent valuation report, it seems possible that Entero Healthcare Solutions is trading beyond its estimated value.

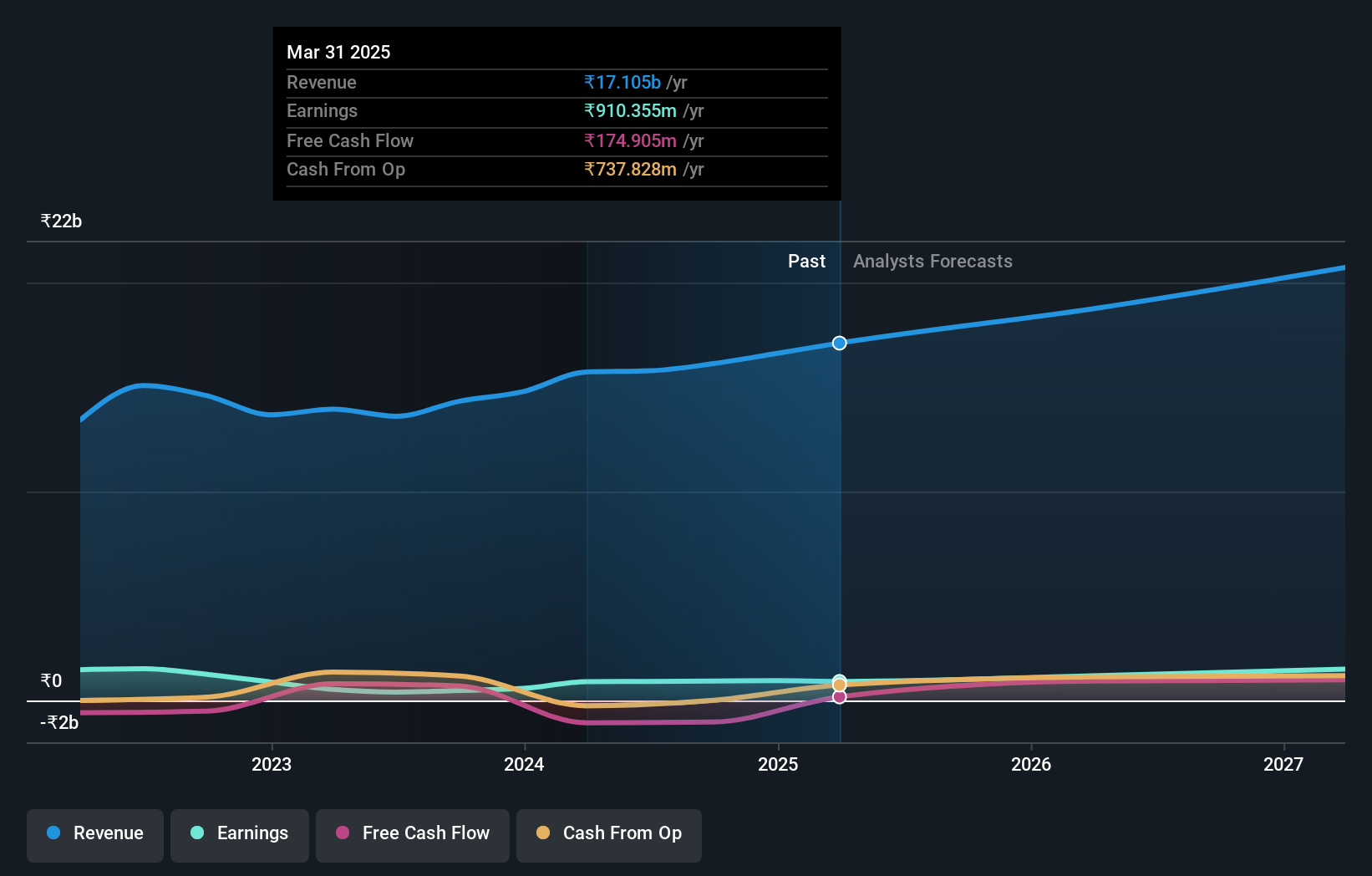

Lumax Auto Technologies (NSEI:LUMAXTECH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lumax Auto Technologies Limited, along with its subsidiaries, manufactures and sells automotive components in India and has a market cap of ₹36.74 billion.

Operations: Lumax Auto Technologies Limited generates revenue from the manufacturing and sale of automotive components in India.

Insider Ownership: 39.1%

Lumax Auto Technologies has demonstrated substantial growth, with earnings rising by 50% over the past year and revenue increasing to ₹7.73 billion for Q1 2024 from ₹6.40 billion a year ago. Although its price-to-earnings ratio (26.3x) is below the Indian market average, it faces challenges such as high debt levels and an unstable dividend track record. Earnings are forecast to grow at 34.1% annually, outpacing the broader market's 16.9%.

- Click here and access our complete growth analysis report to understand the dynamics of Lumax Auto Technologies.

- Our valuation report unveils the possibility Lumax Auto Technologies' shares may be trading at a premium.

Turning Ideas Into Actions

- Dive into all 92 of the Fast Growing Indian Companies With High Insider Ownership we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:LUMAXTECH

Lumax Auto Technologies

Manufactures and sells in automotive components in India.

High growth potential with solid track record and pays a dividend.

Market Insights

Community Narratives