Here's Why Zuari Industries (NSE:ZUARIIND) Has Caught The Eye Of Investors

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Zuari Industries (NSE:ZUARIIND). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Zuari Industries with the means to add long-term value to shareholders.

Check out our latest analysis for Zuari Industries

Zuari Industries' Improving Profits

Zuari Industries has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. As a result, we'll zoom in on growth over the last year, instead. Outstandingly, Zuari Industries' EPS shot from ₹103 to ₹240, over the last year. It's not often a company can achieve year-on-year growth of 133%.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Unfortunately, revenue is down and so are margins. That will not make it easy to grow profits, to say the least.

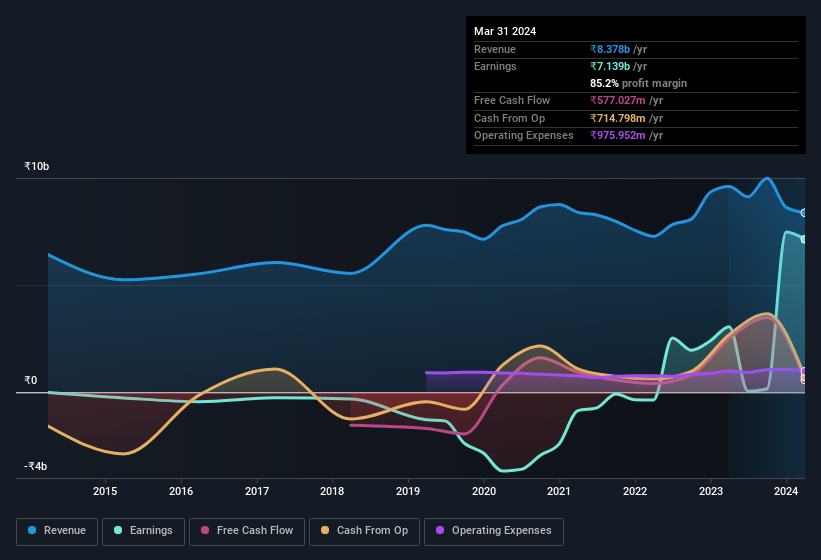

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Since Zuari Industries is no giant, with a market capitalisation of ₹10b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Zuari Industries Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. Shareholders will be pleased by the fact that insiders own Zuari Industries shares worth a considerable sum. As a matter of fact, their holding is valued at ₹1.5b. This considerable investment should help drive long-term value in the business. Those holdings account for over 14% of the company; visible skin in the game.

Should You Add Zuari Industries To Your Watchlist?

Zuari Industries' earnings have taken off in quite an impressive fashion. That EPS growth certainly is attention grabbing, and the large insider ownership only serves to further stoke our interest. At times fast EPS growth is a sign the business has reached an inflection point, so there's a potential opportunity to be had here. So based on this quick analysis, we do think it's worth considering Zuari Industries for a spot on your watchlist. Don't forget that there may still be risks. For instance, we've identified 4 warning signs for Zuari Industries (1 is concerning) you should be aware of.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in IN with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Zuari Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:ZUARIIND

Zuari Industries

Engages in agriculture, heavy engineering, infrastructure, lifestyle, and services businesses in India and internationally.

Low risk and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

GOOGL: AI Platform Expansion And Cloud Demand Will Support Durable Performance Amid Competitive Pressures

Trending Discussion