Top 3 Growth Companies With High Insider Ownership On The Indian Exchange September 2024

Reviewed by Simply Wall St

The Indian market has shown impressive resilience, with the Utilities sector gaining 3.5% while the overall market remained flat last week and up 44% over the past year. As earnings are forecast to grow by 17% annually, identifying growth companies with high insider ownership can be a strategic approach for investors looking to capitalize on this robust performance.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 33.7% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 30.1% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.6% | 31.1% |

| Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 32.5% | 22.2% |

| Jupiter Wagons (NSEI:JWL) | 10.8% | 27.4% |

| Paisalo Digital (BSE:532900) | 16.3% | 24.8% |

| Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 32.3% |

| Rajratan Global Wire (BSE:517522) | 19.8% | 35.8% |

| Aether Industries (NSEI:AETHER) | 31.1% | 45.9% |

| Pricol (NSEI:PRICOLLTD) | 25.5% | 24% |

Here's a peek at a few of the choices from the screener.

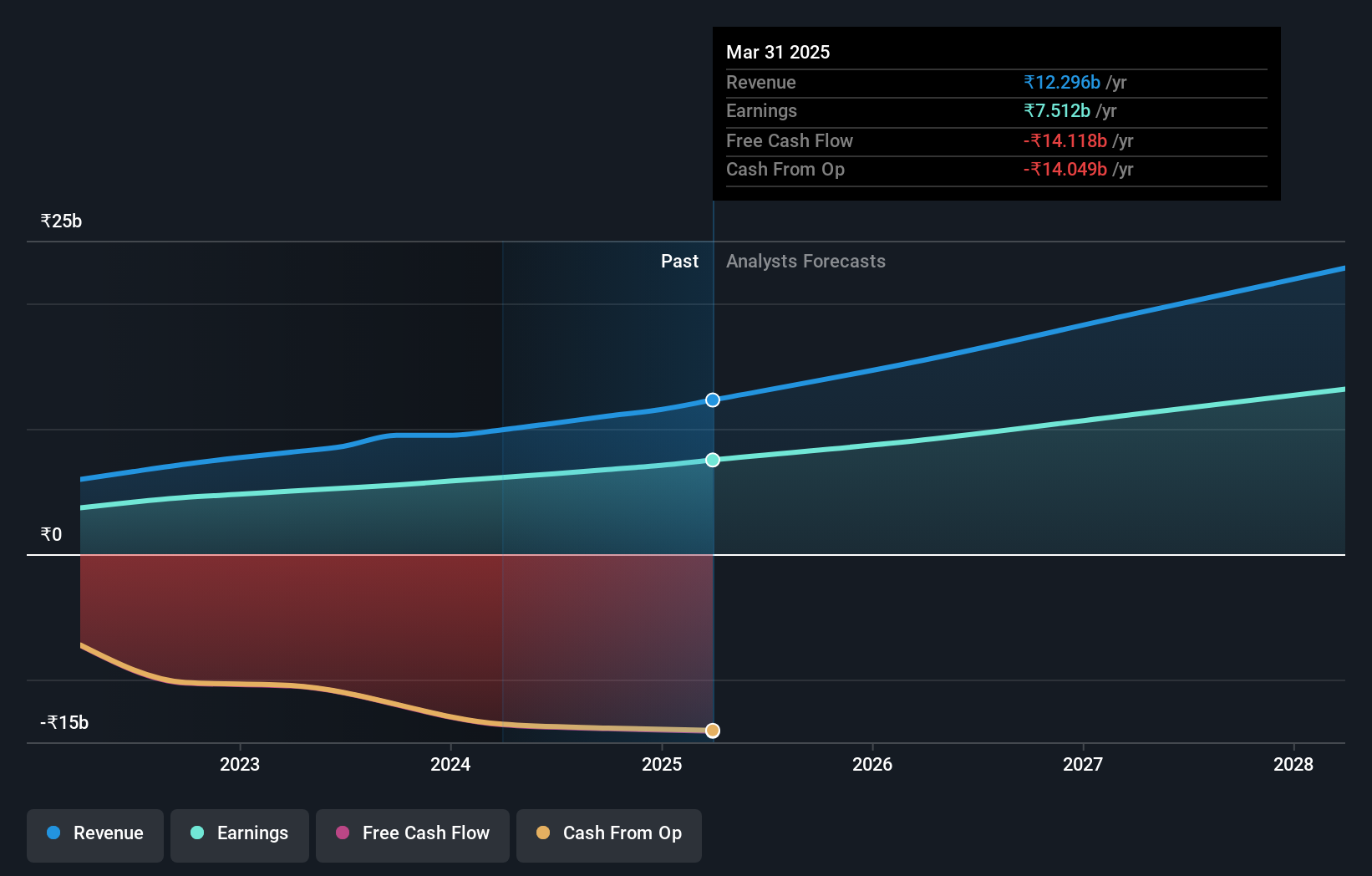

Aptus Value Housing Finance India (NSEI:APTUS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Aptus Value Housing Finance India Limited, with a market cap of ₹185.40 billion, operates as a housing finance company in India through its subsidiary.

Operations: Aptus Value Housing Finance India Limited generates revenue of ₹10.46 billion from providing long-term housing finance, loans against property, and refinance loans.

Insider Ownership: 25.2%

Aptus Value Housing Finance India exhibits strong growth potential with high insider ownership. The company reported significant revenue and net income increases for Q1 2024, reaching INR 4.05 billion and INR 1.72 billion respectively. Earnings are forecast to grow at 18% annually, outpacing the Indian market's average of 17.3%. Recent fixed-income offerings totaling INR 4 billion indicate robust financial strategies, while a low price-to-earnings ratio (28.9x) suggests good valuation relative to the market (34.3x).

- Navigate through the intricacies of Aptus Value Housing Finance India with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that Aptus Value Housing Finance India is trading beyond its estimated value.

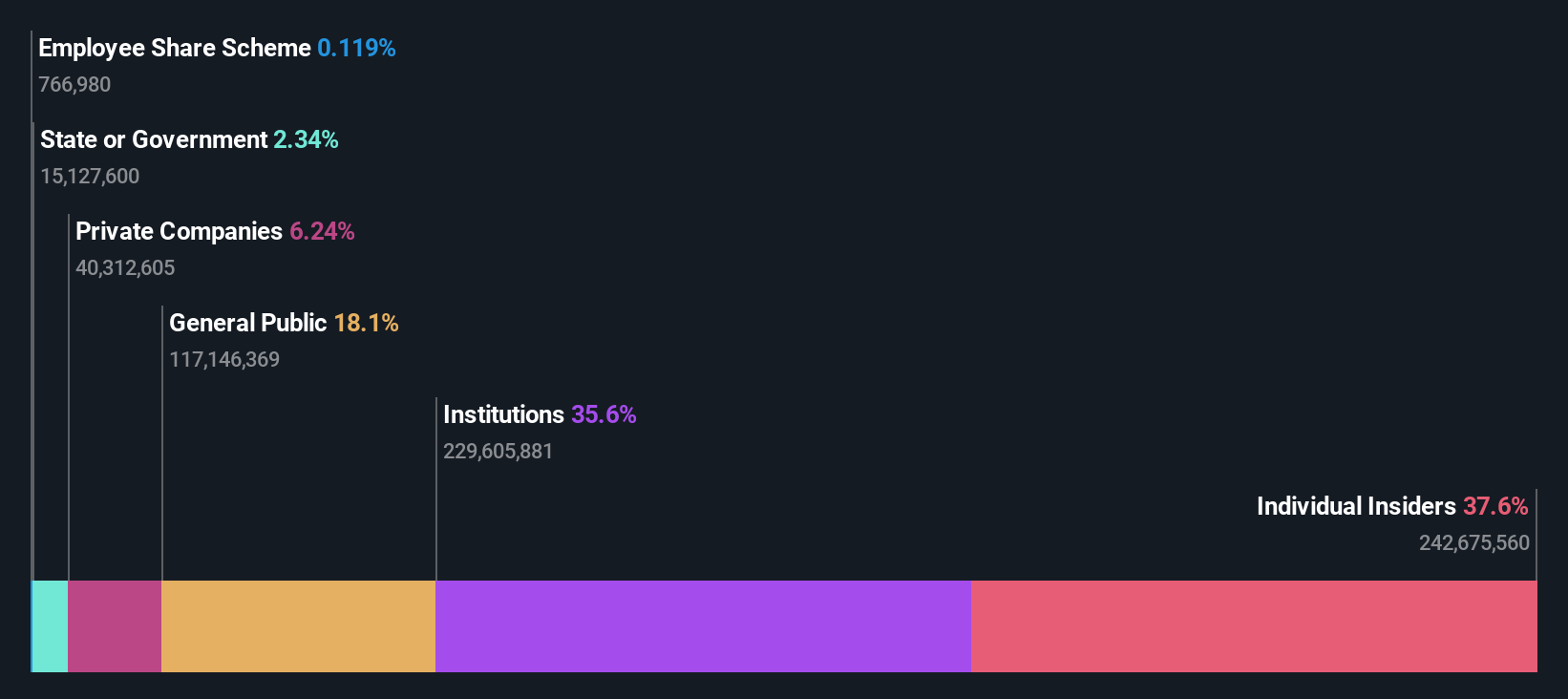

Info Edge (India) (NSEI:NAUKRI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Info Edge (India) Limited operates as an online classifieds company in recruitment, matrimony, real estate, and education services in India and internationally, with a market cap of ₹1.05 trillion.

Operations: The company's revenue segments include ₹19.05 billion from Recruitment Solutions and ₹3.67 billion from 99acres for Real Estate.

Insider Ownership: 37.7%

Info Edge (India) shows promising growth with substantial insider ownership. Earnings are forecast to grow 23.6% annually, outpacing the Indian market's 17.3%. Despite significant recent insider selling, the company has seen increased revenue and net income for Q1 2024, reaching INR 8.28 billion and INR 2.33 billion respectively. Recent executive appointments aim to bolster strategic growth and public policy initiatives, though a low forecasted return on equity (4.6%) remains a concern.

- Unlock comprehensive insights into our analysis of Info Edge (India) stock in this growth report.

- Upon reviewing our latest valuation report, Info Edge (India)'s share price might be too optimistic.

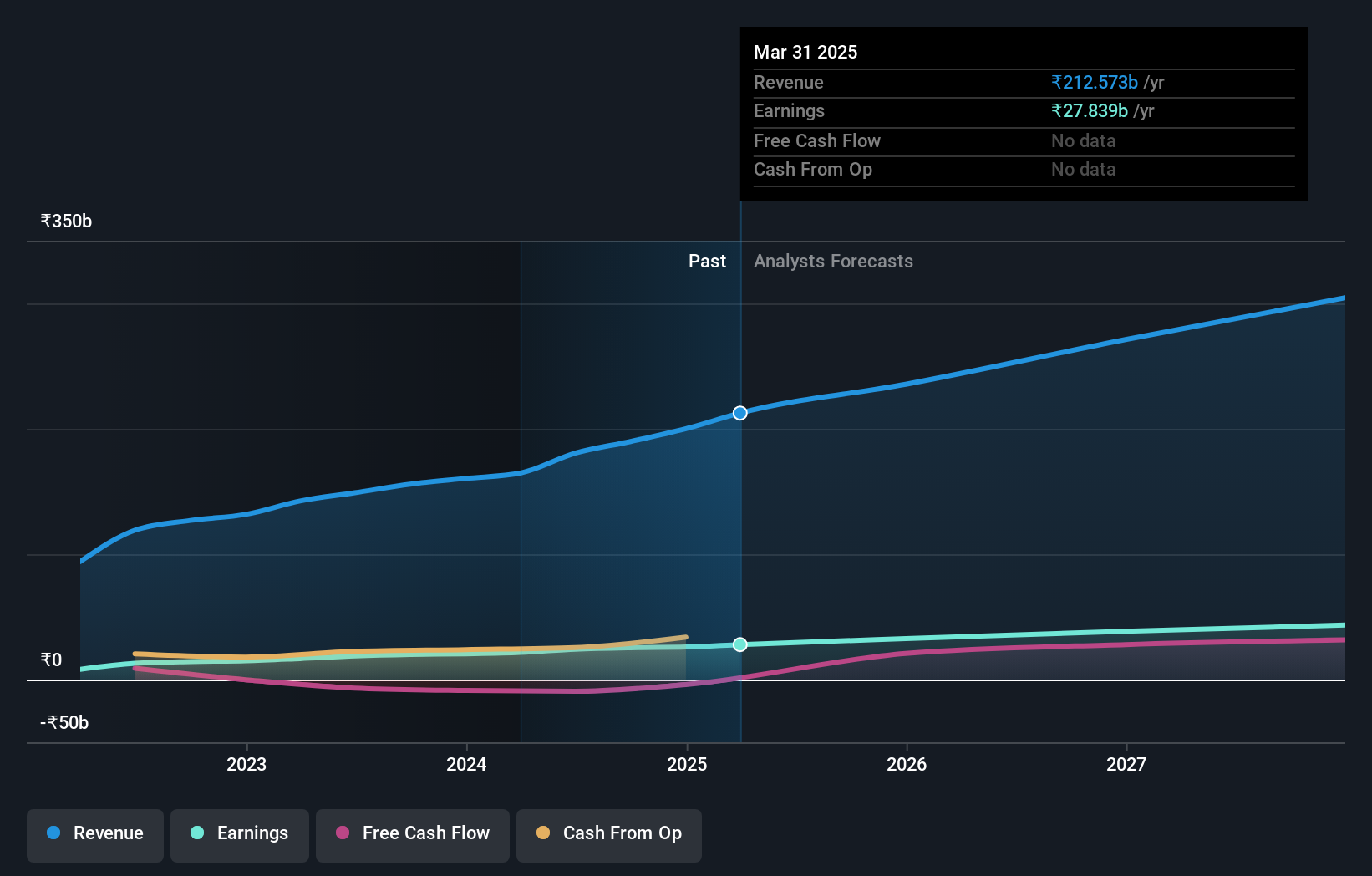

Varun Beverages (NSEI:VBL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Varun Beverages Limited, with a market cap of ₹2.12 trillion, operates as the franchisee for PepsiCo's carbonated soft drinks and non-carbonated beverages.

Operations: The company generates revenue primarily from the manufacturing and sale of beverages, amounting to ₹180.52 billion.

Insider Ownership: 36.3%

Varun Beverages demonstrates strong growth potential with high insider ownership. Earnings grew by 29% over the past year and are forecast to grow 22.34% annually, outpacing the Indian market's average. Despite a high level of debt, revenue is expected to increase at 15.3% per year, faster than the market's 10.2%. Recent developments include a proposed stock split and an interim dividend of INR 1.25 per share for FY2024, reflecting robust financial health and shareholder value focus.

- Delve into the full analysis future growth report here for a deeper understanding of Varun Beverages.

- Our comprehensive valuation report raises the possibility that Varun Beverages is priced higher than what may be justified by its financials.

Taking Advantage

- Discover the full array of 92 Fast Growing Indian Companies With High Insider Ownership right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:VBL

Varun Beverages

Manufactures, bottles, sells, and distributes beverages and value-added products under the PepsiCo brands.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.