Uttam Sugar Mills Limited's (NSE:UTTAMSUGAR) Shares Lagging The Market But So Is The Business

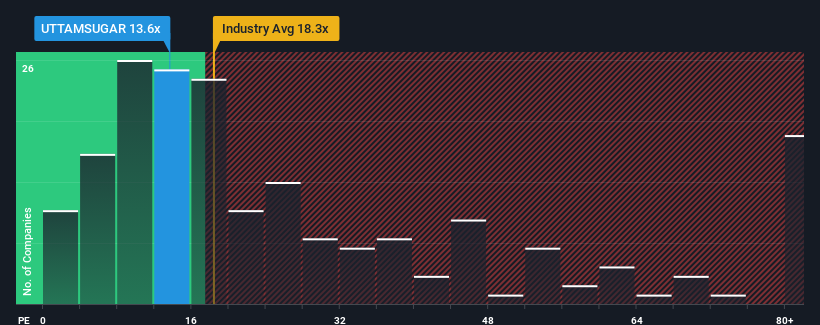

With a price-to-earnings (or "P/E") ratio of 13.6x Uttam Sugar Mills Limited (NSE:UTTAMSUGAR) may be sending bullish signals at the moment, given that almost half of all companies in India have P/E ratios greater than 25x and even P/E's higher than 48x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

As an illustration, earnings have deteriorated at Uttam Sugar Mills over the last year, which is not ideal at all. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Uttam Sugar Mills

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Uttam Sugar Mills would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 60%. The last three years don't look nice either as the company has shrunk EPS by 36% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 25% shows it's an unpleasant look.

With this information, we are not surprised that Uttam Sugar Mills is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Uttam Sugar Mills maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Uttam Sugar Mills (1 is significant) you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:UTTAMSUGAR

Uttam Sugar Mills

Manufactures and sells sugar products under the Uttam brand in India and internationally.

Adequate balance sheet and fair value.

Market Insights

Community Narratives