Som Distilleries & Breweries (NSE:SDBL) shareholder returns have been massive, earning 545% in 3 years

Investing can be hard but the potential fo an individual stock to pay off big time inspires us. You won't get it right every time, but when you do, the returns can be truly splendid. One bright shining star stock has been Som Distilleries & Breweries Limited (NSE:SDBL), which is 541% higher than three years ago. Better yet, the share price has risen 11% in the last week. We love happy stories like this one. The company should be really proud of that performance!

Since the stock has added ₹2.2b to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

See our latest analysis for Som Distilleries & Breweries

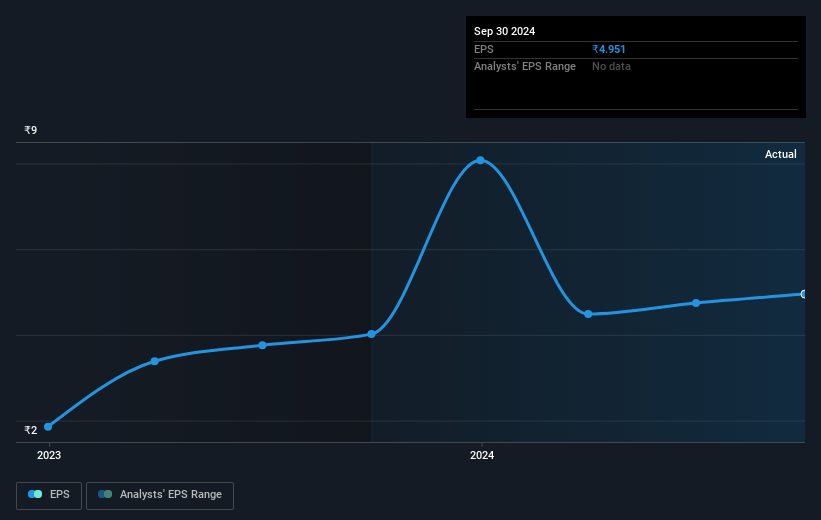

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Som Distilleries & Breweries became profitable within the last three years. Given the importance of this milestone, it's not overly surprising that the share price has increased strongly.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. Dive deeper into the earnings by checking this interactive graph of Som Distilleries & Breweries' earnings, revenue and cash flow.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Som Distilleries & Breweries' total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Its history of dividend payouts mean that Som Distilleries & Breweries' TSR of 545% over the last 3 years is better than the share price return.

A Different Perspective

Som Distilleries & Breweries shareholders are up 3.4% for the year. Unfortunately this falls short of the market return. If we look back over five years, the returns are even better, coming in at 40% per year for five years. Maybe the share price is just taking a breather while the business executes on its growth strategy. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

Som Distilleries & Breweries is not the only stock that insiders are buying. For those who like to find lesser know companies this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SDBL

Som Distilleries & Breweries

Engages in the manufacture and sale of beer and Indian made foreign liquor in India.

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives