We Ran A Stock Scan For Earnings Growth And Sarveshwar Foods (NSE:SARVESHWAR) Passed With Ease

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Sarveshwar Foods (NSE:SARVESHWAR). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Sarveshwar Foods with the means to add long-term value to shareholders.

View our latest analysis for Sarveshwar Foods

Sarveshwar Foods' Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That makes EPS growth an attractive quality for any company. Recognition must be given to the that Sarveshwar Foods has grown EPS by 39% per year, over the last three years. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

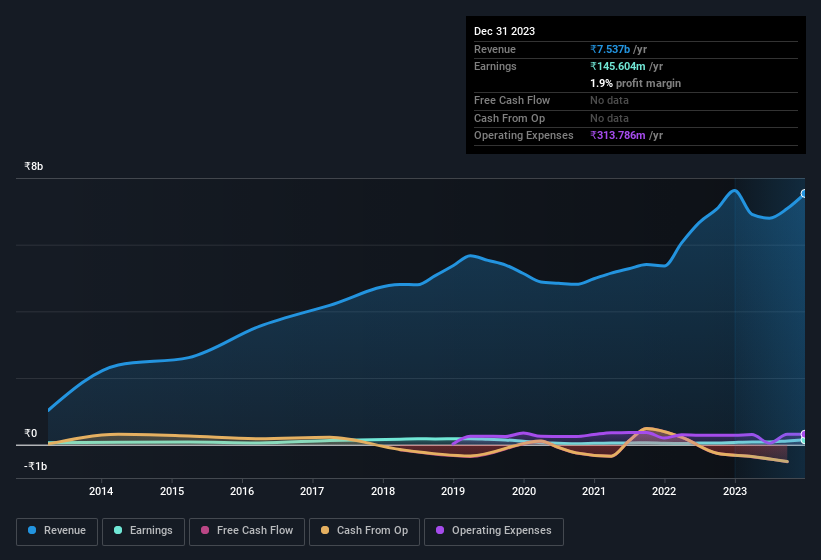

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Despite the relatively flat revenue figures, shareholders will be pleased to see EBIT margins have grown from 3.9% to 6.9% in the last 12 months. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Sarveshwar Foods isn't a huge company, given its market capitalisation of ₹13b. That makes it extra important to check on its balance sheet strength.

Are Sarveshwar Foods Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So we're pleased to report that Sarveshwar Foods insiders own a meaningful share of the business. Indeed, with a collective holding of 70%, company insiders are in control and have plenty of capital behind the venture. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. To give you an idea, the value of insiders' holdings in the business are valued at ₹9.1b at the current share price. That's nothing to sneeze at!

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. Our quick analysis into CEO remuneration would seem to indicate they are. Our analysis has discovered that the median total compensation for the CEOs of companies like Sarveshwar Foods with market caps between ₹8.3b and ₹33b is about ₹16m.

Sarveshwar Foods' CEO only received compensation totalling ₹1.0m in the year to March 2023. You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Should You Add Sarveshwar Foods To Your Watchlist?

Sarveshwar Foods' earnings per share growth have been climbing higher at an appreciable rate. The sweetener is that insiders have a mountain of stock, and the CEO remuneration is quite reasonable. The sharp increase in earnings could signal good business momentum. Sarveshwar Foods is certainly doing some things right and is well worth investigating. You still need to take note of risks, for example - Sarveshwar Foods has 4 warning signs (and 2 which are a bit concerning) we think you should know about.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Indian companies which have demonstrated growth backed by recent insider purchases.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SARVESHWAR

Sarveshwar Foods

Manufactures and sells of basmati and non basmati rice in India.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives