Unveiling Three Undiscovered Gems In India For Your Investment Portfolio

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has risen 1.4%, and in the past year, it has climbed an impressive 46%, with earnings forecasted to grow by 17% annually. In this thriving environment, identifying stocks with strong growth potential and solid fundamentals can be key to enhancing your investment portfolio.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bengal & Assam | 4.48% | 1.53% | 51.11% | ★★★★★★ |

| Shree Digvijay Cement | 0.01% | 13.97% | 16.37% | ★★★★★★ |

| All E Technologies | NA | 40.78% | 31.63% | ★★★★★★ |

| TCPL Packaging | 95.84% | 15.51% | 31.89% | ★★★★★☆ |

| S J Logistics (India) | 11.71% | 90.19% | 60.29% | ★★★★★☆ |

| Macpower CNC Machines | 0.40% | 22.04% | 31.09% | ★★★★★☆ |

| Lotus Chocolate | 13.51% | 28.07% | -10.66% | ★★★★★☆ |

| Magadh Sugar & Energy | 85.44% | 6.65% | 13.60% | ★★★★☆☆ |

| Sanstar | 50.30% | -8.41% | 48.59% | ★★★★☆☆ |

| Sky Gold | 127.01% | 22.02% | 48.03% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

LT Foods (NSEI:LTFOODS)

Simply Wall St Value Rating: ★★★★★★

Overview: LT Foods Limited engages in the milling, processing, and marketing of branded and non-branded basmati rice and rice food products in India, with a market cap of ₹130.25 billion.

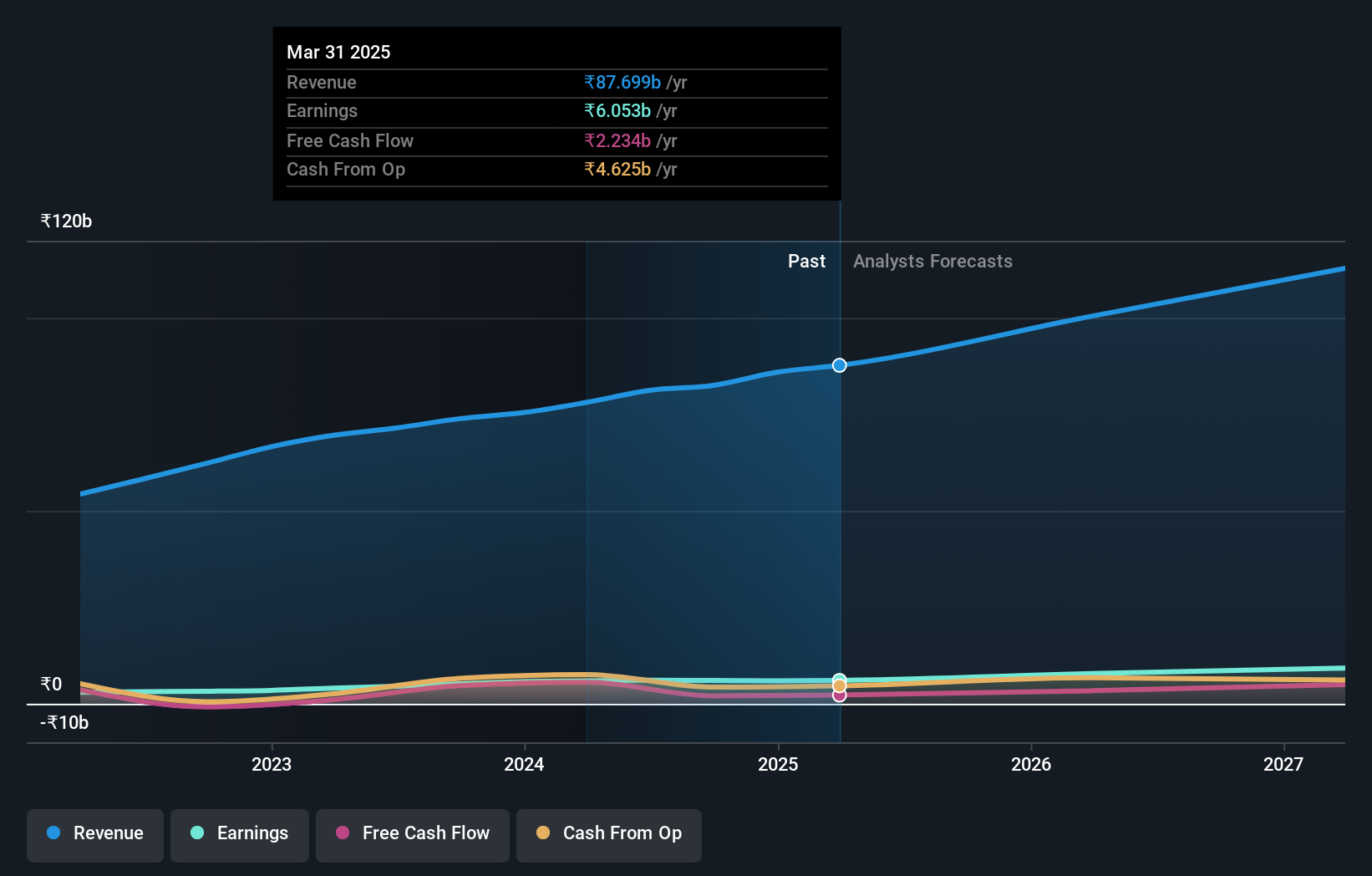

Operations: The primary revenue stream for LT Foods Limited comes from the manufacture and storage of rice, generating ₹81.21 billion. The company focuses on branded and non-branded basmati rice and related products in India.

LT Foods, a notable player in the food industry, has demonstrated robust financial health with a net debt to equity ratio of 25.3%, indicating satisfactory leverage. Its interest payments are well-covered by EBIT at 10.8x coverage, showcasing strong operational efficiency. The company reported earnings growth of 35.7% over the past year, significantly outpacing the industry average of 15%. Recent expansions include a new facility in the U.K., expected to generate £50 million annually within two years.

- Click to explore a detailed breakdown of our findings in LT Foods' health report.

Gain insights into LT Foods' historical performance by reviewing our past performance report.

Network People Services Technologies (NSEI:NPST)

Simply Wall St Value Rating: ★★★★★☆

Overview: Network People Services Technologies Limited develops digital payment solutions for banks, financial institutions, and merchants in India, with a market cap of ₹65.00 billion.

Operations: NPST generates revenue primarily from its Software & Programming segment, amounting to ₹1.62 billion.

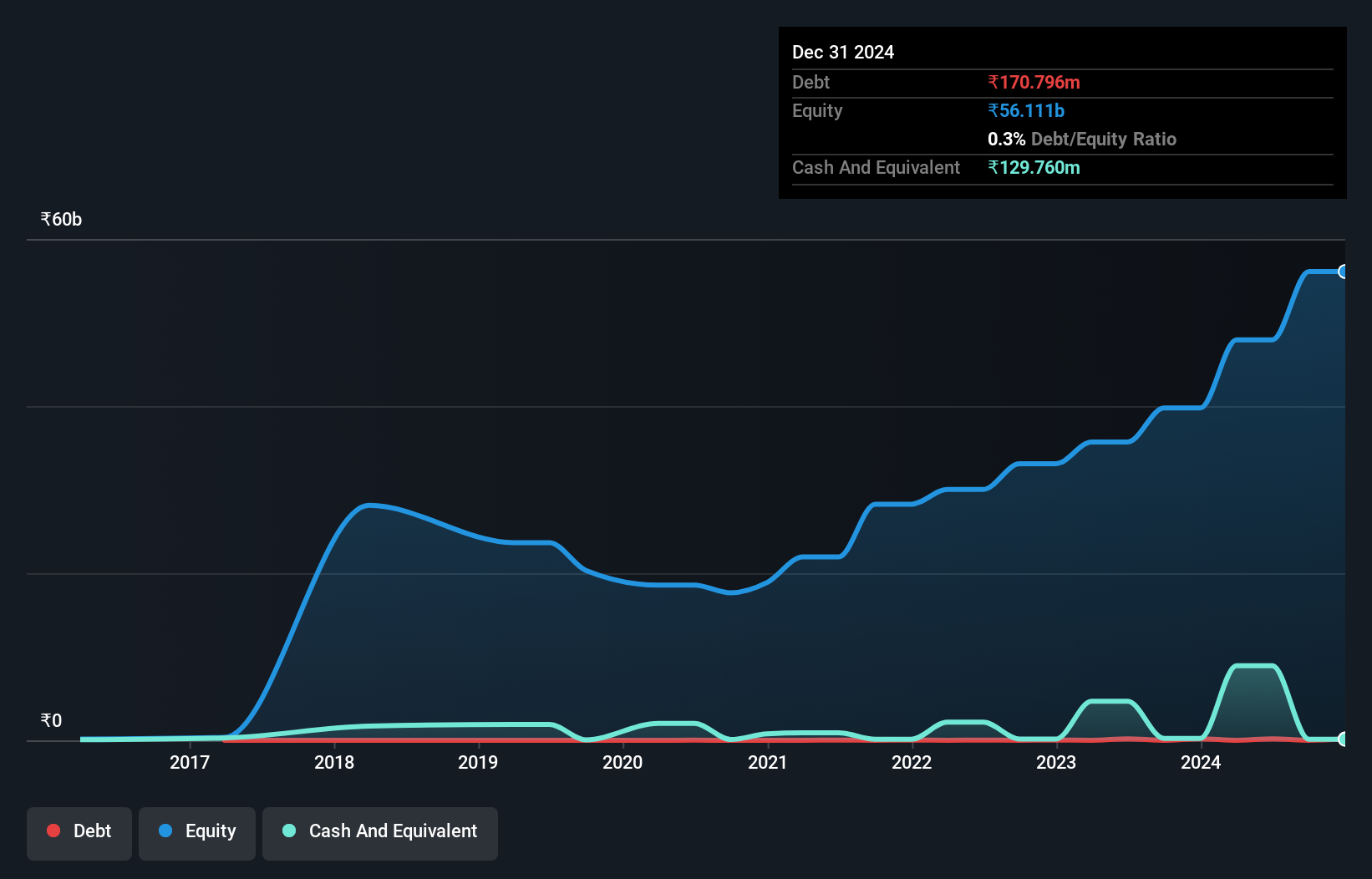

Network People Services Technologies (NPST) has shown remarkable growth, with earnings surging 222.5% over the past year, far outpacing the industry average of 28.4%. The company reported Q1 2025 revenue of ₹602.61 million, up from ₹248.82 million a year ago, and net income increased to ₹156.23 million from ₹51.56 million previously. Despite its highly volatile share price over the last three months, NPST's debt-to-equity ratio remains low at 0.2%, indicating prudent financial management.

Sundaram Finance Holdings (NSEI:SUNDARMHLD)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sundaram Finance Holdings Limited engages in investments, business processing, and support services across India, Australia, and the United Kingdom with a market cap of ₹70.26 billion.

Operations: Sundaram Finance Holdings Limited generates revenue primarily from investments (₹2.51 billion), domestic shared services (₹105.51 million), and overseas shared services (₹489.78 million).

Sundaram Finance Holdings has shown a robust performance with earnings growth of 114.5% over the past year, significantly outpacing the Auto Components industry’s 20.1%. The company reported first-quarter revenue of INR 442.78 million and net income of INR 1,103.35 million, up from INR 252.88 million and INR 706.72 million respectively a year ago. Its debt to equity ratio increased slightly to 0.4% over five years, while its EBIT covers interest payments by an impressive margin of 265 times.

- Click here and access our complete health analysis report to understand the dynamics of Sundaram Finance Holdings.

Evaluate Sundaram Finance Holdings' historical performance by accessing our past performance report.

Next Steps

- Navigate through the entire inventory of 470 Indian Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:LTFOODS

LT Foods

An FMCG company, operates in the specialty rice and rice-based foods business.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives