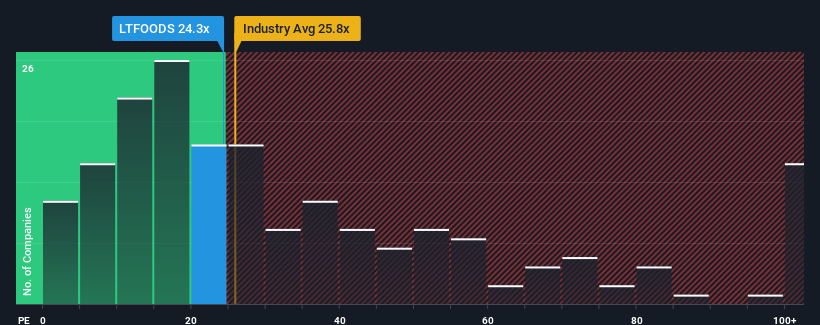

With a price-to-earnings (or "P/E") ratio of 24.3x LT Foods Limited (NSE:LTFOODS) may be sending bullish signals at the moment, given that almost half of all companies in India have P/E ratios greater than 33x and even P/E's higher than 62x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times haven't been advantageous for LT Foods as its earnings have been rising slower than most other companies. The P/E is probably low because investors think this lacklustre earnings performance isn't going to get any better. If you still like the company, you'd be hoping earnings don't get any worse and that you could pick up some stock while it's out of favour.

Check out our latest analysis for LT Foods

How Is LT Foods' Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like LT Foods' to be considered reasonable.

If we review the last year of earnings growth, the company posted a worthy increase of 13%. The latest three year period has also seen an excellent 104% overall rise in EPS, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 18% per year during the coming three years according to the dual analysts following the company. That's shaping up to be similar to the 19% each year growth forecast for the broader market.

In light of this, it's peculiar that LT Foods' P/E sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that LT Foods currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with LT Foods, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on LT Foods, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:LTFOODS

LT Foods

Engages in the milling, processing, and marketing of branded and non-branded basmati rice, and rice food products in India.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives