Over the last 7 days, the Indian stock market has remained flat, yet it has risen 44% in the past 12 months with earnings forecasted to grow by 17% annually. In this thriving environment, identifying lesser-known stocks with strong potential can offer unique opportunities for investors.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wealth First Portfolio Managers | NA | -47.95% | 40.47% | ★★★★★★ |

| Kokuyo Camlin | 27.11% | 23.20% | 75.70% | ★★★★★★ |

| Le Travenues Technology | 10.32% | 26.39% | 67.32% | ★★★★★★ |

| Force Motors | 23.24% | 21.52% | 44.24% | ★★★★★☆ |

| Master Trust | 37.05% | 27.57% | 41.99% | ★★★★★☆ |

| Insolation Energy | 88.64% | 163.87% | 419.31% | ★★★★★☆ |

| Kalyani Investment | NA | 21.42% | 6.35% | ★★★★★☆ |

| Sky Gold | 127.01% | 22.02% | 48.03% | ★★★★☆☆ |

| Sanstar | 50.30% | -8.41% | 48.59% | ★★★★☆☆ |

| Innovana Thinklabs | 13.59% | 12.51% | 20.01% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

LT Foods (NSEI:LTFOODS)

Simply Wall St Value Rating: ★★★★★★

Overview: LT Foods Limited engages in the milling, processing, and marketing of branded and non-branded basmati rice and rice food products in India with a market cap of ₹117.75 billion.

Operations: Revenue from the manufacture and storage of rice stands at ₹81.21 billion.

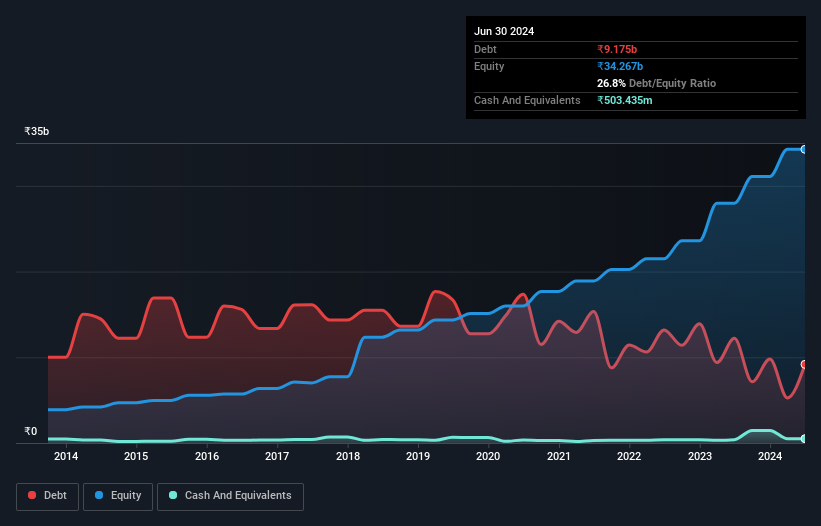

Earnings for LT Foods grew 35.7% last year, outpacing the food industry's 13.9%. The company's net debt to equity ratio improved from 116.4% to 26.8% over five years, indicating better financial health. Trading at just below its fair value, LT Foods offers high-quality earnings and good relative value compared to peers. Recent news includes a new U.K facility with an initial £7 million investment and potential revenue of £50 million annually within two years.

- Click here to discover the nuances of LT Foods with our detailed analytical health report.

Review our historical performance report to gain insights into LT Foods''s past performance.

Marksans Pharma (NSEI:MARKSANS)

Simply Wall St Value Rating: ★★★★★★

Overview: Marksans Pharma Limited, along with its subsidiaries, focuses on the research and development, manufacturing, marketing, and sale of generic pharmaceutical formulations globally and has a market cap of ₹99.76 billion.

Operations: Marksans Pharma Limited generates revenue primarily from its Pharmaceuticals segment, amounting to ₹22.68 billion. The company's market cap stands at ₹99.76 billion.

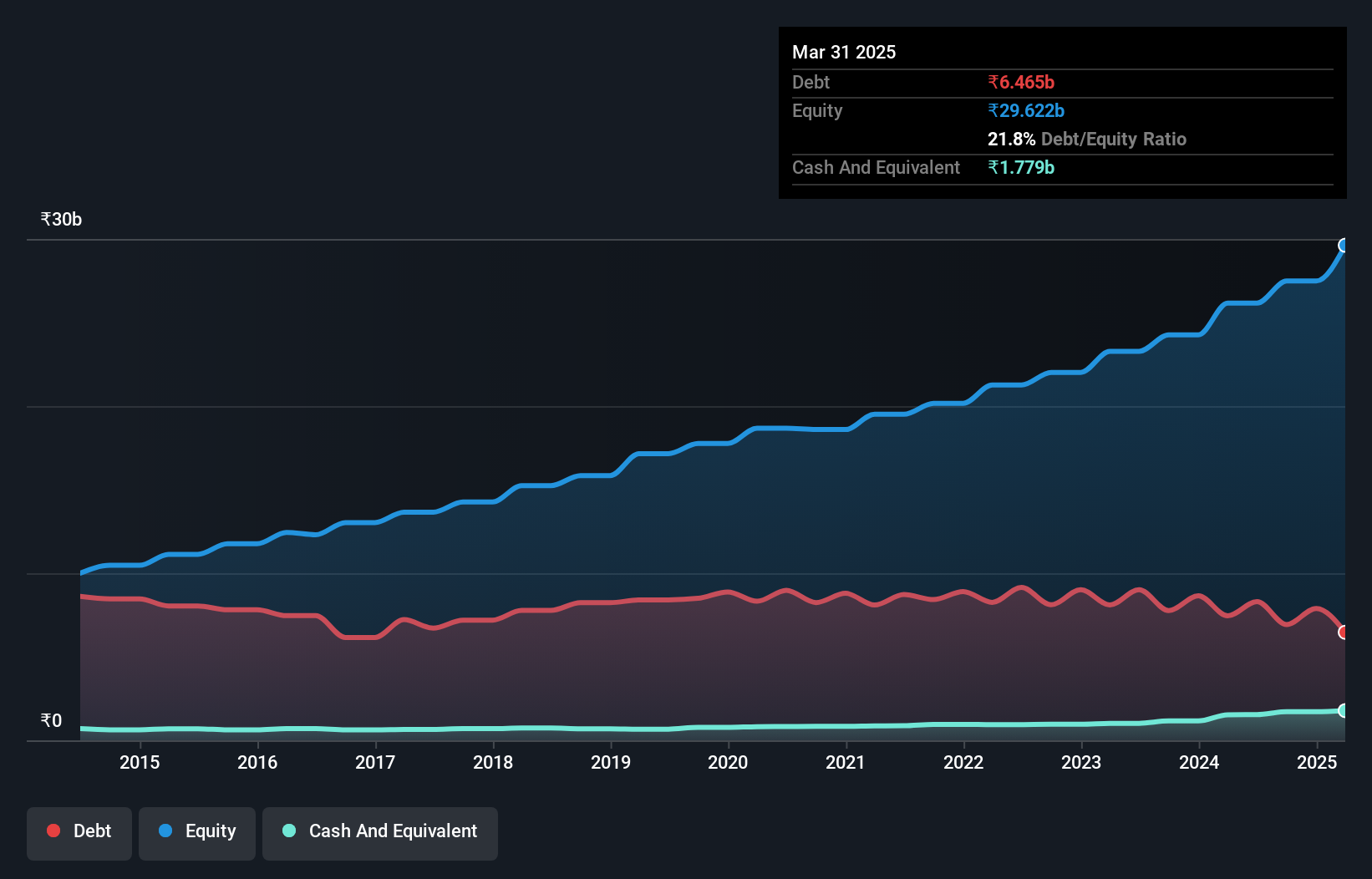

Marksans Pharma, a rising player in India's pharmaceutical sector, has seen its debt to equity ratio improve from 19.9% to 11.7% over the past five years while maintaining a P/E ratio of 29.9x, which is favorable compared to the Indian market's 32.5x. Earnings grew by 21.7% last year, outpacing industry growth of 19.3%. Recent Q1 results show net income at INR 887 million and revenue at INR 6 billion, indicating robust financial health and future growth potential through M&A activities in Europe.

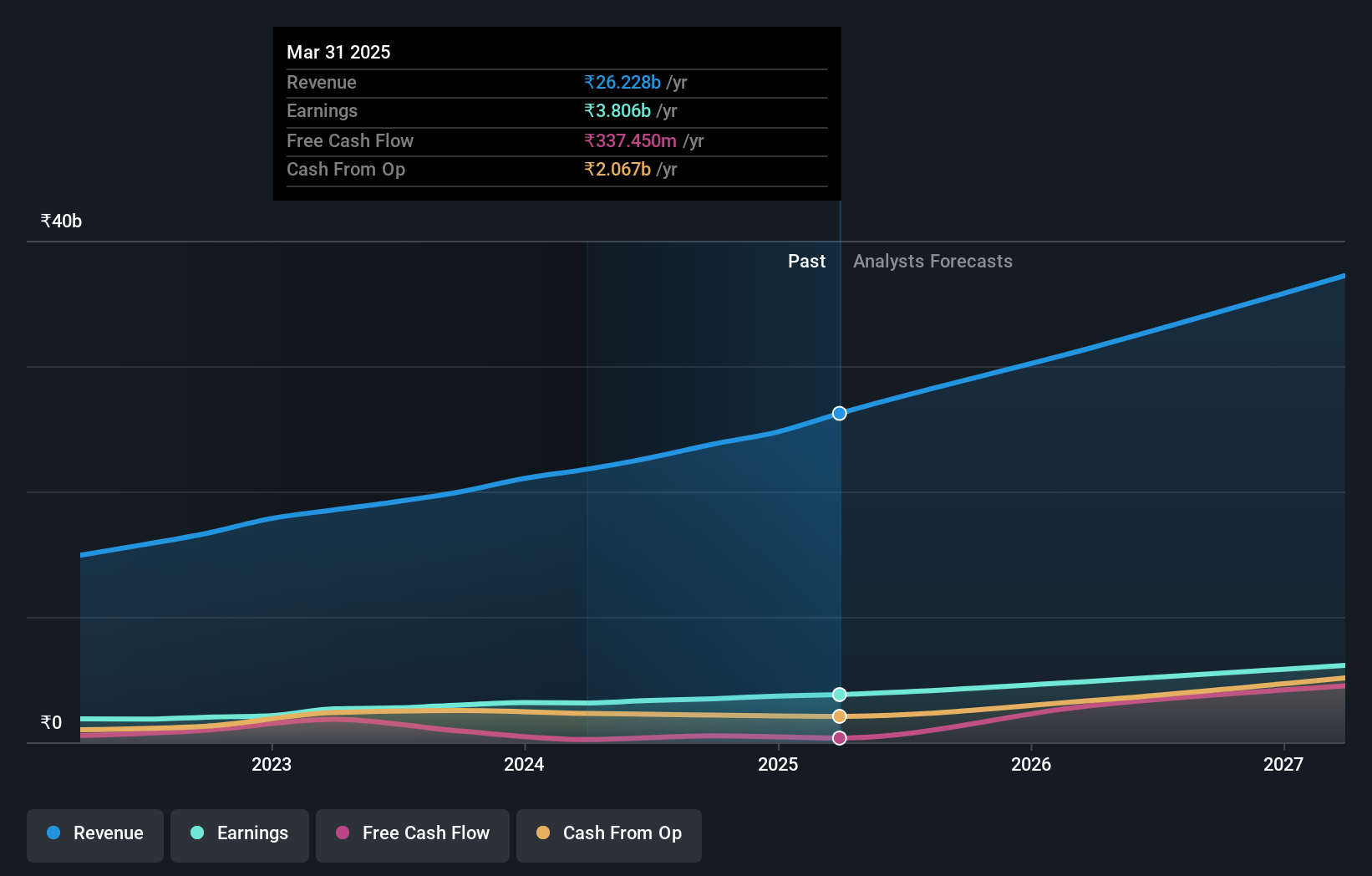

Time Technoplast (NSEI:TIMETECHNO)

Simply Wall St Value Rating: ★★★★★★

Overview: Time Technoplast Limited, along with its subsidiaries, manufactures and sells a variety of technology-based polymer and composite products in India and internationally, with a market cap of ₹89.07 billion.

Operations: Time Technoplast generates revenue primarily from its Polymer Products segment (₹33.43 billion) and Composite Products segment (₹17.99 billion).

Time Technoplast has shown solid performance with a net income of INR 793.1 million for Q1 2024, up from INR 560.9 million last year. The company’s earnings growth of 44.6% over the past year outpaced the industry average of 8.7%. Its debt to equity ratio improved from 49% to 31.7% in five years, showcasing financial prudence. Additionally, its P/E ratio stands at a favorable 26.7x compared to the Indian market's average of 32.5x.

- Unlock comprehensive insights into our analysis of Time Technoplast stock in this health report.

Understand Time Technoplast's track record by examining our Past report.

Make It Happen

- Reveal the 457 hidden gems among our Indian Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:MARKSANS

Marksans Pharma

Engages in the research, manufacturing, marketing, and sale of pharmaceutical formulations in the United States, North America, Europe, the United Kingdom, Australia, New Zealand, and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives