IFB Agro Industries (NSE:IFBAGRO) Share Prices Have Dropped 31% In The Last Three Years

IFB Agro Industries Limited (NSE:IFBAGRO) shareholders will doubtless be very grateful to see the share price up 52% in the last quarter. But that cannot eclipse the less-than-impressive returns over the last three years. Truth be told the share price declined 31% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

View our latest analysis for IFB Agro Industries

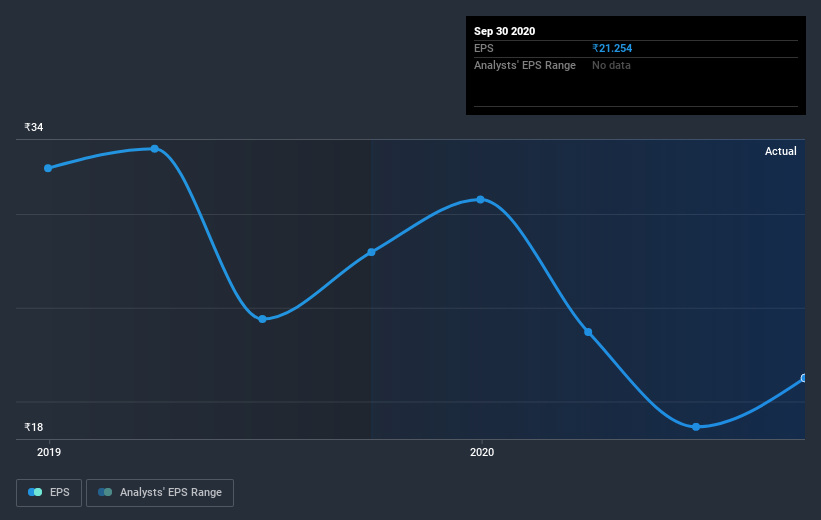

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

IFB Agro Industries saw its EPS decline at a compound rate of 13% per year, over the last three years. This fall in EPS isn't far from the rate of share price decline, which was 12% per year. So it seems that investor expectations of the company are staying pretty steady, despite the disappointment. Rather, the share price has approximately tracked EPS growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

This free interactive report on IFB Agro Industries' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that IFB Agro Industries shareholders have received a total shareholder return of 27% over the last year. That's better than the annualised return of 3% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 3 warning signs for IFB Agro Industries you should be aware of, and 1 of them is concerning.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you decide to trade IFB Agro Industries, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:IFBAGRO

IFB Agro Industries

Manufactures and bottling of alcoholic beverages and processed marine foods in India and internationally.

Excellent balance sheet and fair value.

Market Insights

Community Narratives