Here's Why Hindustan Foods (NSE:HNDFDS) Has Caught The Eye Of Investors

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Hindustan Foods (NSE:HNDFDS). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Hindustan Foods

How Fast Is Hindustan Foods Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Recognition must be given to the that Hindustan Foods has grown EPS by 39% per year, over the last three years. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

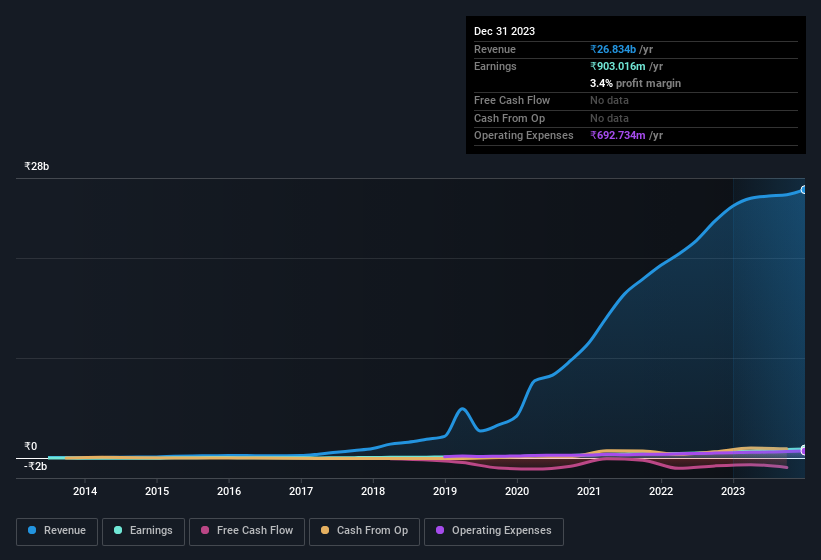

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. While we note Hindustan Foods achieved similar EBIT margins to last year, revenue grew by a solid 6.5% to ₹27b. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Hindustan Foods Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We do note that, in the last year, insiders sold ₹684m worth of shares. But that's far less than the ₹1.1b insiders spent purchasing stock. This bodes well for Hindustan Foods as it highlights the fact that those who are important to the company having a lot of faith in its future. It is also worth noting that it was company insider Harsha Raghavan who made the biggest single purchase, worth ₹896m, paying ₹524 per share.

Along with the insider buying, another encouraging sign for Hindustan Foods is that insiders, as a group, have a considerable shareholding. Notably, they have an enviable stake in the company, worth ₹16b. This totals to 27% of shares in the company. Enough to lead management's decision making process down a path that brings the most benefit to shareholders. Looking very optimistic for investors.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. The cherry on top is that the CEO, Sameer Kothari is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalisations between ₹33b and ₹134b, like Hindustan Foods, the median CEO pay is around ₹32m.

Hindustan Foods offered total compensation worth ₹16m to its CEO in the year to March 2023. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Hindustan Foods To Your Watchlist?

Hindustan Foods' earnings per share growth have been climbing higher at an appreciable rate. What's more, insiders own a significant stake in the company and have been buying more shares. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Hindustan Foods belongs near the top of your watchlist. We should say that we've discovered 1 warning sign for Hindustan Foods that you should be aware of before investing here.

Keen growth investors love to see insider buying. Thankfully, Hindustan Foods isn't the only one. You can see a a curated list of Indian companies which have exhibited consistent growth accompanied by recent insider buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Hindustan Foods might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:HNDFDS

Hindustan Foods

Engages in the business of contract manufacturing of fast moving consumer goods in India and internationally.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives