We Ran A Stock Scan For Earnings Growth And Hatsun Agro Product (NSE:HATSUN) Passed With Ease

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Hatsun Agro Product (NSE:HATSUN). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Hatsun Agro Product with the means to add long-term value to shareholders.

See our latest analysis for Hatsun Agro Product

How Quickly Is Hatsun Agro Product Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Hatsun Agro Product managed to grow EPS by 7.3% per year, over three years. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

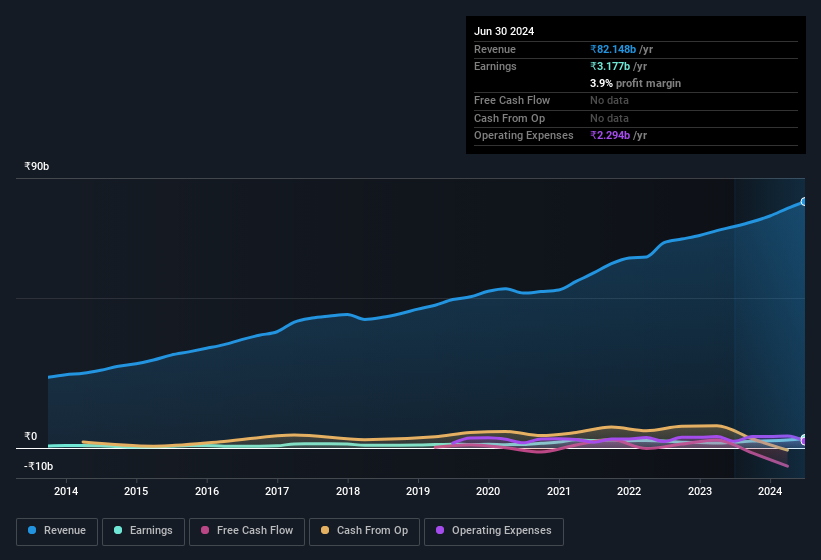

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Hatsun Agro Product maintained stable EBIT margins over the last year, all while growing revenue 11% to ₹82b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Hatsun Agro Product?

Are Hatsun Agro Product Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Insider selling of Hatsun Agro Product shares was insignificant compared to the one buyer, over the last twelve months. Specifically the Non-Executive Chairman, R. Chandramogan, spent ₹32m, paying about ₹1,074 per share. That can definitely be seen as a sign of conviction.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for Hatsun Agro Product will reveal that insiders own a significant piece of the pie. To be exact, company insiders hold 77% of the company, so their decisions have a significant impact on their investments. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. This insider holding amounts to That means they have plenty of their own capital riding on the performance of the business!

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, C. Sathyan, is paid less than the median for similar sized companies. The median total compensation for CEOs of companies similar in size to Hatsun Agro Product, with market caps between ₹168b and ₹537b, is around ₹52m.

Hatsun Agro Product's CEO took home a total compensation package of ₹9.7m in the year prior to March 2024. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Does Hatsun Agro Product Deserve A Spot On Your Watchlist?

As previously touched on, Hatsun Agro Product is a growing business, which is encouraging. In addition, insiders have been busy adding to their sizeable holdings in the company. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. We should say that we've discovered 2 warning signs for Hatsun Agro Product (1 is concerning!) that you should be aware of before investing here.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Hatsun Agro Product, you'll probably love this curated collection of companies in IN that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Hatsun Agro Product might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:HATSUN

Hatsun Agro Product

Engages in manufacturing and marketing of milk, milk products, and cattle feed in India and internationally.

High growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives