Here's Why I Think Hatsun Agro Product (NSE:HATSUN) Is An Interesting Stock

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

So if you're like me, you might be more interested in profitable, growing companies, like Hatsun Agro Product (NSE:HATSUN). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Hatsun Agro Product

Hatsun Agro Product's Earnings Per Share Are Growing.

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That makes EPS growth an attractive quality for any company. It certainly is nice to see that Hatsun Agro Product has managed to grow EPS by 35% per year over three years. As a result, we can understand why the stock trades on a high multiple of trailing twelve month earnings.

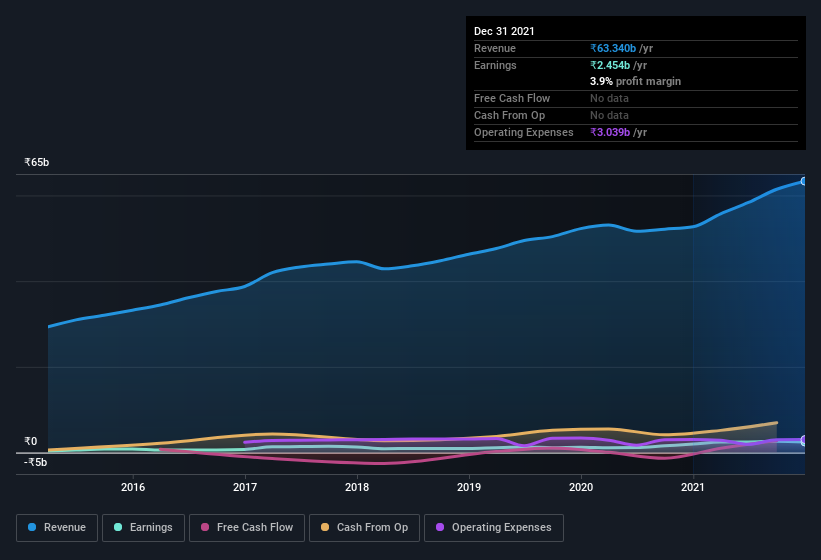

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Hatsun Agro Product's EBIT margins were flat over the last year, revenue grew by a solid 20% to ₹63b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Hatsun Agro Product's balance sheet strength, before getting too excited.

Are Hatsun Agro Product Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We did see some selling in the last twelve months, but that's insignificant compared to the whopping ₹212m that the Non-Executive Chairman, R. Chandramogan spent acquiring shares. We should note the average purchase price was around ₹1,046. Big purchases like that are well worth noting, especially for those who like to follow the insider money.

On top of the insider buying, we can also see that Hatsun Agro Product insiders own a large chunk of the company. Indeed, with a collective holding of 78%, company insiders are in control and have plenty of capital behind the venture. This makes me think they will be incentivised to plan for the long term - something I like to see. At the current share price, that insider holding is worth a whopping ₹195b. That means they have plenty of their own capital riding on the performance of the business!

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. The cherry on top is that the CEO, C. Sathyan is paid comparatively modestly to CEOs at similar sized companies. I discovered that the median total compensation for the CEOs of companies like Hatsun Agro Product with market caps between ₹153b and ₹489b is about ₹44m.

The Hatsun Agro Product CEO received total compensation of just ₹8.0m in the year to . That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Should You Add Hatsun Agro Product To Your Watchlist?

You can't deny that Hatsun Agro Product has grown its earnings per share at a very impressive rate. That's attractive. The cranberry sauce on the turkey is that insiders own a bunch of shares, and one has been buying more. So I do think this is one stock worth watching. What about risks? Every company has them, and we've spotted 2 warning signs for Hatsun Agro Product you should know about.

As a growth investor I do like to see insider buying. But Hatsun Agro Product isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Hatsun Agro Product might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:HATSUN

Hatsun Agro Product

Engages in manufacturing and marketing of milk, milk products, and cattle feed in India and internationally.

High growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives