Here's Why We Think Gokul Refoils & Solvent (NSE:GOKUL) Might Deserve Your Attention Today

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Gokul Refoils & Solvent (NSE:GOKUL). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Our analysis indicates that GOKUL is potentially undervalued!

How Fast Is Gokul Refoils & Solvent Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Recognition must be given to the that Gokul Refoils & Solvent has grown EPS by 54% per year, over the last three years. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers. Getting in to the the finer details, it important to know that the EPS growth has been helped by share buybacks, demonstrating that the business is positioned to return capital to its shareholders.

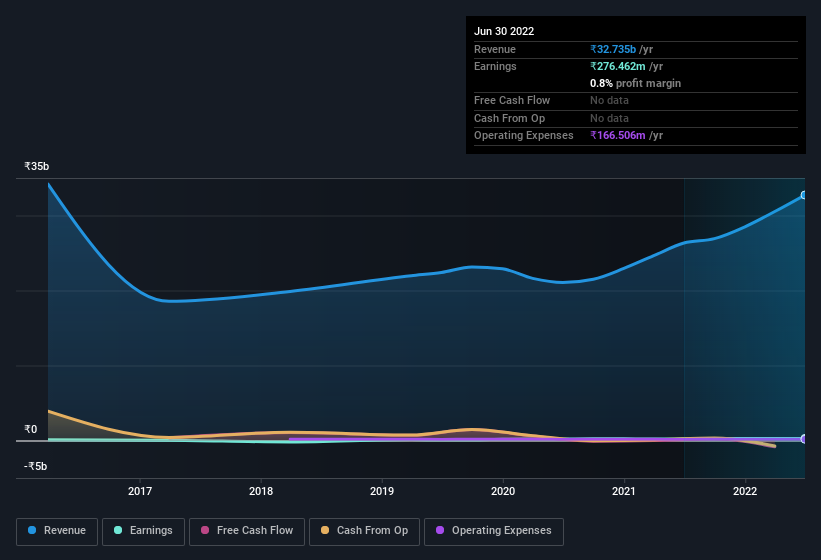

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Gokul Refoils & Solvent maintained stable EBIT margins over the last year, all while growing revenue 24% to ₹33b. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Gokul Refoils & Solvent isn't a huge company, given its market capitalisation of ₹3.7b. That makes it extra important to check on its balance sheet strength.

Are Gokul Refoils & Solvent Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So we're pleased to report that Gokul Refoils & Solvent insiders own a meaningful share of the business. In fact, they own 57% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. To give you an idea, the value of insiders' holdings in the business are valued at ₹2.1b at the current share price. So there's plenty there to keep them focused!

Is Gokul Refoils & Solvent Worth Keeping An Eye On?

Gokul Refoils & Solvent's earnings per share growth have been climbing higher at an appreciable rate. That sort of growth is nothing short of eye-catching, and the large investment held by insiders should certainly brighten the view of the company. At times fast EPS growth is a sign the business has reached an inflection point, so there's a potential opportunity to be had here. Based on the sum of its parts, we definitely think its worth watching Gokul Refoils & Solvent very closely. It is worth noting though that we have found 2 warning signs for Gokul Refoils & Solvent (1 shouldn't be ignored!) that you need to take into consideration.

Although Gokul Refoils & Solvent certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GOKUL

Gokul Refoils & Solvent

Engages in the seed processing, solvent extraction, and refining edible and non-edible industrial oils in India and internationally.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.