Are You An Income Investor? Don't Miss Out On G.M. Breweries Limited (NSE:GMBREW)

Today we'll take a closer look at G.M. Breweries Limited (NSE:GMBREW) from a dividend investor's perspective. Owning a strong business and reinvesting the dividends is widely seen as an attractive way of growing your wealth. Yet sometimes, investors buy a popular dividend stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

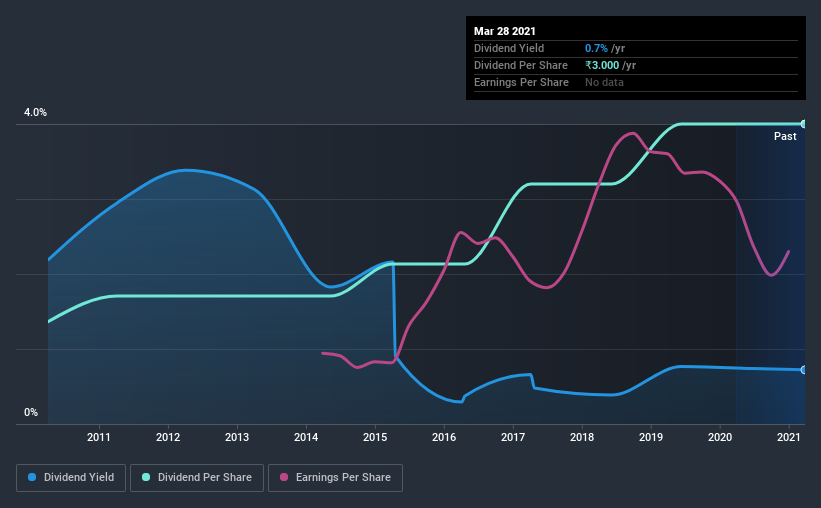

While G.M. Breweries's 0.7% dividend yield is not the highest, we think its lengthy payment history is quite interesting. Some simple research can reduce the risk of buying G.M. Breweries for its dividend - read on to learn more.

Explore this interactive chart for our latest analysis on G.M. Breweries!

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Looking at the data, we can see that 10% of G.M. Breweries' profits were paid out as dividends in the last 12 months. With a low payout ratio, it looks like the dividend is comprehensively covered by earnings.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. G.M. Breweries' cash payout ratio last year was 18%. Cash flows are typically lumpy, but this looks like an appropriately conservative payout. It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

With a strong net cash balance, G.M. Breweries investors may not have much to worry about in the near term from a dividend perspective.

We update our data on G.M. Breweries every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. For the purpose of this article, we only scrutinise the last decade of G.M. Breweries' dividend payments. The dividend has been stable over the past 10 years, which is great. We think this could suggest some resilience to the business and its dividends. During the past 10-year period, the first annual payment was ₹1.0 in 2011, compared to ₹3.0 last year. This works out to be a compound annual growth rate (CAGR) of approximately 11% a year over that time.

Dividends have been growing pretty quickly, and even more impressively, they haven't experienced any notable falls during this period.

Dividend Growth Potential

Dividend payments have been consistent over the past few years, but we should always check if earnings per share (EPS) are growing, as this will help maintain the purchasing power of the dividend. G.M. Breweries has grown its earnings per share at 2.4% per annum over the past five years. As we saw above, earnings per share growth has not been strong. On the plus side, the dividend payout ratio is low and dividends could grow faster than earnings, if the company decides to increase its payout ratio.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. Firstly, we like that G.M. Breweries has low and conservative payout ratios. Second, earnings growth has been mediocre, but at least the dividends have been relatively stable. All things considered, G.M. Breweries looks like a strong prospect. At the right valuation, it could be something special.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. You can also discover whether shareholders are aligned with insider interests by checking our visualisation of insider shareholdings and trades in G.M. Breweries stock.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

When trading G.M. Breweries or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade G.M. Breweries, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:GMBREW

Flawless balance sheet established dividend payer.