The board of LT Foods Limited (NSE:DAAWAT) has announced that it will pay a dividend on the 30th of November, with investors receiving ₹0.50 per share. This payment means the dividend yield will be 0.8%, which is below the average for the industry.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that LT Foods' stock price has increased by 36% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

View our latest analysis for LT Foods

LT Foods' Payment Has Solid Earnings Coverage

If it is predictable over a long period, even low dividend yields can be attractive. LT Foods is quite easily earning enough to cover the dividend, however it is being let down by weak cash flows. With the company not bringing in any cash, paying out to shareholders is bound to become difficult at some point.

Over the next year, EPS is forecast to expand by 24.6%. If the dividend continues on this path, the payout ratio could be 10% by next year, which we think can be pretty sustainable going forward.

LT Foods' Dividend Has Lacked Consistency

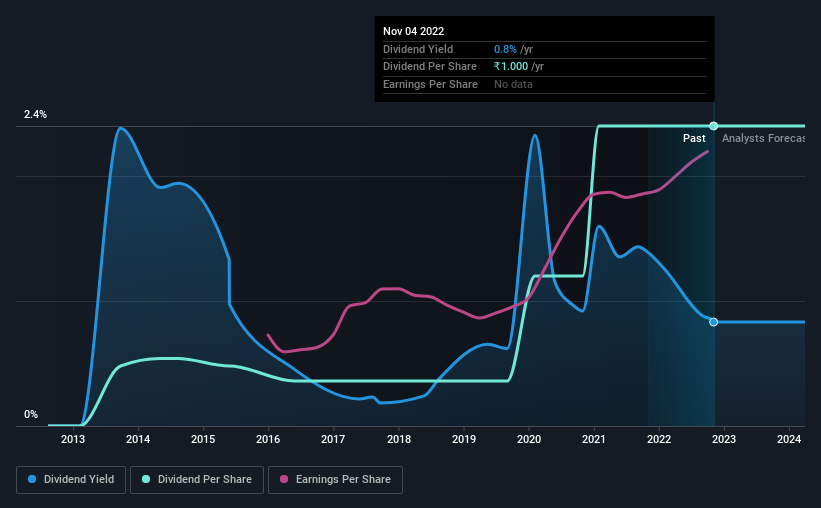

Looking back, LT Foods' dividend hasn't been particularly consistent. This suggests that the dividend might not be the most reliable. The annual payment during the last 9 years was ₹0.20 in 2013, and the most recent fiscal year payment was ₹1.00. This works out to be a compound annual growth rate (CAGR) of approximately 20% a year over that time. Despite the rapid growth in the dividend over the past number of years, we have seen the payments go down the past as well, so that makes us cautious.

The Dividend Looks Likely To Grow

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. LT Foods has seen EPS rising for the last five years, at 15% per annum. Growth in EPS bodes well for the dividend, as does the low payout ratio that the company is currently reporting.

In Summary

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. While LT Foods is earning enough to cover the payments, the cash flows are lacking. We would probably look elsewhere for an income investment.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Case in point: We've spotted 3 warning signs for LT Foods (of which 1 can't be ignored!) you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:LTFOODS

LT Foods

Engages in the milling, processing, and marketing of branded and non-branded basmati rice, and rice food products in India.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives